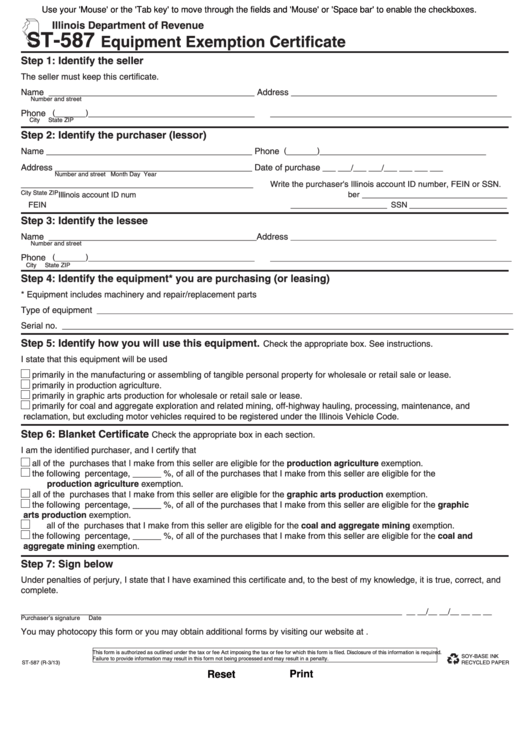

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-587

Equipment Exemption Certificate

Step 1:

Identify the seller

The seller must keep this certificate.

Name

Address

_______________________________________________

_______________________________________________

Number and street

( _______ ) ______________________________________

Phone

_____________________________________________________

City

State

ZIP

Step 2:

Identify the purchaser (lessor)

Name

Phone

( _______ ) ______________________________________

_______________________________________________

Address

Date of purchase

_____________________________________________

___ ___/___ ___/___ ___ ___ ___

Number and street

Month

Day

Year

___________________________________________________

Write the purchaser's Illinois account ID number, FEIN or SSN.

City

State

ZIP

______________________________

Illinois account ID number

___________________

___________________

FEIN

SSN

Step 3:

Identify the lessee

Name

Address

_______________________________________________

_______________________________________________

Number and street

Phone

( _______ ) ______________________________________

_____________________________________________________

City

State

ZIP

Step 4:

Identify the equipment* you are purchasing (or leasing)

* Equipment includes machinery and repair/replacement parts

Type of equipment

_______________________________________________________________________________________________

Serial no.

_______________________________________________________________________________________________________

Step 5:

Identify how you will use this equipment.

Check the appropriate box. See instructions.

I state that this equipment will be used

primarily in the manufacturing or assembling of tangible personal property for wholesale or retail sale or lease.

primarily in production agriculture.

primarily in graphic arts production for wholesale or retail sale or lease.

primarily for coal and aggregate exploration and related mining, off-highway hauling, processing, maintenance, and

reclamation, but excluding motor vehicles required to be registered under the Illinois Vehicle Code.

Step 6:

Blanket Certificate

Check the appropriate box in each section.

I am the identified purchaser, and I certify that

all of the purchases that I make from this seller are eligible for the production agriculture exemption.

the following percentage, ______ %, of all of the purchases that I make from this seller are eligible for the

production agriculture exemption.

all of the purchases that I make from this seller are eligible for the graphic arts production exemption.

the following percentage, ______ %, of all of the purchases that I make from this seller are eligible for the graphic

arts production exemption.

all of the purchases that I make from this seller are eligible for the coal and aggregate mining exemption.

the following percentage, ______ %, of all of the purchases that I make from this seller are eligible for the coal and

aggregate mining exemption.

Step 7:

Sign below

Under penalties of perjury, I state that I have examined this certificate and, to the best of my knowledge, it is true, correct, and

complete.

_______________________________________________________________________________________

__ __/__ __/__ __ __ __

Purchaser’s signature

Date

You may photocopy this form or you may obtain additional forms by visiting our website at tax.illinois.gov.

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is required.

SOY-BASE INK

Failure to provide information may result in this form not being processed and may result in a penalty.

ST-587 (R-3/13)

RECYCLED PAPER

Reset

Print

1

1 2

2