R-9005 (1/13)

If your name has

If your address has

If amended return,

If final return,

O

O

O

O

changed, mark circle.

changed, mark circle.

mark circle.

mark circle.

Account Number

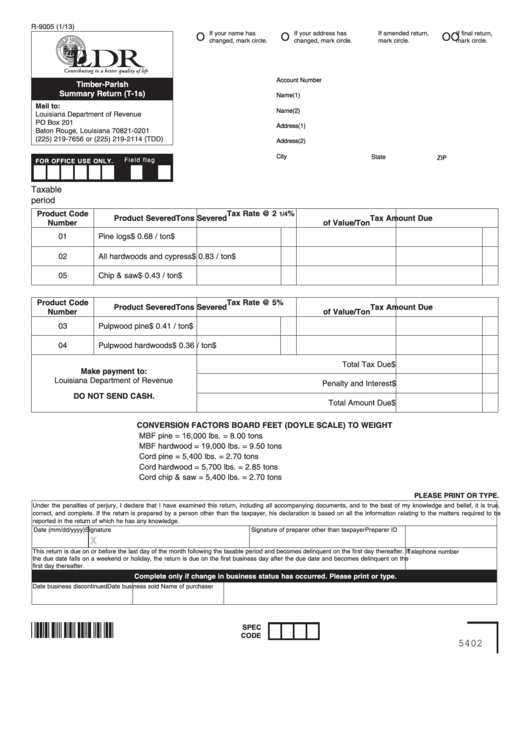

Timber-Parish

Summary Return (T-1s)

Name(1)

Mail to:

Name(2)

Louisiana Department of Revenue

PO Box 201

Address(1)

Baton Rouge, Louisiana 70821-0201

(225) 219-7656 or (225) 219-2114 (TDD)

Address(2)

City

State

ZIP

Fie ld fla g

FOR OFFICE USE ONLY.

Taxable

period

Product Code

Tax Rate @ 2

%

1/4

Product Severed

Tons Severed

Tax Amount Due

Number

of Value/Ton

01

Pine logs

$ 0.68 / ton

$

02

All hardwoods and cypress

$ 0.83 / ton

$

05

Chip & saw

$ 0.43 / ton

$

Product Code

Tax Rate @ 5%

Product Severed

Tons Severed

Tax Amount Due

Number

of Value/Ton

03

Pulpwood pine

$ 0.41 / ton

$

04

Pulpwood hardwoods

$ 0.36 / ton

$

Total Tax Due

$

Make payment to:

Louisiana Department of Revenue

Penalty and Interest

$

DO NOT SEND CASH.

Total Amount Due

$

CONVERSION FACTORS BOARD FEET (DOYLE SCALE) TO WEIGHT

MBF pine

=

16,000 lbs. =

8.00 tons

MBF hardwood =

19,000 lbs. =

9.50 tons

Cord pine

=

5,400 lbs. =

2.70 tons

Cord hardwood =

5,700 lbs. =

2.85 tons

Cord chip & saw =

5,400 lbs. =

2.70 tons

PLEASE PRINT OR TYPE.

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and belief, it is true,

correct, and complete. If the return is prepared by a person other than the taxpayer, his declaration is based on all the information relating to the matters required to be

reported in the return of which he has any knowledge.

Date (mm/dd/yyyy) Signature

Signature of preparer other than taxpayer

Preparer ID

X

This return is due on or before the last day of the month following the taxable period and becomes delinquent on the first day thereafter. If

Telephone number

the due date falls on a weekend or holiday, the return is due on the first business day after the due date and becomes delinquent on the

first day thereafter.

Complete only if change in business status has occurred. Please print or type.

Date business discontinued

Date business sold

Name of purchaser

SPEC

CODE

5402

1

1 2

2