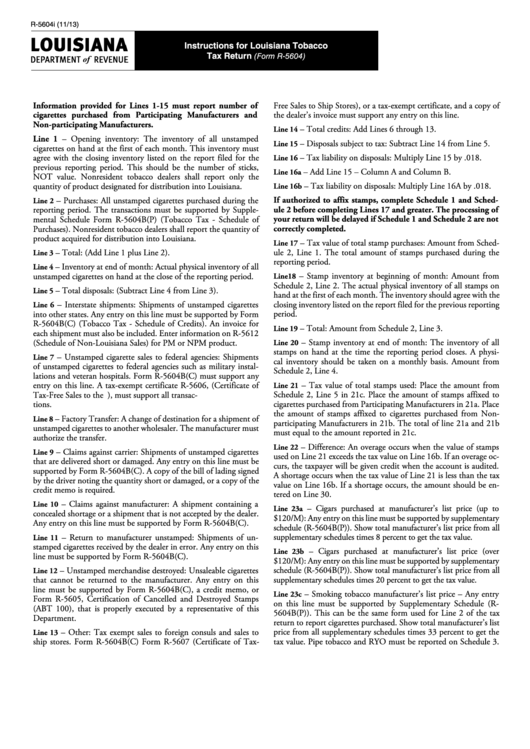

Form R-5604i - Instructions For Louisiana Tobacco Tax Return

ADVERTISEMENT

R-5604i (11/13)

Instructions for Louisiana Tobacco

Tax Return

(Form R-5604)

Free Sales to Ship Stores), or a tax-exempt certificate, and a copy of

Information provided for Lines 1-15 must report number of

cigarettes purchased from Participating Manufacturers and

the dealer’s invoice must support any entry on this line.

Non-participating Manufacturers.

– Total credits: Add Lines 6 through 13.

Line 14

Line 1 – Opening inventory: The inventory of all unstamped

– Disposals subject to tax: Subtract Line 14 from Line 5.

Line 15

cigarettes on hand at the first of each month. This inventory must

agree with the closing inventory listed on the report filed for the

– Tax liability on disposals: Multiply Line 15 by .018.

Line 16

previous reporting period. This should be the number of sticks,

– Add Line 15 – Column A and Column B.

Line 16a

NOT value. Nonresident tobacco dealers shall report only the

– Tax liability on disposals: Multiply Line 16A by .018.

quantity of product designated for distribution into Louisiana.

Line 16b

If authorized to affix stamps, complete Schedule 1 and Sched-

– Purchases: All unstamped cigarettes purchased during the

Line 2

reporting period. The transactions must be supported by Supple-

ule 2 before completing Lines 17 and greater. The processing of

your return will be delayed if Schedule 1 and Schedule 2 are not

mental Schedule Form R-5604B(P) (Tobacco Tax - Schedule of

Purchases). Nonresident tobacco dealers shall report the quantity of

correctly completed.

product acquired for distribution into Louisiana.

– Tax value of total stamp purchases: Amount from Sched-

Line 17

ule 2, Line 1. The total amount of stamps purchased during the

– Total: (Add Line 1 plus Line 2).

Line 3

reporting period.

– Inventory at end of month: Actual physical inventory of all

Line 4

– Stamp inventory at beginning of month: Amount from

unstamped cigarettes on hand at the close of the reporting period.

Line18

Schedule 2, Line 2. The actual physical inventory of all stamps on

– Total disposals: (Subtract Line 4 from Line 3).

Line 5

hand at the first of each month. The inventory should agree with the

– Interstate shipments: Shipments of unstamped cigarettes

closing inventory listed on the report filed for the previous reporting

Line 6

period.

into other states. Any entry on this line must be supported by Form

R-5604B(C) (Tobacco Tax - Schedule of Credits). An invoice for

– Total: Amount from Schedule 2, Line 3.

Line 19

each shipment must also be included. Enter information on R-5612

(Schedule of Non-Louisiana Sales) for PM or NPM product.

– Stamp inventory at end of month: The inventory of all

Line 20

stamps on hand at the time the reporting period closes. A physi-

– Unstamped cigarette sales to federal agencies: Shipments

Line 7

cal inventory should be taken on a monthly basis. Amount from

of unstamped cigarettes to federal agencies such as military instal-

Schedule 2, Line 4.

lations and veteran hospitals. Form R-5604B(C) must support any

– Tax value of total stamps used: Place the amount from

entry on this line. A tax-exempt certificate R-5606, (Certificate of

Line 21

Tax-Free Sales to the U.S. Armed Forces), must support all transac-

Schedule 2, Line 5 in 21c. Place the amount of stamps affixed to

cigarettes purchased from Participating Manufacturers in 21a. Place

tions.

the amount of stamps affixed to cigarettes purchased from Non-

– Factory Transfer: A change of destination for a shipment of

Line 8

participating Manufacturers in 21b. The total of line 21a and 21b

unstamped cigarettes to another wholesaler. The manufacturer must

must equal to the amount reported in 21c.

authorize the transfer.

– Difference: An overage occurs when the value of stamps

Line 22

– Claims against carrier: Shipments of unstamped cigarettes

Line 9

used on Line 21 exceeds the tax value on Line 16b. If an overage oc-

that are delivered short or damaged. Any entry on this line must be

curs, the taxpayer will be given credit when the account is audited.

supported by Form R-5604B(C). A copy of the bill of lading signed

A shortage occurs when the tax value of Line 21 is less than the tax

by the driver noting the quantity short or damaged, or a copy of the

value on Line 16b. If a shortage occurs, the amount should be en-

credit memo is required.

tered on Line 30.

– Claims against manufacturer: A shipment containing a

Line 10

– Cigars purchased at manufacturer’s list price (up to

Line 23a

concealed shortage or a shipment that is not accepted by the dealer.

$120/M): Any entry on this line must be supported by supplementary

Any entry on this line must be supported by Form R-5604B(C).

schedule (R-5604B(P)). Show total manufacturer’s list price from all

– Return to manufacturer unstamped: Shipments of un-

supplementary schedules times 8 percent to get the tax value.

Line 11

stamped cigarettes received by the dealer in error. Any entry on this

– Cigars purchased at manufacturer’s list price (over

Line 23b

line must be supported by Form R-5604B(C).

$120/M): Any entry on this line must be supported by supplementary

schedule (R-5604B(P)). Show total manufacturer’s list price from all

– Unstamped merchandise destroyed: Unsaleable cigarettes

Line 12

that cannot be returned to the manufacturer. Any entry on this

supplementary schedules times 20 percent to get the tax value.

line must be supported by Form R-5604B(C), a credit memo, or

– Smoking tobacco manufacturer’s list price – Any entry

Line 23c

Form R-5605, Certification of Cancelled and Destroyed Stamps

on this line must be supported by Supplementary Schedule (R-

(ABT 100), that is properly executed by a representative of this

5604B(P)). This can be the same form used for Line 2 of the tax

Department.

return to report cigarettes purchased. Show total manufacturer’s list

– Other: Tax exempt sales to foreign consuls and sales to

price from all supplementary schedules times 33 percent to get the

Line 13

tax value. Pipe tobacco and RYO must be reported on Schedule 3.

ship stores. Form R-5604B(C) Form R-5607 (Certificate of Tax-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2