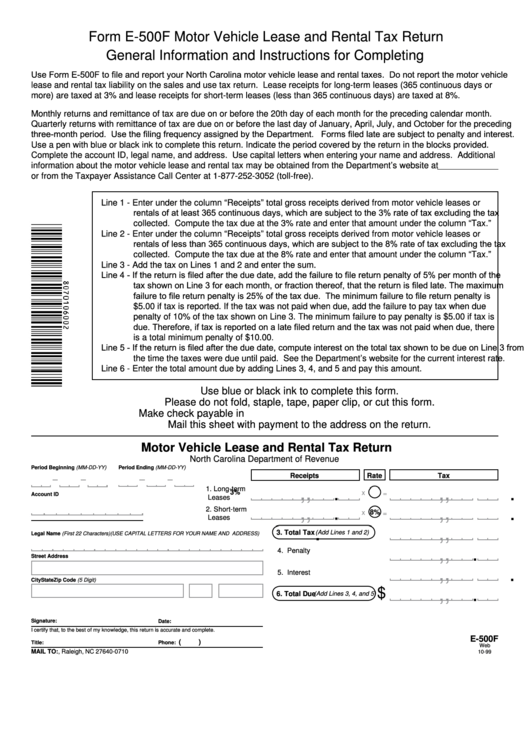

Form E-500F Motor Vehicle Lease and Rental Tax Return

General Information and Instructions for Completing

Use Form E-500F to file and report your North Carolina motor vehicle lease and rental taxes. Do not report the motor vehicle

lease and rental tax liability on the sales and use tax return. Lease receipts for long-term leases (365 continuous days or

more) are taxed at 3% and lease receipts for short-term leases (less than 365 continuous days) are taxed at 8%.

Monthly returns and remittance of tax are due on or before the 20th day of each month for the preceding calendar month.

Quarterly returns with remittance of tax are due on or before the last day of January, April, July, and October for the preceding

three-month period. Use the filing frequency assigned by the Department. Forms filed late are subject to penalty and interest.

Use a pen with blue or black ink to complete this return. Indicate the period covered by the return in the blocks provided.

Complete the account ID, legal name, and address. Use capital letters when entering your name and address. Additional

information about the motor vehicle lease and rental tax may be obtained from the Department’s website at

or from the Taxpayer Assistance Call Center at 1-877-252-3052 (toll-free).

Line 1 - Enter under the column “Receipts” total gross receipts derived from motor vehicle leases or

rentals of at least 365 continuous days, which are subject to the 3% rate of tax excluding the tax

collected. Compute the tax due at the 3% rate and enter that amount under the column “Tax.”

Line 2 - Enter under the column “Receipts” total gross receipts derived from motor vehicle leases or

rentals of less than 365 continuous days, which are subject to the 8% rate of tax excluding the tax

collected. Compute the tax due at the 8% rate and enter that amount under the column “Tax.”

Line 3 - Add the tax on Lines 1 and 2 and enter the sum.

Line 4 - If the return is filed after the due date, add the failure to file return penalty of 5% per month of the

tax shown on Line 3 for each month, or fraction thereof, that the return is filed late. The maximum

failure to file return penalty is 25% of the tax due. The minimum failure to file return penalty is

$5.00 if tax is reported. If the tax was not paid when due, add the failure to pay tax when due

penalty of 10% of the tax shown on Line 3. The minimum failure to pay penalty is $5.00 if tax is

due. Therefore, if tax is reported on a late filed return and the tax was not paid when due, there

is a total minimum penalty of $10.00.

Line 5 - If the return is filed after the due date, compute interest on the total tax shown to be due on Line 3 from

the time the taxes were due until paid. See the Department’s website for the current interest rate.

Line 6 - Enter the total amount due by adding Lines 3, 4, and 5 and pay this amount.

Use blue or black ink to complete this form.

Please do not fold, staple, tape, paper clip, or cut this form.

Make check payable in U.S. currency to N.C. Department of Revenue.

Mail this sheet with payment to the address on the return.

Motor Vehicle Lease and Rental Tax Return

North Carolina Department of Revenue

Period Beginning (MM-DD-YY)

Period Ending (MM-DD-YY)

Receipts

Rate

Tax

,

,

.

,

,

.

1. Long-term

3%

x

=

Account ID

Leases

,

,

.

,

,

.

2. Short-term

8%

x

=

Leases

,

,

.

3. Total Tax

(Add Lines 1 and 2)

Legal Name (First 22 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

,

,

.

4. Penalty

Street Address

,

,

.

5. Interest

City

State

Zip Code (5 Digit)

,

,

.

$

6. Total Due

(Add Lines 3, 4, and 5)

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

E-500F

(

)

Title:

Phone:

Web

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0710

10-99

1

1