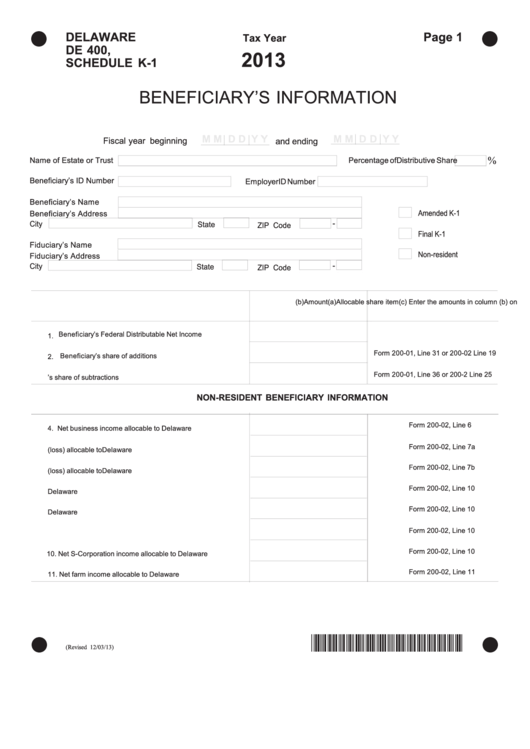

DELAWARE

Page 1

Tax Year

DE 400,

2013

SCHEDULE K-1

BENEFICIARY’S INFORMATION

Reset

Print Form

Fiscal year

beginning

and ending

%

Name of Estate or Trust

Percentage of Distributive Share

Beneficiary’s ID Number

Employer ID Number

Beneficiary’s Name

Amended K-1

Beneficiary’s Address

-

City

State

ZIP Code

Final K-1

Fiduciary’s Name

Non-resident

Fiduciary’s Address

-

City

State

ZIP Code

(a) Allocable share item

(b) Amount

(c) Enter the amounts in column (b) on

1. Beneficiary’s Federal Distributable Net Income....................

Form 200-01, Line 31 or 200-02 Line 19

2. Beneficiary’s share of additions..........................................

Form 200-01, Line 36 or 200-2 Line 25

3. Beneficiary’s share of subtractions.....................................

NON-RESIDENT BENEFICIARY INFORMATION

Form 200-02, Line 6

4. Net business income allocable to Delaware..........................

Form 200-02, Line 7a

5. Capital gain (loss) allocable to Delaware.............................

Form 200-02, Line 7b

6. Other gain (loss) allocable to Delaware...............................

Form 200-02, Line 10

7. Net partnership income allocable to Delaware......................

Form 200-02, Line 10

8. Net estate and trust income allocable to Delaware...............

Form 200-02, Line 10

9. Net rent and royalty income allocable to Delaware...............

Form 200-02, Line 10

10. Net S-Corporation income allocable to Delaware..................

Form 200-02, Line 11

11. Net farm income allocable to Delaware................................

*DF20713019999*

(Revised 12/03/13)

1

1