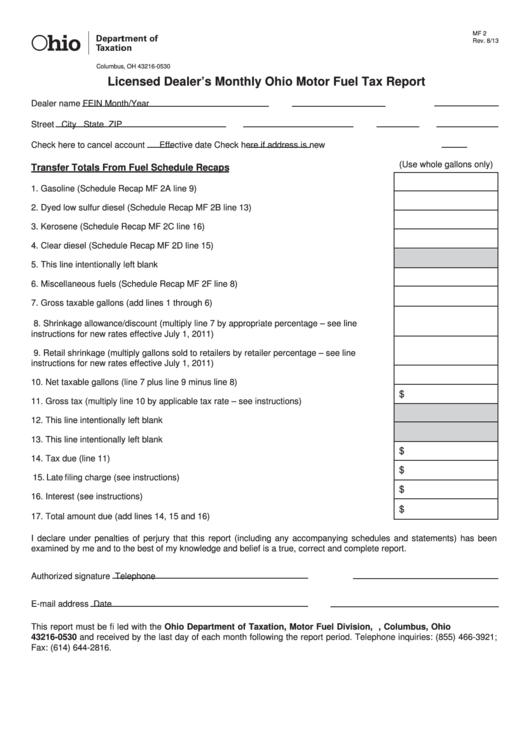

MF 2

Rev. 8/13

P.O. Box 530

Columbus, OH 43216-0530

Licensed Dealer’s Monthly Ohio Motor Fuel Tax Report

Dealer name

FEIN

Month/Year

Street

City

State

ZIP

Check here to cancel account

Effective date

Check here if address is new

(Use whole gallons only)

Transfer Totals From Fuel Schedule Recaps

1. Gasoline (Schedule Recap MF 2A line 9) ......................................................................... 1.

2. Dyed low sulfur diesel (Schedule Recap MF 2B line 13) .................................................. 2.

3. Kerosene (Schedule Recap MF 2C line 16) ..................................................................... 3.

4. Clear diesel (Schedule Recap MF 2D line 15) .................................................................. 4.

5. This line intentionally left blank ......................................................................................... 5.

6. Miscellaneous fuels (Schedule Recap MF 2F line 8) ........................................................ 6.

7. Gross taxable gallons (add lines 1 through 6) .................................................................. 7.

8. Shrinkage allowance/discount (multiply line 7 by appropriate percentage – see line

instructions for new rates effective July 1, 2011) .............................................................. 8.

9. Retail shrinkage (multiply gallons sold to retailers by retailer percentage – see line

instructions for new rates effective July 1, 2011) .............................................................. 9.

10. Net taxable gallons (line 7 plus line 9 minus line 8) ........................................................ 10.

$

11. Gross tax (multiply line 10 by applicable tax rate – see instructions) ..............................11.

12. This line intentionally left blank ....................................................................................... 12.

13. This line intentionally left blank ....................................................................................... 13.

$

14. Tax due (line 11) .............................................................................................................. 14.

$

15. Late fi ling charge (see instructions) ................................................................................ 15.

$

16. Interest (see instructions) ................................................................................................ 16.

$

17. Total amount due (add lines 14, 15 and 16) .................................................................... 17.

I declare under penalties of perjury that this report (including any accompanying schedules and statements) has been

examined by me and to the best of my knowledge and belief is a true, correct and complete report.

Authorized signature

Telephone

E-mail address

Date

This report must be fi led with the Ohio Department of Taxation, Motor Fuel Division, P.O. Box 530, Columbus, Ohio

43216-0530 and received by the last day of each month following the report period. Telephone inquiries: (855) 466-3921;

Fax: (614) 644-2816.

1

1 2

2