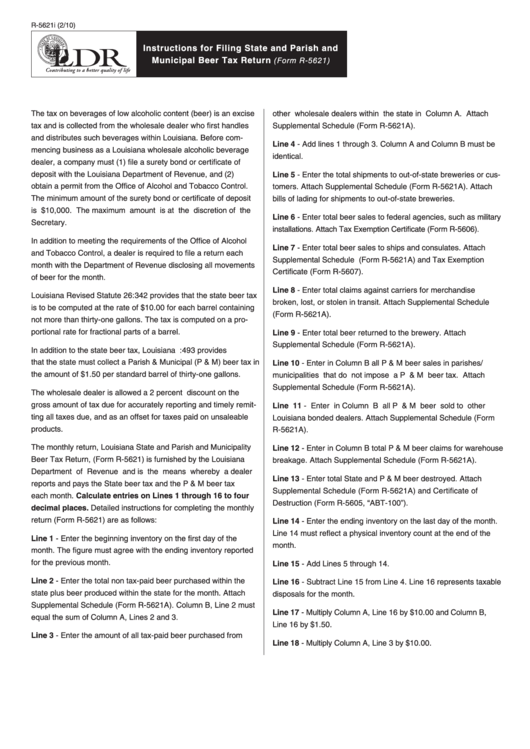

Form R-5621i - Instructions For Filing State And Parish And Municipal Beer Tax Return

ADVERTISEMENT

R-5621i (2/10)

Instructions for Filing State and Parish and

Municipal Beer Tax Return

(Form R-5621)

The tax on beverages of low alcoholic content (beer) is an excise

other wholesale dealers within the state in Column A. Attach

tax and is collected from the wholesale dealer who first handles

Supplemental Schedule (Form R-5621A).

and distributes such beverages within Louisiana. Before com-

Line 4 - Add lines 1 through 3. Column A and Column B must be

mencing business as a Louisiana wholesale alcoholic beverage

identical.

dealer, a company must (1) file a surety bond or certificate of

deposit with the Louisiana Department of Revenue, and (2)

Line 5 - Enter the total shipments to out-of-state breweries or cus-

obtain a permit from the Office of Alcohol and Tobacco Control.

tomers. Attach Supplemental Schedule (Form R-5621A). Attach

The minimum amount of the surety bond or certificate of deposit

bills of lading for shipments to out-of-state breweries.

is $10,000. The maximum amount is at the discretion of the

Line 6 - Enter total beer sales to federal agencies, such as military

Secretary.

installations. Attach Tax Exemption Certificate (Form R-5606).

In addition to meeting the requirements of the Office of Alcohol

Line 7 - Enter total beer sales to ships and consulates. Attach

and Tobacco Control, a dealer is required to file a return each

Supplemental Schedule (Form R-5621A) and Tax Exemption

month with the Department of Revenue disclosing all movements

Certificate (Form R-5607).

of beer for the month.

Line 8 - Enter total claims against carriers for merchandise

Louisiana Revised Statute 26:342 provides that the state beer tax

broken, lost, or stolen in transit. Attach Supplemental Schedule

is to be computed at the rate of $10.00 for each barrel containing

(Form R-5621A).

not more than thirty-one gallons. The tax is computed on a pro-

portional rate for fractional parts of a barrel.

Line 9 - Enter total beer returned to the brewery. Attach

Supplemental Schedule (Form R-5621A).

In addition to the state beer tax, Louisiana R.S.26:493 provides

that the state must collect a Parish & Municipal (P & M) beer tax in

Line 10 - Enter in Column B all P & M beer sales in parishes/

the amount of $1.50 per standard barrel of thirty-one gallons.

municipalities that do not impose a P & M beer tax. Attach

Supplemental Schedule (Form R-5621A).

The wholesale dealer is allowed a 2 percent discount on the

gross amount of tax due for accurately reporting and timely remit-

Line 11 - Enter in Column B all P & M beer sold to other

ting all taxes due, and as an offset for taxes paid on unsaleable

Louisiana bonded dealers. Attach Supplemental Schedule (Form

products.

R-5621A).

The monthly return, Louisiana State and Parish and Municipality

Line 12 - Enter in Column B total P & M beer claims for warehouse

Beer Tax Return, (Form R-5621) is furnished by the Louisiana

breakage. Attach Supplemental Schedule (Form R-5621A).

Department of Revenue and is the means whereby a dealer

Line 13 - Enter total State and P & M beer destroyed. Attach

reports and pays the State beer tax and the P & M beer tax

Supplemental Schedule (Form R-5621A) and Certificate of

each month. Calculate entries on Lines 1 through 16 to four

Destruction (Form R-5605, “ABT-100”).

decimal places. Detailed instructions for completing the monthly

return (Form R-5621) are as follows:

Line 14 - Enter the ending inventory on the last day of the month.

Line 14 must reflect a physical inventory count at the end of the

Line 1 - Enter the beginning inventory on the first day of the

month.

month. The figure must agree with the ending inventory reported

for the previous month.

Line 15 - Add Lines 5 through 14.

Line 2 - Enter the total non tax-paid beer purchased within the

Line 16 - Subtract Line 15 from Line 4. Line 16 represents taxable

state plus beer produced within the state for the month. Attach

disposals for the month.

Supplemental Schedule (Form R-5621A). Column B, Line 2 must

Line 17 - Multiply Column A, Line 16 by $10.00 and Column B,

equal the sum of Column A, Lines 2 and 3.

Line 16 by $1.50.

Line 3 - Enter the amount of all tax-paid beer purchased from

Line 18 - Multiply Column A, Line 3 by $10.00.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2