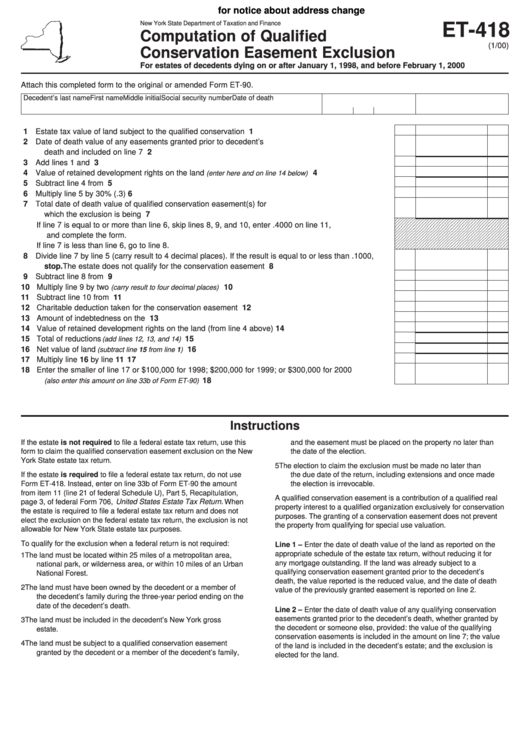

Form Et-418 - Computation Of Qualified Conservation Easement Exclusion

ADVERTISEMENT

Click here

for notice about address change

New York State Department of Taxation and Finance

ET-418

Computation of Qualified

(1/00)

Conservation Easement Exclusion

For estates of decedents dying on or after January 1, 1998, and before February 1, 2000

Attach this completed form to the original or amended Form ET-90.

Decedent’s last name

First name

Middle initial

Social security number

Date of death

1 Estate tax value of land subject to the qualified conservation easement .................................................

1

2 Date of death value of any easements granted prior to decedent’s

death and included on line 7 below .......................................................................................................

2

3 Add lines 1 and 2 .......................................................................................................................................

3

4 Value of retained development rights on the land

....................................

4

(enter here and on line 14 below)

5 Subtract line 4 from 3 .................................................................................................................................

5

6 Multiply line 5 by 30% (.3) .........................................................................................................................

6

7 Total date of death value of qualified conservation easement(s) for

which the exclusion is being claimed .....................................................................................................

7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

If line 7 is equal to or more than line 6, skip lines 8, 9, and 10, enter .4000 on line 11,

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

and complete the form.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

If line 7 is less than line 6, go to line 8.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9

8 Divide line 7 by line 5 (carry result to 4 decimal places). If the result is equal to or less than .1000,

stop. The estate does not qualify for the conservation easement exclusion .........................................

8

9 Subtract line 8 from .3000 .........................................................................................................................

9

10 Multiply line 9 by two

.............................................................................

10

(carry result to four decimal places)

11 Subtract line 10 from .4000 .......................................................................................................................

11

12 Charitable deduction taken for the conservation easement ......................................................................

12

13 Amount of indebtedness on the land .........................................................................................................

13

14 Value of retained development rights on the land (from line 4 above) .....................................................

14

15 Total of reductions

...............................................................................................

15

(add lines 12, 13, and 14)

16 Net value of land

..............................................................................................

16

(subtract line 15 from line 1)

17 Multiply line 16 by line 11 ..........................................................................................................................

17

18 Enter the smaller of line 17 or $100,000 for 1998; $200,000 for 1999; or $300,000 for 2000

.......................................................................................

18

(also enter this amount on line 33b of Form ET-90)

Instructions

If the estate is not required to file a federal estate tax return, use this

and the easement must be placed on the property no later than

form to claim the qualified conservation easement exclusion on the New

the date of the election.

York State estate tax return.

5

The election to claim the exclusion must be made no later than

If the estate is required to file a federal estate tax return, do not use

the due date of the return, including extensions and once made

Form ET-418. Instead, enter on line 33b of Form ET-90 the amount

the election is irrevocable.

from item 11 (line 21 of federal Schedule U), Part 5, Recapitulation,

A qualified conservation easement is a contribution of a qualified real

page 3, of federal Form 706, United States Estate Tax Return. When

property interest to a qualified organization exclusively for conservation

the estate is required to file a federal estate tax return and does not

purposes. The granting of a conservation easement does not prevent

elect the exclusion on the federal estate tax return, the exclusion is not

the property from qualifying for special use valuation.

allowable for New York State estate tax purposes.

To qualify for the exclusion when a federal return is not required:

Line 1 – Enter the date of death value of the land as reported on the

appropriate schedule of the estate tax return, without reducing it for

1

The land must be located within 25 miles of a metropolitan area,

any mortgage outstanding. If the land was already subject to a

national park, or wilderness area, or within 10 miles of an Urban

qualifying conservation easement granted prior to the decedent’s

National Forest.

death, the value reported is the reduced value, and the date of death

2

The land must have been owned by the decedent or a member of

value of the previously granted easement is reported on line 2.

the decedent’s family during the three-year period ending on the

date of the decedent’s death.

Line 2 – Enter the date of death value of any qualifying conservation

easements granted prior to the decedent’s death, whether granted by

3

The land must be included in the decedent’s New York gross

the decedent or someone else, provided: the value of the qualifying

estate.

conservation easements is included in the amount on line 7; the value

4

The land must be subject to a qualified conservation easement

of the land is included in the decedent’s estate; and the exclusion is

granted by the decedent or a member of the decedent’s family,

elected for the land.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3