Form Et-130 - Tentative Payment Of Estate Tax

ADVERTISEMENT

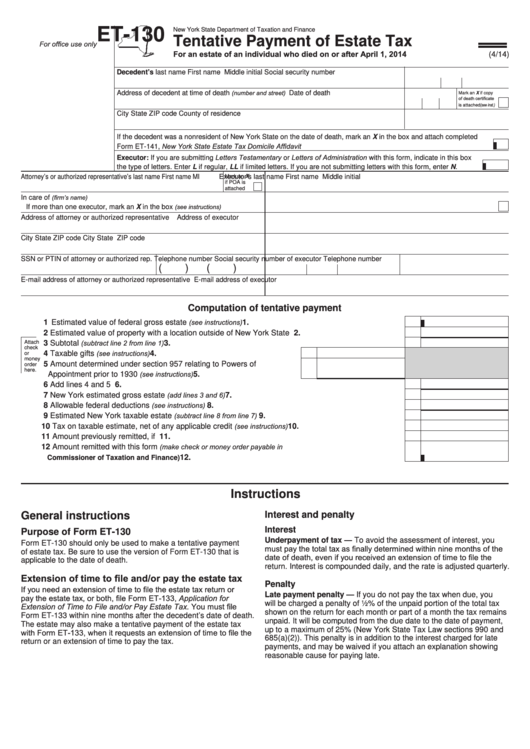

ET-130

New York State Department of Taxation and Finance

Tentative Payment of Estate Tax

For office use only

For an estate of an individual who died on or after April 1, 2014

(4/14)

Decedent’s last name

First name

Middle initial

Social security number

(number and street)

Address of decedent at time of death

Date of death

Mark an X if copy

of death certificate

is attached (see inst.)

City

State

ZIP code

County of residence

If the decedent was a nonresident of New York State on the date of death, mark an X in the box and attach completed

Form ET-141, New York State Estate Tax Domicile Affidavit ...................................................................................................

Executor: If you are submitting Letters Testamentary or Letters of Administration with this form, indicate in this box

the type of letters. Enter L if regular, LL if limited letters. If you are not submitting letters with this form, enter N. ............

Attorney’s or authorized representative’s last name

First name

MI

Mark an X

Executor’s last name

First name

Middle initial

if POA is

attached

(firm’s name)

In care of

(see instructions)

If more than one executor, mark an X in the box

.................

Address of attorney or authorized representative

Address of executor

City

State

ZIP code

City

State

ZIP code

SSN or PTIN of attorney or authorized rep. Telephone number

Social security number of executor

Telephone number

(

)

(

)

E-mail address of attorney or authorized representative

E-mail address of executor

Computation of tentative payment

(see instructions)

1 Estimated value of federal gross estate

.......................................................................

1.

2 Estimated value of property with a location outside of New York State .................................................

2.

(subtract line 2 from line 1)

Attach

3 Subtotal

..........................................................................................................

3.

check

(see instructions)

4 Taxable gifts

.................................................................

4.

or

money

5 Amount determined under section 957 relating to Powers of

order

here.

(see instructions)

Appointment prior to 1930

.........................................

5.

6 Add lines 4 and 5 ...................................................................................................................................

6.

(add lines 3 and 6)

7 New York estimated gross estate

...............................................................................

7.

(see instructions)

8 Allowable federal deductions

.......................................................................................

8.

(subtract line 8 from line 7)

9 Estimated New York taxable estate

...............................................................

9.

(see instructions)

10 Tax on taxable estimate, net of any applicable credit

.................................................. 10.

11 Amount previously remitted, if any......................................................................................................... 11.

(make check or money order payable in U.S. funds to

12 Amount remitted with this form

.............................................................................................. 12.

Commissioner of Taxation and Finance)

Instructions

Interest and penalty

General instructions

Interest

Purpose of Form ET-130

Underpayment of tax — To avoid the assessment of interest, you

Form ET-130 should only be used to make a tentative payment

must pay the total tax as finally determined within nine months of the

of estate tax. Be sure to use the version of Form ET-130 that is

date of death, even if you received an extension of time to file the

applicable to the date of death.

return. Interest is compounded daily, and the rate is adjusted quarterly.

Extension of time to file and/or pay the estate tax

Penalty

If you need an extension of time to file the estate tax return or

Late payment penalty — If you do not pay the tax when due, you

pay the estate tax, or both, file Form ET-133, Application for

will be charged a penalty of ½% of the unpaid portion of the total tax

Extension of Time to File and/or Pay Estate Tax. You must file

shown on the return for each month or part of a month the tax remains

Form ET-133 within nine months after the decedent’s date of death.

unpaid. It will be computed from the due date to the date of payment,

The estate may also make a tentative payment of the estate tax

up to a maximum of 25% (New York State Tax Law sections 990 and

with Form ET-133, when it requests an extension of time to file the

685(a)(2)). This penalty is in addition to the interest charged for late

return or an extension of time to pay the tax.

payments, and may be waived if you attach an explanation showing

reasonable cause for paying late.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2