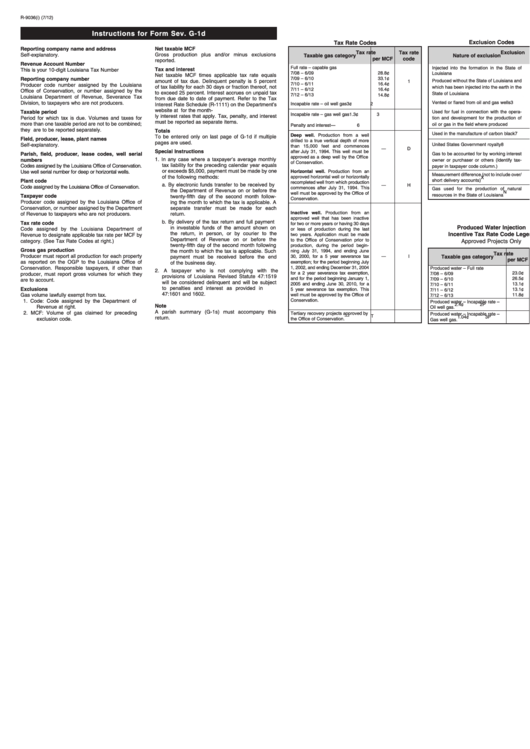

Form R-9036(I) - Instructions For Form Sev. G-1d

ADVERTISEMENT

R-9036(i) (7/12)

Instructions for Form Sev. G-1d

Exclusion Codes

Tax Rate Codes

Reporting company name and address

Net taxable

MCFet taxable MCF

Tax rate

Tax rate

Exclusion

Self-explanatory.

Gross production plus and/or minus exclusions

Taxable gas category

Nature of exclusion

per MCF

code

code

reported.

Revenue Account Number

Full rate – capable gas

Injected into the formation in the State of

Tax and interest

This is your 10-digit Louisiana Tax Number

1

7/08 – 6/09

28.8¢

Louisiana

Net taxable MCF times applicable tax rate equals

Reporting company number

7/09 – 6/10

33.1¢

amount of tax due. Delinquent penalty is 5 percent

Produced without the State of Louisiana and

1

7/10 – 6/11

16.4¢

Producer code number assigned by the Louisiana

of tax liability for each 30 days or fraction thereof, not

which has been injected into the earth in the

2

7/11 – 6/12

16.4¢

Office of Conservation, or number assigned by the

to exceed 25 percent. Interest accrues on unpaid tax

State of Louisiana

7/12 – 6/13

14.8¢

Louisiana Department of Revenue, Severance Tax

from due date to date of payment. Refer to the Tax

Division, to taxpayers who are not producers.

Vented or flared from oil and gas wells

3

Interest Rate Schedule (R-1111) on the Department’s

Incapable rate – oil well gas

3¢

2

website at for the month-

Taxable period

Used for fuel in connection with the opera-

Incapable rate – gas well gas

1.3¢

3

ly interest rates that apply. Tax, penalty, and interest

Period for which tax is due. Volumes and taxes for

tion and development for the production of

4

must be reported as separate items.

more than one taxable period are not to be combined;

oil or gas in the field where produced

Penalty and interest

—

6

they are to be reported separately.

Totals

Used in the manufacture of carbon black

7

Deep well. Production from a well

To be entered only on last page of G-1d if multiple

Field, producer, lease, plant names

drilled to a true vertical depth of more

pages are used.

Self-explanatory.

United States Government royalty

8

than 15,000 feet and commences

—

D

Special Instructions

after July 31, 1994. This well must be

Parish, field, producer, lease codes, well serial

Gas to be accounted for by working interest

approved as a deep well by the Office

1. In any case where a taxpayer’s average monthly

numbers

owner or purchaser or others (Identify tax-

9

of Conservation.

tax liability for the preceding calendar year equals

Codes assigned by the Louisiana Office of Conservation.

payer in taxpayer code column.)

or exceeds $5,000, payment must be made by one

Horizontal well. Production from an

Use well serial number for deep or horizontal wells.

Measurement difference (not to include over/

of the following methods:

approved horizontal well or horizontally

X

Plant code

short delivery accounts)

recompleted well from which production

a. By electronic funds transfer to be received by

—

H

Code assigned by the Louisiana Office of Conservation.

commences after July 31, 1994. This

Gas used for the production of natural

the Department of Revenue on or before the

N

well must be approved by the Office of

resources in the State of Louisiana

Taxpayer code

twenty-fifth day of the second month follow-

Conservation.

Producer code assigned by the Louisiana Office of

ing the month to which the tax is applicable. A

Conservation, or number assigned by the Department

separate transfer must be made for each

Inactive well. Production from an

of Revenue to taxpayers who are not producers.

return.

approved well that has been inactive

b. By delivery of the tax return and full payment

Tax rate code

for two or more years or having 30 days

Produced Water Injection

in investable funds of the amount shown on

Code assigned by the Louisiana Department of

or less of production during the last

the return, in person, or by courier to the

Incentive Tax Rate Code Legend

Revenue to designate applicable tax rate per MCF by

two years. Application must be made

Department of Revenue on or before the

to the Office of Conservation prior to

Approved Projects Only

category. (See Tax Rate Codes at right.)

twenty-fifth day of the second month following

production, during the period begin-

Gross gas production

the month to which the tax is applicable. Such

ning July 31, 1994, and ending June

Tax rate

Tax rate

Producer must report all production for each property

Taxable gas category

payment must be received before the end

30, 2000, for a 5 year severance tax

—

I

per MCF

code

as reported on the OGP to the Louisiana Office of

exemption; for the period beginning July

of the business day.

Conservation. Responsible taxpayers, if other than

1, 2002, and ending December 31, 2004

Produced water – Full rate

2. A taxpayer who is not complying with the

for a 2 year severance tax exemption,

23.0¢

producer, must report gross volumes for which they

7/08 – 6/09

provisions of Louisiana Revised Statute 47:1519

and for the period beginning January 1,

26.5¢

7/09 – 6/10

are to account.

will be considered delinquent and will be subject

1P

2005 and ending June 30, 2010, for a

13.1¢

7/10 – 6/11

to penalties and interest as provided in R.S.

Exclusions

5 year severance tax exemption. This

13.1¢

7/11 – 6/12

47:1601 and 1602.

Gas volume lawfully exempt from tax.

well must be approved by the Office of

11.8¢

7/12 – 6/13

Conservation.

1.

Code: Code assigned by the Department of

Produced water – Incapable rate –

2.4¢

2P

Note

Revenue at right.

Oil well gas.

A parish summary (G-1s) must accompany this

2.

MCF: Volume of gas claimed for preceding

Tertiary recovery projects approved by

Produced water – Incapable rate –

—

T

1.04¢

3P

return.

exclusion code.

the Office of Conservation.

Gas well gas.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1