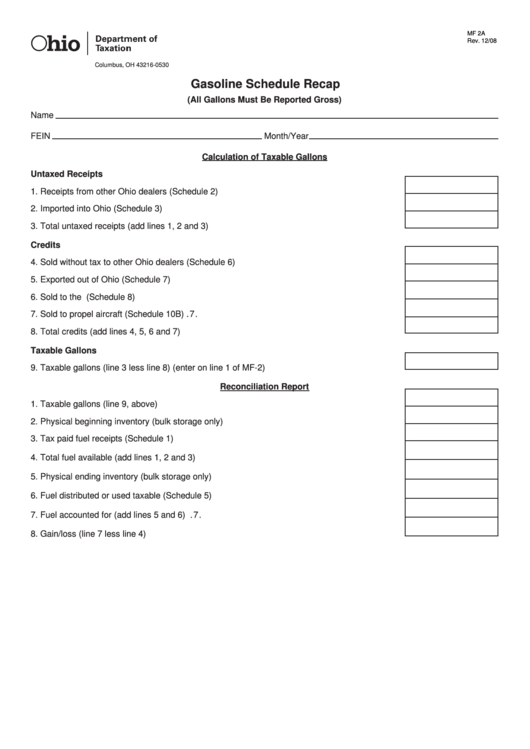

MF 2A

Rev. 12/08

P.O. Box 530

Columbus, OH 43216-0530

Gasoline Schedule Recap

(All Gallons Must Be Reported Gross)

Name

FEIN

Month/Year

Calculation of Taxable Gallons

Untaxed Receipts

1. Receipts from other Ohio dealers (Schedule 2) ........................................................................1.

2. Imported into Ohio (Schedule 3)................................................................................................2.

3. Total untaxed receipts (add lines 1, 2 and 3) .............................................................................3.

Credits

4. Sold without tax to other Ohio dealers (Schedule 6) .................................................................4.

5. Exported out of Ohio (Schedule 7) ............................................................................................5.

6. Sold to the U.S. government (Schedule 8) ................................................................................6.

7. Sold to propel aircraft (Schedule 10B).......................................................................................7.

8. Total credits (add lines 4, 5, 6 and 7) .........................................................................................8.

Taxable Gallons

9. Taxable gallons (line 3 less line 8) (enter on line 1 of MF-2) .....................................................9.

Reconciliation Report

1. Taxable gallons (line 9, above) ..................................................................................................1.

2. Physical beginning inventory (bulk storage only) ......................................................................2.

3. Tax paid fuel receipts (Schedule 1) ...........................................................................................3.

4. Total fuel available (add lines 1, 2 and 3) ..................................................................................4.

5. Physical ending inventory (bulk storage only) ...........................................................................5.

6. Fuel distributed or used taxable (Schedule 5) ...........................................................................6.

7. Fuel accounted for (add lines 5 and 6) ......................................................................................7.

8. Gain/loss (line 7 less line 4).......................................................................................................8.

1

1 2

2