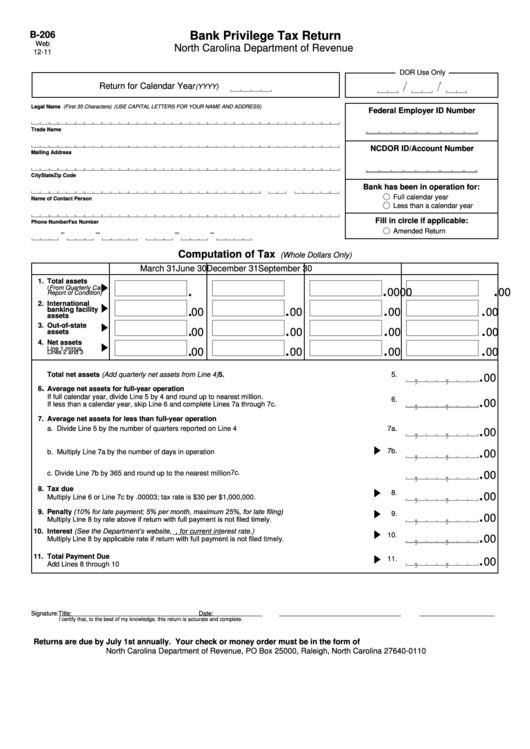

Bank Privilege Tax Return

B-206

Web

North Carolina Department of Revenue

12-11

DOR Use Only

Return for Calendar Year

(YYYY)

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Federal Employer ID Number

Trade Name

NCDOR ID/Account Number

Mailing Address

City

State

Zip Code

Bank has been in operation for:

Full calendar year

Name of Contact Person

Less than a calendar year

Fill in circle if applicable:

Phone Number

Fax Number

Amended Return

Computation of Tax

(Whole Dollars Only)

March 31

June 30

September 30

December 31

1.

Total assets

.

.

.

.

(From Quarterly Call

00

00

00

00

Report of Condition)

2.

International

.

.

.

.

banking facility

00

00

00

00

assets

.

.

.

.

3. Out-of-state

00

00

00

00

assets

4.

Net assets

.

.

.

.

Line 1 minus

00

00

00

00

Lines 2 and 3

,

,

.

5.

Total net assets (Add quarterly net assets from Line 4)

5.

00

.

6

Average net assets for full-year operation

,

,

.

If full calendar year, divide Line 5 by 4 and round up to nearest million.

6.

00

If less than a calendar year, skip Line 6 and complete Lines 7a through 7c.

7.

Average net assets for less than full-year operation

,

,

.

a. Divide Line 5 by the number of quarters reported on Line 4

7a.

00

,

,

.

7b.

b. Multiply Line 7a by the number of days in operation

00

,

,

.

7c.

c. Divide Line 7b by 365 and round up to the nearest million

00

,

,

8.

Tax due

.

8.

00

Multiply Line 6 or Line 7c by .00003; tax rate is $30 per $1,000,000.

,

,

Penalty (10% for late payment; 5% per month, maximum 25%, for late filing)

.

9.

9.

00

Multiply Line 8 by rate above if return with full payment is not filed timely.

,

,

10.

Interest (See the Department’s website, , for current interest rate.)

.

10.

Multiply Line 8 by applicable rate if return with full payment is not filed timely.

00

,

,

.

11.

Total Payment Due

11.

00

Add Lines 8 through 10

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Returns are due by July 1st annually. Your check or money order must be in the form of U.S. currency from a domestic bank.

North Carolina Department of Revenue, PO Box 25000, Raleigh, North Carolina 27640-0110

1

1