(

)

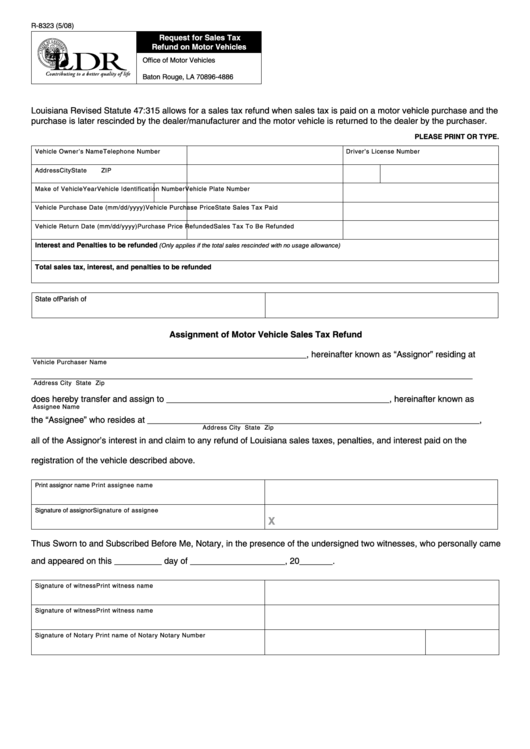

R-8323 (5/08)

Request for Sales Tax

Refund on Motor Vehicles

Office of Motor Vehicles

P.O. Box 64886

Baton Rouge, LA 70896-4886

Louisiana Revised Statute 47:315 allows for a sales tax refund when sales tax is paid on a motor vehicle purchase and the

purchase is later rescinded by the dealer/manufacturer and the motor vehicle is returned to the dealer by the purchaser.

PLEASE PRINT OR TYPE.

Vehicle Owner’s Name

Telephone Number

Driver’s License Number

Address

City

State

ZIP

Make of Vehicle

Year

Vehicle Identification Number

Vehicle Plate Number

Vehicle Purchase Date (mm/dd/yyyy)

Vehicle Purchase Price

State Sales Tax Paid

Vehicle Return Date (mm/dd/yyyy)

Purchase Price Refunded

Sales Tax To Be Refunded

Interest and Penalties to be refunded

(Only applies if the total sales rescinded with no usage allowance)

Total sales tax, interest, and penalties to be refunded

State of

Parish of

Assignment of Motor Vehicle Sales Tax Refund

__________________________________________________________, hereinafter known as “Assignor” residing at

Vehicle Purchaser Name

_____________________________________________________________________________________________

Address

City

State

Zip

does hereby transfer and assign to _______________________________________________, hereinafter known as

Assignee Name

the “Assignee” who resides at ______________________________________________________________________,

Address

City

State

Zip

all of the Assignor’s interest in and claim to any refund of Louisiana sales taxes, penalties, and interest paid on the

registration of the vehicle described above.

Print assignor name

Print assignee name

Signature of assignor

Signature of assignee

X

Thus Sworn to and Subscribed Before Me, Notary, in the presence of the undersigned two witnesses, who personally came

and appeared on this __________ day of ____________________, 20_______.

Signature of witness

Print witness name

Signature of witness

Print witness name

Signature of Notary

Print name of Notary

Notary Number

1

1