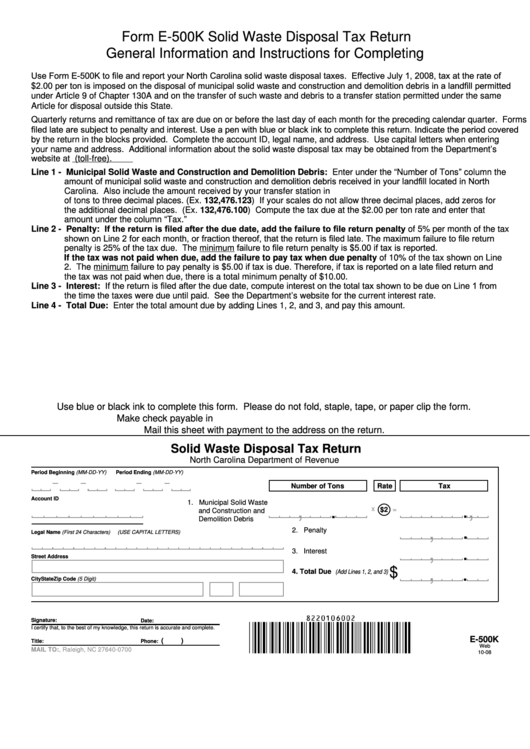

Form E-500K Solid Waste Disposal Tax Return

General Information and Instructions for Completing

Use Form E-500K to file and report your North Carolina solid waste disposal taxes. Effective July 1, 2008, tax at the rate of

$2.00 per ton is imposed on the disposal of municipal solid waste and construction and demolition debris in a landfill permitted

under Article 9 of Chapter 130A and on the transfer of such waste and debris to a transfer station permitted under the same

Article for disposal outside this State.

Quarterly returns and remittance of tax are due on or before the last day of each month for the preceding calendar quarter. Forms

filed late are subject to penalty and interest. Use a pen with blue or black ink to complete this return. Indicate the period covered

by the return in the blocks provided. Complete the account ID, legal name, and address. Use capital letters when entering

your name and address. Additional information about the solid waste disposal tax may be obtained from the Department’s

website at or from the Taxpayer Assistance and Collection Center at 1-877-252-3052 (toll-free).

Line 1 - Municipal Solid Waste and Construction and Demolition Debris: Enter under the “Number of Tons” column the

amount of municipal solid waste and construction and demolition debris received in your landfill located in North

Carolina. Also include the amount received by your transfer station in N.C. for disposal outside N.C. Carry amount

of tons to three decimal places. (Ex. 132,476.123) If your scales do not allow three decimal places, add zeros for

the additional decimal places. (Ex. 132,476.100) Compute the tax due at the $2.00 per ton rate and enter that

amount under the column “Tax.”

Line 2 - Penalty: If the return is filed after the due date, add the failure to file return penalty of 5% per month of the tax

shown on Line 2 for each month, or fraction thereof, that the return is filed late. The maximum failure to file return

penalty is 25% of the tax due. The minimum failure to file return penalty is $5.00 if tax is reported.

If the tax was not paid when due, add the failure to pay tax when due penalty of 10% of the tax shown on Line

2. The minimum failure to pay penalty is $5.00 if tax is due. Therefore, if tax is reported on a late filed return and

the tax was not paid when due, there is a total minimum penalty of $10.00.

Line 3 - Interest: If the return is filed after the due date, compute interest on the total tax shown to be due on Line 1 from

the time the taxes were due until paid. See the Department’s website for the current interest rate.

Line 4 - Total Due: Enter the total amount due by adding Lines 1, 2, and 3, and pay this amount.

Use blue or black ink to complete this form. Please do not fold, staple, tape, or paper clip the form.

Make check payable in U.S. currency to N.C. Department of Revenue.

Mail this sheet with payment to the address on the return.

Solid Waste Disposal Tax Return

North Carolina Department of Revenue

Period Beginning (MM-DD-YY)

Period Ending (MM-DD-YY)

Number of Tons

Rate

Tax

Account ID

1. Municipal Solid Waste

,

.

,

.

x

$2

=

and Construction and

Demolition Debris

,

.

2. Penalty

Legal Name (First 24 Characters)

(USE CAPITAL LETTERS)

.

,

3. Interest

Street Address

$

,

.

4. Total Due

(Add Lines 1, 2, and 3)

City

State

Zip Code (5 Digit)

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

E-500K

(

)

Title:

Phone:

Web

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0700

10-08

1

1