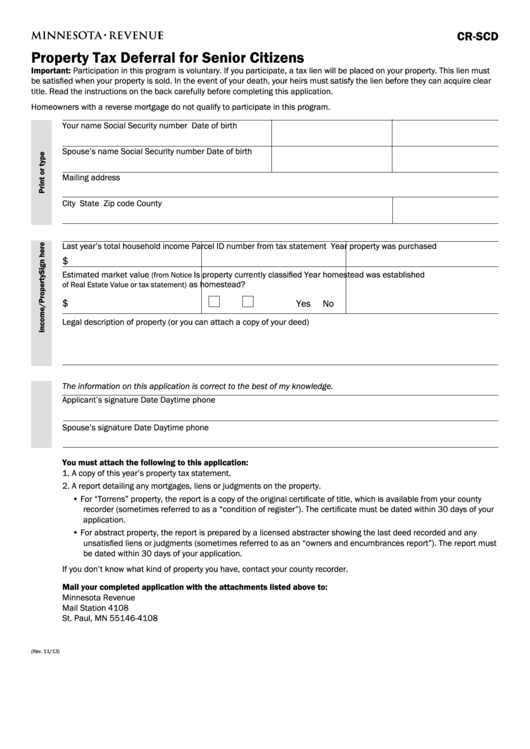

CR-SCD

Property Tax Deferral for Senior Citizens

Important: Participation in this program is voluntary. If you participate, a tax lien will be placed on your property. This lien must

be satisfied when your property is sold. In the event of your death, your heirs must satisfy the lien before they can acquire clear

title. Read the instructions on the back carefully before completing this application.

Homeowners with a reverse mortgage do not qualify to participate in this program.

Your name

Social Security number

Date of birth

Spouse’s name

Social Security number

Date of birth

Mailing address

City

State

Zip code

County

Last year’s total household income

Parcel ID number from tax statement

Year property was purchased

$

Estimated market value

Is property currently classified

Year homestead was established

(from Notice

as homestead?

of Real Estate Value or tax statement)

$

Yes

No

Legal description of property (or you can attach a copy of your deed)

The information on this application is correct to the best of my knowledge.

Applicant’s signature

Date

Daytime phone

Spouse’s signature

Date

Daytime phone

You must attach the following to this application:

1. A copy of this year’s property tax statement.

2. A report detailing any mortgages, liens or judgments on the property.

• For “Torrens” property, the report is a copy of the original certificate of title, which is available from your county

recorder (sometimes referred to as a “condition of register”). The certificate must be dated within 30 days of your

application.

• For abstract property, the report is prepared by a licensed abstracter showing the last deed recorded and any

unsatisfied liens or judgments (sometimes referred to as an “owners and encumbrances report”). The report must

be dated within 30 days of your application.

If you don’t know what kind of property you have, contact your county recorder.

Mail your completed application with the attachments listed above to:

Minnesota Revenue

Mail Station 4108

St. Paul, MN 55146-4108

(Rev. 11/13)

1

1 2

2