Instructions For Form R-9054 (Sev 0-5) - Monthly Oil Well Report For Exempt Wells

ADVERTISEMENT

R-9054i (12/08)

Instructions for Form R-9054 (SEV 0-5)

Monthly Oil Well Report for Exempt Wells

Reporting company name/address – Self-explanatory.

Revenue account number – This is your 10-digit Louisiana Tax Number

Reporting company number – Producer code number or transporter code number assigned by the Louisiana Office of Conservation or

number assigned by the Department of Revenue (Severance Tax Division) to taxpayers who are not producers or transporters.

Taxable Period – Period for which the well is exempt. Production for more than one exempt period is to be reported separately

Field, Producer, Lease, Well names – Self-explanatory.

Exempt tax rate code – See below for explanation. This should be the same as reported on Form R-9015 (SEV 0-1d), Oil and/

or Condensate Severance Tax Return - Lease Detail. These wells must be approved by the Office of Conservation before the

exemption can be taken.

Conservation well serial number – Number assigned by the Louisiana Office of Conservation.

Parish, Field, Producer, Lease codes – Codes assigned by the Louisiana Office of Conservation.

Production – Volume produced for a taxable period for which codes on the line item are applicable. Volumes must be reported by well.

Disposition – Volume “run” in a taxable period for which codes on the line item are applicable. Volumes must be reported by well.

Value for payout of well cost – Gross value of disposition less royalty and direct well operating costs. Do not fill out this block for any

well with an exemption code I.

Taxpayer number – Producer code number or transporter code number assigned by the Louisiana Office of Conservation or number

assigned by the Department of Revenue (Taxpayer Severance Division); to taxpayers who are not producers or transporters.

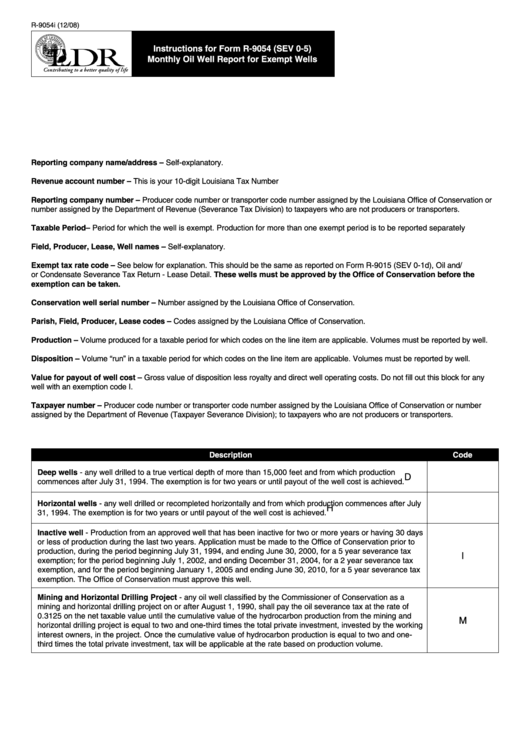

Description

Code

Deep wells - any well drilled to a true vertical depth of more than 15,000 feet and from which production

D

commences after July 31, 1994. The exemption is for two years or until payout of the well cost is achieved.

Horizontal wells - any well drilled or recompleted horizontally and from which production commences after July

H

31, 1994. The exemption is for two years or until payout of the well cost is achieved.

Inactive well - Production from an approved well that has been inactive for two or more years or having 30 days

or less of production during the last two years. Application must be made to the Office of Conservation prior to

production, during the period beginning July 31, 1994, and ending June 30, 2000, for a 5 year severance tax

I

exemption; for the period beginning July 1, 2002, and ending December 31, 2004, for a 2 year severance tax

exemption, and for the period beginning January 1, 2005 and ending June 30, 2010, for a 5 year severance tax

exemption. The Office of Conservation must approve this well.

Mining and Horizontal Drilling Project - any oil well classified by the Commissioner of Conservation as a

mining and horizontal drilling project on or after August 1, 1990, shall pay the oil severance tax at the rate of

0.3125 on the net taxable value until the cumulative value of the hydrocarbon production from the mining and

M

horizontal drilling project is equal to two and one-third times the total private investment, invested by the working

interest owners, in the project. Once the cumulative value of hydrocarbon production is equal to two and one-

third times the total private investment, tax will be applicable at the rate based on production volume.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1