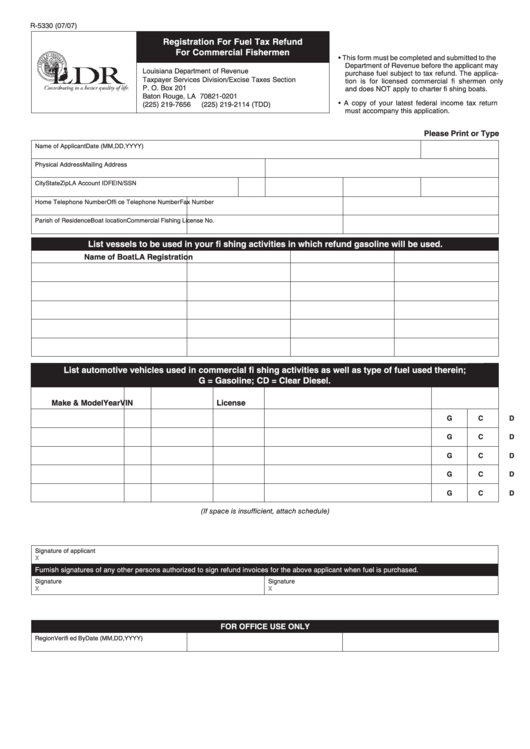

Form R-5330 - Registration For Fuel Tax Refund For Commercial Fishermen

ADVERTISEMENT

R-5330 (07/07)

Registration For Fuel Tax Refund

For Commercial Fishermen

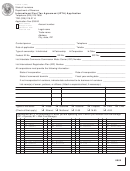

• This form must be completed and submitted to the

Department of Revenue before the applicant may

Louisiana Department of Revenue

purchase fuel subject to tax refund. The applica-

Taxpayer Services Division/Excise Taxes Section

tion is for licensed commercial fi shermen only

P. O. Box 201

and does NOT apply to charter fi shing boats.

Baton Rouge, LA 70821-0201

• A copy of your latest federal income tax return

(225) 219-7656

(225) 219-2114 (TDD)

must accompany this application.

Please Print or Type

Name of Applicant

Date (MM,DD,YYYY)

Physical Address

Mailing Address

City

State

Zip

LA Account ID

FEIN/SSN

Home Telephone Number

Offi ce Telephone Number

Fax Number

Parish of Residence

Boat location

Commercial Fishing License No.

List vessels to be used in your fi shing activities in which refund gasoline will be used.

Name of Boat

LA Registration No.

Make of engine

Horse power

List automotive vehicles used in commercial fi shing activities as well as type of fuel used therein;

G = Gasoline; CD = Clear Diesel.

Make & Model

Year

VIN

License No.

Describe how each vehicle will be used

Circle Fuel Type

G

CD

G

CD

G

CD

G

CD

G

CD

(If space is insufficient, attach schedule)

Signature of applicant

X

Furnish signatures of any other persons authorized to sign refund invoices for the above applicant when fuel is purchased.

Signature

Signature

X

X

FOR OFFICE USE ONLY

Region

Verifi ed By

Date (MM,DD,YYYY)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1