Arixona Form 120ext Instruction - Application For Automatic Extension Of Time To File Arizona Form Corporation, Partnership, And Exempt Organization Returns - 2011

ADVERTISEMENT

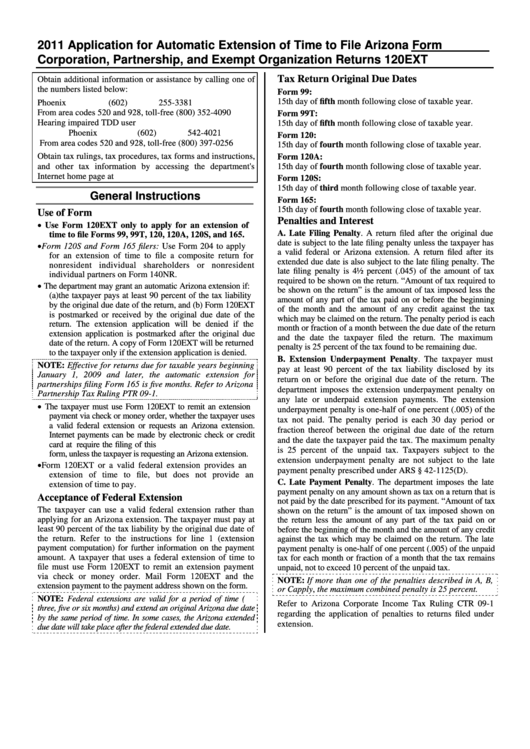

2011 Application for Automatic Extension of Time to File

Arizona Form

Corporation, Partnership, and Exempt Organization Returns

120EXT

Tax Return Original Due Dates

Obtain additional information or assistance by calling one of

the numbers listed below:

Form 99:

15th day of fifth month following close of taxable year.

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

Form 99T:

Hearing impaired TDD user

15th day of fifth month following close of taxable year.

Phoenix

(602) 542-4021

Form 120:

From area codes 520 and 928, toll-free

(800) 397-0256

15th day of fourth month following close of taxable year.

Obtain tax rulings, tax procedures, tax forms and instructions,

Form 120A:

and other tax information by accessing the department's

15th day of fourth month following close of taxable year.

Internet home page at

Form 120S:

15th day of third month following close of taxable year.

General Instructions

Form 165:

15th day of fourth month following close of taxable year.

Use of Form

Penalties and Interest

Use Form 120EXT only to apply for an extension of

A. Late Filing Penalty. A return filed after the original due

time to file Forms 99, 99T, 120, 120A, 120S, and 165.

date is subject to the late filing penalty unless the taxpayer has

Form 120S and Form 165 filers: Use Form 204 to apply

a valid federal or Arizona extension. A return filed after its

for an extension of time to file a composite return for

extended due date is also subject to the late filing penalty. The

nonresident individual shareholders or nonresident

late filing penalty is 4½ percent (.045) of the amount of tax

individual partners on Form 140NR.

required to be shown on the return. “Amount of tax required to

The department may grant an automatic Arizona extension if:

be shown on the return” is the amount of tax imposed less the

(a) the taxpayer pays at least 90 percent of the tax liability

amount of any part of the tax paid on or before the beginning

by the original due date of the return, and (b) Form 120EXT

of the month and the amount of any credit against the tax

is postmarked or received by the original due date of the

which may be claimed on the return. The penalty period is each

return. The extension application will be denied if the

month or fraction of a month between the due date of the return

extension application is postmarked after the original due

and the date the taxpayer filed the return. The maximum

date of the return. A copy of Form 120EXT will be returned

penalty is 25 percent of the tax found to be remaining due.

to the taxpayer only if the extension application is denied.

B. Extension Underpayment Penalty. The taxpayer must

NOTE: Effective for returns due for taxable years beginning

pay at least 90 percent of the tax liability disclosed by its

January 1, 2009 and later, the automatic extension for

return on or before the original due date of the return. The

partnerships filing Form 165 is five months. Refer to Arizona

department imposes the extension underpayment penalty on

Partnership Tax Ruling PTR 09-1.

any late or underpaid extension payments. The extension

The taxpayer must use Form 120EXT to remit an extension

underpayment penalty is one-half of one percent (.005) of the

payment via check or money order, whether the taxpayer uses

tax not paid. The penalty period is each 30 day period or

a valid federal extension or requests an Arizona extension.

fraction thereof between the original due date of the return

Internet payments can be made by electronic check or credit

and the date the taxpayer paid the tax. The maximum penalty

card at and do not require the filing of this

is 25 percent of the unpaid tax. Taxpayers subject to the

form, unless the taxpayer is requesting an Arizona extension.

extension underpayment penalty are not subject to the late

Form 120EXT or a valid federal extension provides an

payment penalty prescribed under ARS § 42-1125(D).

extension of time to file, but does not provide an

C. Late Payment Penalty. The department imposes the late

extension of time to pay.

payment penalty on any amount shown as tax on a return that is

Acceptance of Federal Extension

not paid by the date prescribed for its payment. “Amount of tax

The taxpayer can use a valid federal extension rather than

shown on the return” is the amount of tax imposed shown on

applying for an Arizona extension. The taxpayer must pay at

the return less the amount of any part of the tax paid on or

least 90 percent of the tax liability by the original due date of

before the beginning of the month and the amount of any credit

the return. Refer to the instructions for line 1 (extension

against the tax which may be claimed on the return. The late

payment computation) for further information on the payment

payment penalty is one-half of one percent (.005) of the unpaid

amount. A taxpayer that uses a federal extension of time to

tax for each month or fraction of a month that the tax remains

file must use Form 120EXT to remit an extension payment

unpaid, not to exceed 10 percent of the unpaid tax.

via check or money order. Mail Form 120EXT and the

NOTE: If more than one of the penalties described in A, B,

extension payment to the payment address shown on the form.

or C apply, the maximum combined penalty is 25 percent.

NOTE: Federal extensions are valid for a period of time (i.e.

Refer to Arizona Corporate Income Tax Ruling CTR 09-1

three, five or six months) and extend an original Arizona due date

regarding the application of penalties to returns filed under

by the same period of time. In some cases, the Arizona extended

extension.

due date will take place after the federal extended due date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2