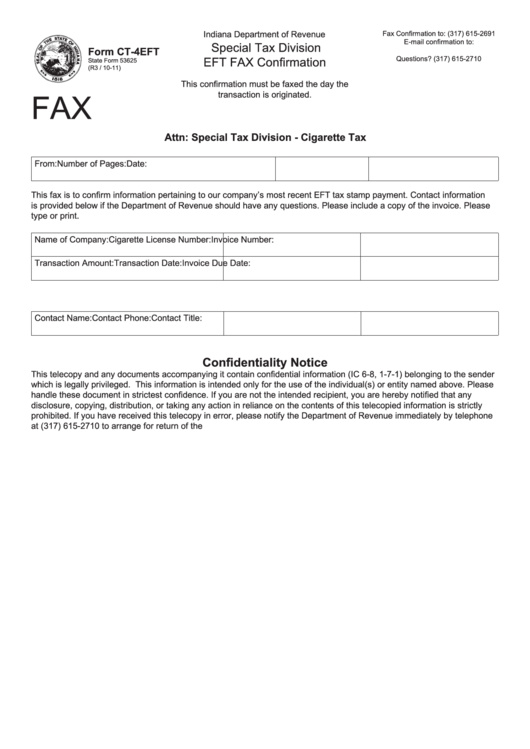

Indiana Department of Revenue

Fax Confirmation to: (317) 615-2691

E-mail confirmation to:

Special Tax Division

Form CT-4EFT

INCigTax@dor.in.gov

Questions? (317) 615-2710

EFT FAX Confirmation

State Form 53625

(R3 / 10-11)

This confirmation must be faxed the day the

FAX

transaction is originated.

Attn: Special Tax Division - Cigarette Tax

From:

Number of Pages:

Date:

This fax is to confirm information pertaining to our company’s most recent EFT tax stamp payment. Contact information

is provided below if the Department of Revenue should have any questions. Please include a copy of the invoice. Please

type or print.

Name of Company:

Cigarette License Number:

Invoice Number:

Transaction Amount:

Transaction Date:

Invoice Due Date:

Contact Name:

Contact Phone:

Contact Title:

Confidentiality Notice

This telecopy and any documents accompanying it contain confidential information (IC 6-8, 1-7-1) belonging to the sender

which is legally privileged. This information is intended only for the use of the individual(s) or entity named above. Please

handle these document in strictest confidence. If you are not the intended recipient, you are hereby notified that any

disclosure, copying, distribution, or taking any action in reliance on the contents of this telecopied information is strictly

prohibited. If you have received this telecopy in error, please notify the Department of Revenue immediately by telephone

at (317) 615-2710 to arrange for return of the documents.Thank you in advance for your cooperation.

1

1