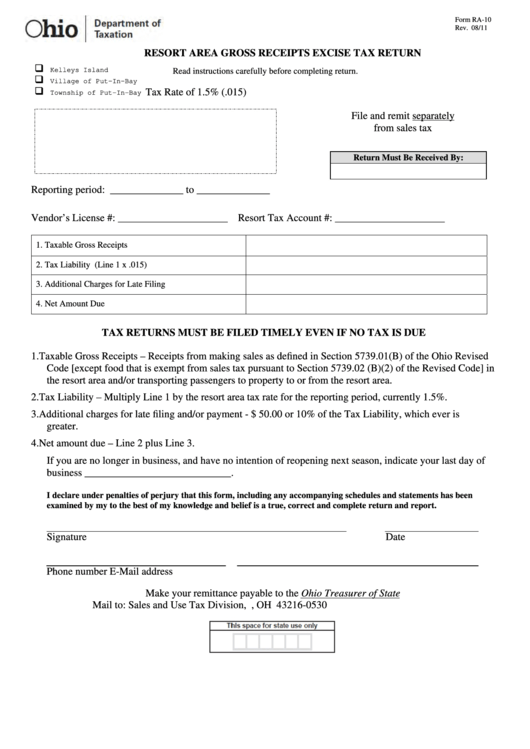

Reset Form

Form RA-10

Rev. 08/11

RESORT AREA GROSS RECEIPTS EXCISE TAX RETURN

Kelleys Island

Read instructions carefully before completing return.

Village of Put-In-Bay

Tax Rate of 1.5% (.015)

Township of Put-In-Bay

File and remit separately

from sales tax

Return Must Be Received By:

Reporting period: ______________ to ______________

Vendor’s License #: _____________________ Resort Tax Account #: _____________________

1. Taxable Gross Receipts

2. Tax Liability (Line 1 x .015)

3. Additional Charges for Late Filing

4. Net Amount Due

TAX RETURNS MUST BE FILED TIMELY EVEN IF NO TAX IS DUE

1. Taxable Gross Receipts – Receipts from making sales as defined in Section 5739.01(B) of the Ohio Revised

Code [except food that is exempt from sales tax pursuant to Section 5739.02 (B)(2) of the Revised Code] in

the resort area and/or transporting passengers to property to or from the resort area.

2. Tax Liability – Multiply Line 1 by the resort area tax rate for the reporting period, currently 1.5%.

3. Additional charges for late filing and/or payment - $ 50.00 or 10% of the Tax Liability, which ever is

greater.

4. Net amount due – Line 2 plus Line 3.

If you are no longer in business, and have no intention of reopening next season, indicate your last day of

business ____________________________.

I declare under penalties of perjury that this form, including any accompanying schedules and statements has been

examined by my to the best of my knowledge and belief is a true, correct and complete return and report.

Signature

Date

Phone number

E-Mail address

Make your remittance payable to the Ohio Treasurer of State

Mail to: Sales and Use Tax Division, P.O. Box 530 Columbus, OH 43216-0530

1

1