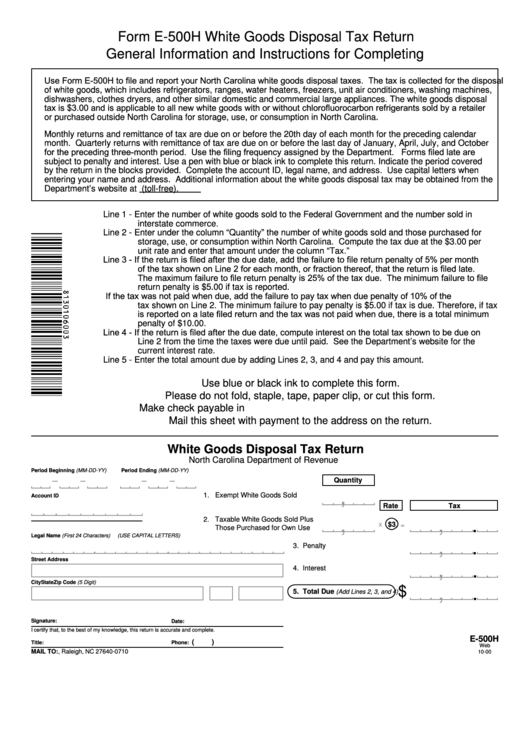

Form E-500H White Goods Disposal Tax Return

General Information and Instructions for Completing

Use Form E-500H to file and report your North Carolina white goods disposal taxes. The tax is collected for the disposal

of white goods, which includes refrigerators, ranges, water heaters, freezers, unit air conditioners, washing machines,

dishwashers, clothes dryers, and other similar domestic and commercial large appliances. The white goods disposal

tax is $3.00 and is applicable to all new white goods with or without chlorofluorocarbon refrigerants sold by a retailer

or purchased outside North Carolina for storage, use, or consumption in North Carolina.

Monthly returns and remittance of tax are due on or before the 20th day of each month for the preceding calendar

month. Quarterly returns with remittance of tax are due on or before the last day of January, April, July, and October

for the preceding three-month period. Use the filing frequency assigned by the Department. Forms filed late are

subject to penalty and interest. Use a pen with blue or black ink to complete this return. Indicate the period covered

by the return in the blocks provided. Complete the account ID, legal name, and address. Use capital letters when

entering your name and address. Additional information about the white goods disposal tax may be obtained from the

Department’s website at or from the Taxpayer Assistance Call Center at 1-877-252-3052 (toll-free).

Line 1 - Enter the number of white goods sold to the Federal Government and the number sold in

interstate commerce.

Line 2 - Enter under the column “Quantity” the number of white goods sold and those purchased for

storage, use, or consumption within North Carolina. Compute the tax due at the $3.00 per

unit rate and enter that amount under the column “Tax.”

Line 3 - If the return is filed after the due date, add the failure to file return penalty of 5% per month

of the tax shown on Line 2 for each month, or fraction thereof, that the return is filed late.

The maximum failure to file return penalty is 25% of the tax due. The minimum failure to file

return penalty is $5.00 if tax is reported.

If the tax was not paid when due, add the failure to pay tax when due penalty of 10% of the

tax shown on Line 2. The minimum failure to pay penalty is $5.00 if tax is due. Therefore, if tax

is reported on a late filed return and the tax was not paid when due, there is a total minimum

penalty of $10.00.

Line 4 - If the return is filed after the due date, compute interest on the total tax shown to be due on

Line 2 from the time the taxes were due until paid. See the Department’s website for the

current interest rate.

Line 5 - Enter the total amount due by adding Lines 2, 3, and 4 and pay this amount.

Use blue or black ink to complete this form.

Please do not fold, staple, tape, paper clip, or cut this form.

Make check payable in U.S. currency to N.C. Department of Revenue.

Mail this sheet with payment to the address on the return.

White Goods Disposal Tax Return

North Carolina Department of Revenue

Period Beginning (MM-DD-YY)

Period Ending (MM-DD-YY)

Quantity

,

1.

Exempt White Goods Sold

Account ID

Rate

Tax

2. Taxable White Goods Sold Plus

,

,

.

x

$3

=

Those Purchased for Own Use

Legal Name (First 24 Characters)

(USE CAPITAL LETTERS)

,

.

3. Penalty

Street Address

,

.

4. Interest

City

State

Zip Code (5 Digit)

,

.

$

5. Total Due

(Add Lines 2, 3, and 4)

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

E-500H

(

)

Title:

Phone:

Web

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0710

10-00

1

1