Form St-556-F -Miscellaneous Information About Filing Form St-556, Sales Tax Transaction Return

ADVERTISEMENT

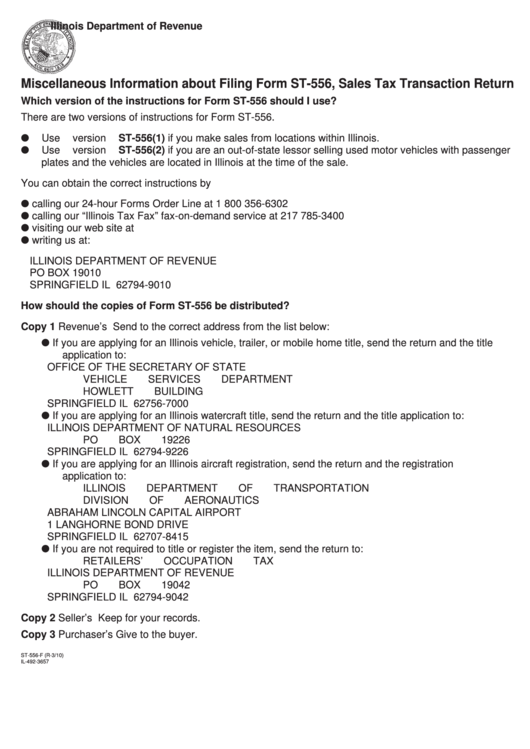

Illinois Department of Revenue

Miscellaneous Information about Filing Form ST-556, Sales Tax Transaction Return

Which version of the instructions for Form ST-556 should I use?

There are two versions of instructions for Form ST-556.

●

Use version ST-556(1) if you make sales from locations within Illinois.

●

Use version ST-556(2) if you are an out-of-state lessor selling used motor vehicles with passenger

plates and the vehicles are located in Illinois at the time of the sale.

You can obtain the correct instructions by

●

calling our 24-hour Forms Order Line at 1 800 356-6302

●

calling our “Illinois Tax Fax” fax-on-demand service at 217 785-3400

●

visiting our web site at tax.illinois.gov

●

writing us at:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19010

SPRINGFIELD IL 62794-9010

How should the copies of Form ST-556 be distributed?

Copy 1 Revenue’s

Send to the correct address from the list below:

●

If you are applying for an Illinois vehicle, trailer, or mobile home title, send the return and the title

application to:

OFFICE OF THE SECRETARY OF STATE

VEHICLE SERVICES DEPARTMENT

HOWLETT BUILDING

SPRINGFIELD IL 62756-7000

●

If you are applying for an Illinois watercraft title, send the return and the title application to:

ILLINOIS DEPARTMENT OF NATURAL RESOURCES

PO BOX 19226

SPRINGFIELD IL 62794-9226

●

If you are applying for an Illinois aircraft registration, send the return and the registration

application to:

ILLINOIS DEPARTMENT OF TRANSPORTATION

DIVISION OF AERONAUTICS

ABRAHAM LINCOLN CAPITAL AIRPORT

1 LANGHORNE BOND DRIVE

SPRINGFIELD IL 62707-8415

●

If you are not required to title or register the item, send the return to:

RETAILERS’ OCCUPATION TAX

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19042

SPRINGFIELD IL 62794-9042

Copy 2 Seller’s

Keep for your records.

Copy 3 Purchaser’s

Give to the buyer.

ST-556-F (R-3/10)

IL-492-3657

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1