Reset Form

FIT CS

Rev. 7/14

P.O. Box 16158

Columbus, OH 43216-6158

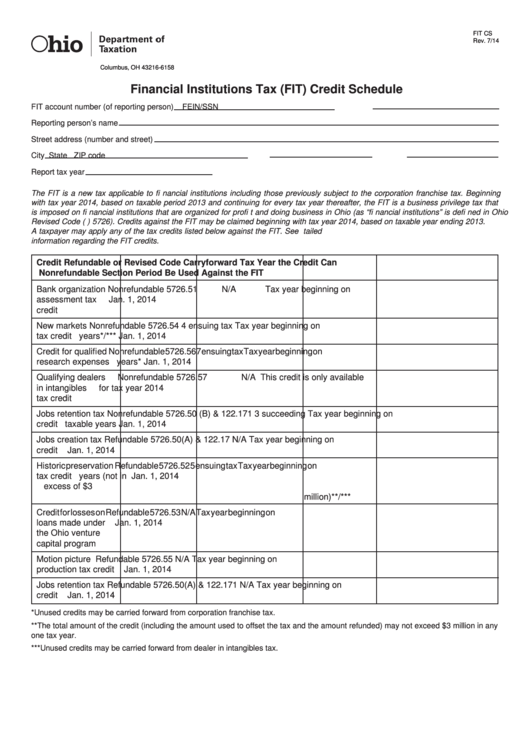

Financial Institutions Tax (FIT) Credit Schedule

FIT account number (of reporting person)

FEIN/SSN

Reporting person’s name

Street address (number and street)

City

State

ZIP code

Report tax year

The FIT is a new tax applicable to fi nancial institutions including those previously subject to the corporation franchise tax. Beginning

with tax year 2014, based on taxable period 2013 and continuing for every tax year thereafter, the FIT is a business privilege tax that

is imposed on fi nancial institutions that are organized for profi t and doing business in Ohio (as “fi nancial institutions” is defi ned in Ohio

Revised Code (R.C.) 5726). Credits against the FIT may be claimed beginning with tax year 2014, based on taxable year ending 2013.

A taxpayer may apply any of the tax credits listed below against the FIT. See R.C. sections 5726.50 through 5726.57 for more detailed

information regarding the FIT credits.

Credit

Refundable or

Revised Code

Carryforward

Tax Year the Credit Can

Nonrefundable

Section

Period

Be Used Against the FIT

Bank organization

Nonrefundable

5726.51

N/A

Tax year beginning on

assessment tax

Jan. 1, 2014

credit

New markets

Nonrefundable

5726.54

4 ensuing tax

Tax year beginning on

tax credit

years*/***

Jan. 1, 2014

Credit for qualifi ed

Nonrefundable

5726.56

7 ensuing tax

Tax year beginning on

research expenses

years*

Jan. 1, 2014

Qualifying dealers

Nonrefundable

5726.57

N/A

This credit is only available

in intangibles

for tax year 2014

tax credit

Jobs retention tax

Nonrefundable

5726.50 (B) & 122.171

3 succeeding

Tax year beginning on

credit

taxable years

Jan. 1, 2014

Jobs creation tax

Refundable

5726.50(A) & 122.17

N/A

Tax year beginning on

credit

Jan. 1, 2014

Historic preservation

Refundable

5726.52

5 ensuing tax

Tax year beginning on

tax credit

years (not in

Jan. 1, 2014

excess of $3

million)**/***

Credit for losses on

Refundable

5726.53

N/A

Tax year beginning on

loans made under

Jan. 1, 2014

the Ohio venture

capital program

Motion picture

Refundable

5726.55

N/A

Tax year beginning on

production tax credit

Jan. 1, 2014

Jobs retention tax

Refundable

5726.50(A) & 122.171

N/A

Tax year beginning on

credit

Jan. 1, 2014

*Unused credits may be carried forward from corporation franchise tax.

**The total amount of the credit (including the amount used to offset the tax and the amount refunded) may not exceed $3 million in any

one tax year.

***Unused credits may be carried forward from dealer in intangibles tax.

1

1 2

2