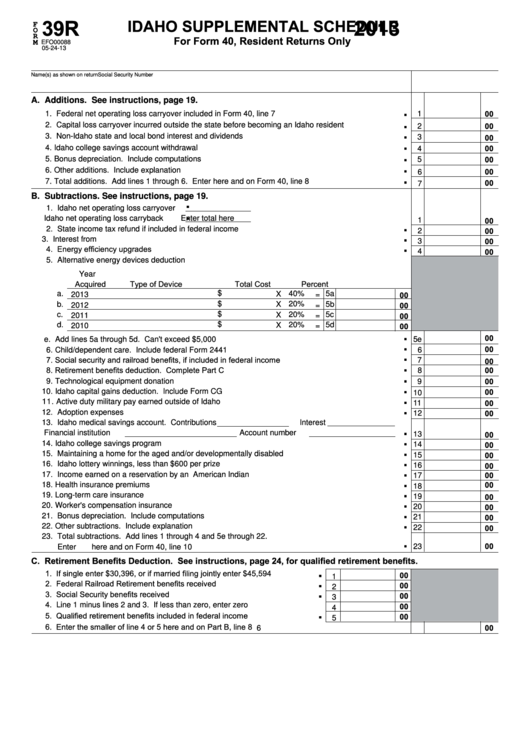

39R

2013

IDAHO SUPPLEMENTAL SCHEDULE

F

O

R

For Form 40, Resident Returns Only

M

EFO00088

05-24-13

Name(s) as shown on return

Social Security Number

A. Additions. See instructions, page 19.

.

00

1

1. Federal net operating loss carryover included in Form 40, line 7 .....................................................

. .

00

2. Capital loss carryover incurred outside the state before becoming an Idaho resident .....................

2

00

3. Non-Idaho state and local bond interest and dividends ....................................................................

3

.

00

4. Idaho college savings account withdrawal ........................................................................................

4

.

00

5. Bonus depreciation. Include computations ......................................................................................

5

.

6. Other additions. Include explanation ...............................................................................................

00

.

6

00

7. Total additions. Add lines 1 through 6. Enter here and on Form 40, line 8 .....................................

7

B. Subtractions. See instructions, page 19.

.

1. Idaho net operating loss carryover

.

Idaho net operating loss carryback

Enter total here ...................................

00

. .

1

2. State income tax refund if included in federal income .......................................................................

00

2

3. Interest from U.S. Government obligations .......................................................................................

00

.

3

4. Energy efficiency upgrades ...............................................................................................................

00

4

5. Alternative energy devices deduction

Year

Acquired

Type of Device

Total Cost

Percent

$

40%

00

a.

X

5a

2013

=

$

20%

00

b.

X

5b

2012

=

00

$

20%

c.

X

5c

2011

=

$

00

d.

20%

5d

X

2010

=

. .

00

e. Add lines 5a through 5d. Can't exceed $5,000 ............................................................................

5e

00

.

6. Child/dependent care. Include federal Form 2441 ...........................................................................

6

7. Social security and railroad benefits, if included in federal income ...................................................

00

.

7

8. Retirement benefits deduction. Complete Part C .............................................................................

00

8

.

00

9. Technological equipment donation ....................................................................................................

.

9

00

10. Idaho capital gains deduction. Include Form CG .............................................................................

. .

10

00

11. Active duty military pay earned outside of Idaho ...............................................................................

11

00

12. Adoption expenses ............................................................................................................................

12

13. Idaho medical savings account. Contributions

Interest

.

Financial institution

Account number

00

. .

13

14. Idaho college savings program .........................................................................................................

00

14

15. Maintaining a home for the aged and/or developmentally disabled ..................................................

00

. .

15

00

16. Idaho lottery winnings, less than $600 per prize ...............................................................................

16

00

17. Income earned on a reservation by an American Indian ..................................................................

. .

17

00

18. Health insurance premiums ...............................................................................................................

18

19. Long-term care insurance .................................................................................................................

00

. .

19

20. Worker's compensation insurance ....................................................................................................

00

20

00

21. Bonus depreciation. Include computations .......................................................................................

.

21

00

22. Other subtractions. Include explanation ...........................................................................................

22

.

23. Total subtractions. Add lines 1 through 4 and 5e through 22.

00

23

Enter here and on Form 40, line 10 ...................................................................................................

C. Retirement Benefits Deduction. See instructions, page 24, for qualified retirement benefits.

. .

1. If single enter $30,396, or if married filing jointly enter $45,594 ................

00

1

2. Federal Railroad Retirement benefits received .........................................

00

.

2

3. Social Security benefits received ...............................................................

00

3

00

4. Line 1 minus lines 2 and 3. If less than zero, enter zero ..........................

.

4

5. Qualified retirement benefits included in federal income ...........................

00

5

6. Enter the smaller of line 4 or 5 here and on Part B, line 8 ................................................................

00

6

1

1 2

2