Form Tr 2 - Ohio Tire Fee Return

Download a blank fillable Form Tr 2 - Ohio Tire Fee Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Tr 2 - Ohio Tire Fee Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

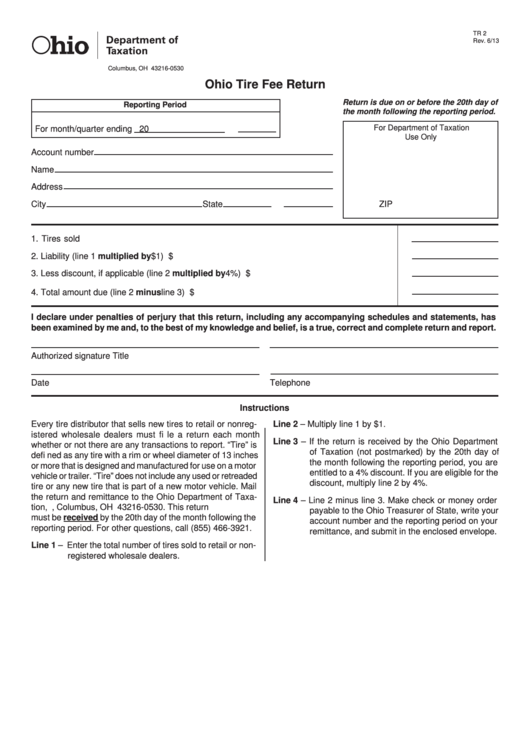

TR 2

Rev. 6/13

P.O. Box 530

Columbus, OH 43216-0530

Ohio Tire Fee Return

Return is due on or before the 20th day of

Reporting Period

the month following the reporting period.

For Department of Taxation

For month/quarter ending

20

Use Only

Account number

Name

Address

City

State

ZIP

1. Tires sold ...................................................................................................................................

2. Liability (line 1 multiplied by $1) .............................................................................................. $

3. Less discount, if applicable (line 2 multiplied by 4%) .............................................................. $

4. Total amount due (line 2 minus line 3) ..................................................................................... $

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has

been examined by me and, to the best of my knowledge and belief, is a true, correct and complete return and report.

Authorized signature

Title

Date

Telephone

Instructions

Every tire distributor that sells new tires to retail or nonreg-

Line 2 – Multiply line 1 by $1.

istered wholesale dealers must fi le a return each month

Line 3 – If the return is received by the Ohio Department

whether or not there are any transactions to report. “Tire” is

of Taxation (not postmarked) by the 20th day of

defi ned as any tire with a rim or wheel diameter of 13 inches

the month following the reporting period, you are

or more that is designed and manufactured for use on a motor

entitled to a 4% discount. If you are eligible for the

vehicle or trailer. “Tire” does not include any used or retreaded

discount, multiply line 2 by 4%.

tire or any new tire that is part of a new motor vehicle. Mail

the return and remittance to the Ohio Department of Taxa-

Line 4 – Line 2 minus line 3. Make check or money order

tion, P.O. Box 530, Columbus, OH 43216-0530. This return

payable to the Ohio Treasurer of State, write your

must be received by the 20th day of the month following the

account number and the reporting period on your

reporting period. For other questions, call (855) 466-3921.

remittance, and submit in the enclosed envelope.

Line 1 – Enter the total number of tires sold to retail or non-

registered wholesale dealers.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1