Form Ct-32-A/c - Report By A Banking Corporation Included In A Combined Franchise Tax Return - 2014

ADVERTISEMENT

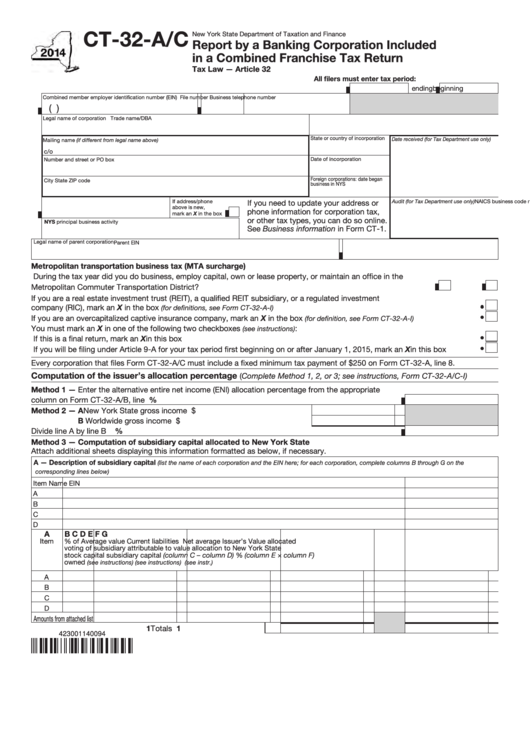

CT-32-A/C

New York State Department of Taxation and Finance

Report by a Banking Corporation Included

in a Combined Franchise Tax Return

Tax Law — Article 32

All filers must enter tax period:

beginning

ending

Combined member employer identification number (EIN)

File number

Business telephone number

(

)

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

If address/phone

If you need to update your address or

Audit (for Tax Department use only)

(from NYS Pub 910)

above is new,

phone information for corporation tax,

mark an X in the box

or other tax types, you can do so online.

NYS principal business activity

See Business information in Form CT-1.

Legal name of parent corporation

Parent EIN

Metropolitan transportation business tax (MTA surcharge)

During the tax year did you do business, employ capital, own or lease property, or maintain an office in the

Metropolitan Commuter Transportation District? ................................................................................................. Yes

No

If you are a real estate investment trust (REIT), a qualified REIT subsidiary, or a regulated investment

company (RIC), mark an X in the box

...............................................................................................

(for definitions, see Form CT-32-A-I)

If you are an overcapitalized captive insurance company, mark an X in the box

...............................

(for definition, see Form CT-32-A-I)

You must mark an X in one of the following two checkboxes

:

(see instructions)

If this is a final return, mark an X in this box ......................................................................................................................................

If you will be filing under Article 9-A for your tax period first beginning on or after January 1, 2015, mark an X in this box ............

Every corporation that files Form CT-32-A/C must include a fixed minimum tax payment of $250 on Form CT-32-A, line 8.

Computation of the issuer’s allocation percentage

(Complete Method 1, 2, or 3; see instructions, Form CT-32-A/C-I)

Method 1 — Enter the alternative entire net income (ENI) allocation percentage from the appropriate

column on Form CT-32-A/B, line 121......................................................................................

%

Method 2 — A New York State gross income ....................................................$

B Worldwide gross income ............................................................$

%

Divide line A by line B .................................................................................................................

Method 3 — Computation of subsidiary capital allocated to New York State

Attach additional sheets displaying this information formatted as below, if necessary.

A — Description of subsidiary capital

(list the name of each corporation and the EIN here; for each corporation, complete columns B through G on the

corresponding lines below)

Item

Name

EIN

A

B

C

D

A

B

C

D

E

F

G

Item

% of

Average value

Current liabilities

Net average

Issuer’s

Value allocated

voting

of subsidiary

attributable to

value

allocation

to New York State

stock

capital

subsidiary capital

(column C – column D)

%

(column E × column F)

owned

(see instructions)

(see instructions)

(see instr.)

A

B

C

D

Amounts from attached list

1 Totals .......................................

1

423001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2