B-205

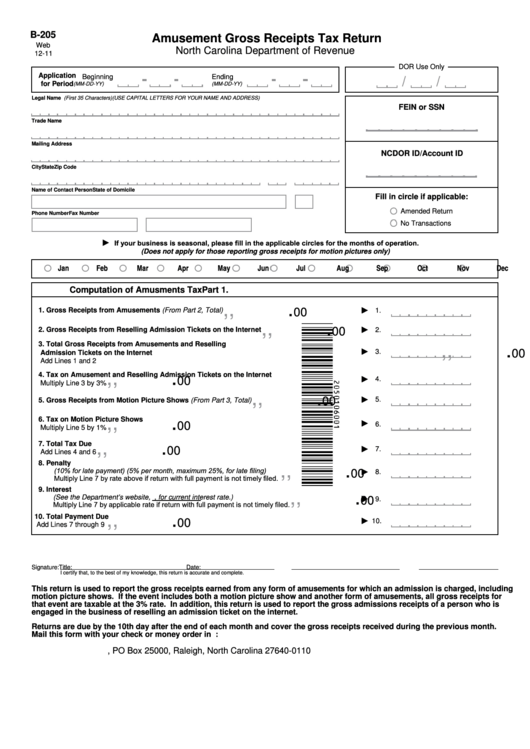

Amusement Gross Receipts Tax Return

Web

North Carolina Department of Revenue

12-11

DOR Use Only

Application

Beginning

Ending

for Period

(MM-DD-YY)

(MM-DD-YY)

Legal Name (First 35 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

FEIN or SSN

Trade Name

Mailing Address

NCDOR ID/Account ID

City

State

Zip Code

Name of Contact Person

State of Domicile

Fill in circle if applicable:

Amended Return

Phone Number

Fax Number

No Transactions

If your business is seasonal, please fill in the applicable circles for the months of operation.

(Does not apply for those reporting gross receipts for motion pictures only)

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Part 1.

Computation of Amusments Tax

,

,

.

1.

Gross Receipts from Amusements (From Part 2, Total)

1.

00

,

,

.

2.

Gross Receipts from Reselling Admission Tickets on the Internet

2.

00

3.

Total Gross Receipts from Amusements and Reselling

,

,

.

3.

00

Admission Tickets on the Internet

Add Lines 1 and 2

,

,

.

4.

Tax on Amusement and Reselling Admission Tickets on the Internet

4.

00

Multiply Line 3 by 3%

,

,

.

5.

00

5.

Gross Receipts from Motion Picture Shows (From Part 3, Total)

,

,

.

6.

Tax on Motion Picture Shows

6.

00

Multiply Line 5 by 1%

,

,

.

7.

Total Tax Due

7.

00

Add Lines 4 and 6

8.

Penalty

,

,

.

(10% for late payment) (5% per month, maximum 25%, for late filing)

8.

00

Multiply Line 7 by rate above if return with full payment is not timely filed.

9.

Interest

,

,

.

(See the Department’s website, , for current interest rate.)

9.

00

Multiply Line 7 by applicable rate if return with full payment is not timely filed.

,

,

.

10.

Total Payment Due

10.

00

Add Lines 7 through 9

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

This return is used to report the gross receipts earned from any form of amusements for which an admission is charged, including

motion picture shows. If the event includes both a motion picture show and another form of amusements, all gross receipts for

that event are taxable at the 3% rate. In addition, this return is used to report the gross admissions receipts of a person who is

engaged in the business of reselling an admission ticket on the internet.

Returns are due by the 10th day after the end of each month and cover the gross receipts received during the previous month.

Mail this form with your check or money order in U.S. currency from a domestic bank to:

N.C. Department of Revenue, PO Box 25000, Raleigh, North Carolina 27640-0110

1

1 2

2