Form 1040n Schedules I, Ii, And Iii - 2012

ADVERTISEMENT

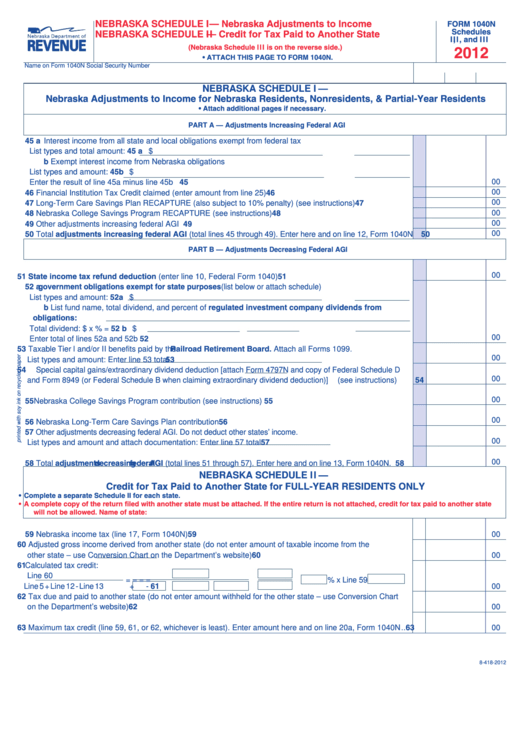

NEBRASKA SCHEDULE I — Nebraska Adjustments to Income

FORM 1040N

Schedules

NEBRASKA SCHEDULE II — Credit for Tax Paid to Another State

I, II, and III

(Nebraska Schedule III is on the reverse side.)

2012

• ATTACH THIS PAGE TO FORM 1040N.

Name on Form 1040N

Social Security Number

NEBRASKA SCHEDULE I —

Nebraska Adjustments to Income for Nebraska Residents, Nonresidents, & Partial-Year Residents

• Attach additional pages if necessary.

PART A — Adjustments Increasing Federal AGI

45 a Interest income from all state and local obligations exempt from federal tax

45 a $

List types and total amount:

b Exempt interest income from Nebraska obligations

45 b $

List types and amount:

Enter the result of line 45a minus line 45b ..................................................................................................... 45

00

46 Financial Institution Tax Credit claimed (enter amount from line 25) ................................................................... 46

00

47 Long-Term Care Savings Plan RECAPTURE (also subject to 10% penalty) (see instructions) .......................... 47

00

48 Nebraska College Savings Program RECAPTURE (see instructions) ................................................................ 48

00

49 Other adjustments increasing federal AGI .......................................................................................................... 49

00

50 Total adjustments increasing federal AGI (total lines 45 through 49). Enter here and on line 12, Form 1040N 50

00

PART B — Adjustments Decreasing Federal AGI

51 State income tax refund deduction (enter line 10, Federal Form 1040) .......................................................... 51

00

52 a U.S. government obligations exempt for state purposes (list below or attach schedule)

52 a $

List types and amount:

b List fund name, total dividend, and percent of regulated investment company dividends from

U.S. obligations:

52 b $

Total dividend: $

x

% =

Enter total of lines 52a and 52b ...................................................................................................................... 52

00

53 Taxable Tier I and/or II benefits paid by the Railroad Retirement Board. Attach all Forms 1099.

Enter line 53 total ........ 53

00

List types and amount:

54 Special capital gains/extraordinary dividend deduction [attach Form 4797N and copy of Federal Schedule D

and Form 8949 (or Federal Schedule B when claiming extraordinary dividend deduction)] (see instructions) ...... 54

00

55 Nebraska College Savings Program contribution (see instructions).................................................................... 55

00

56 Nebraska Long-Term Care Savings Plan contribution ......................................................................................... 56

00

57 Other adjustments decreasing federal AGI. Do not deduct other states’ income.

Enter line 57 total ........ 57

00

List types and amount and attach documentation:

58 Total adjustments decreasing federal AGI (total lines 51 through 57). Enter here and on line 13, Form 1040N. 58

00

NEBRASKA SCHEDULE II —

Credit for Tax Paid to Another State for FULL-YEAR RESIDENTS ONLY

• Complete a separate Schedule II for each state.

• A complete copy of the return filed with another state must be attached. If the entire return is not attached, credit for tax paid to another state

will not be allowed. Name of state:

59 Nebraska income tax (line 17, Form 1040N) ....................................................................................................... 59

00

60 Adjusted gross income derived from another state (do not enter amount of taxable income from the

other state – use Conversion Chart on the Department’s website) ..................................................................... 60

00

61

Calculated tax credit:

Line 60

=

=

=

% x Line 59

=

61

00

Line 5 + Line 12 - Line 13

+

-

62 Tax due and paid to another state (do not enter amount withheld for the other state – use Conversion Chart

on the Department’s website) .............................................................................................................................. 62

00

63 Maximum tax credit (line 59, 61, or 62, whichever is least). Enter amount here and on line 20a, Form 1040N .. 63

00

8-418-2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2