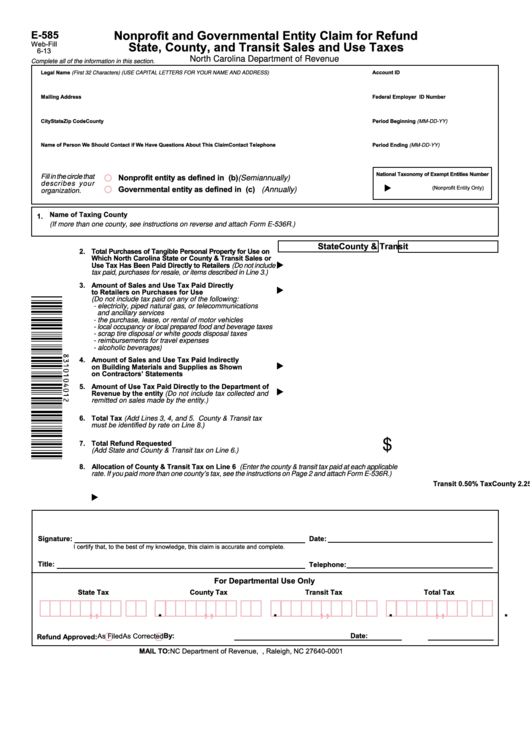

Nonprofit and Governmental Entity Claim for Refund

E-585

State, County, and Transit Sales and Use Taxes

Web-Fill

6-13

North Carolina Department of Revenue

Complete all of the information in this section.

Legal Name (First 32 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Account ID

Mailing Address

Federal Employer ID Number

City

State

Zip Code

County

Period Beginning (MM-DD-YY)

Name of Person We Should Contact if We Have Questions About This Claim

Contact Telephone

Period Ending (MM-DD-YY)

National Taxonomy of Exempt Entities Number

Nonprofit entity as defined in G.S. 105-164.14(b) (Semiannually)

Fill in the circle that

describes your

Governmental entity as defined in G.S. 105-164.14(c) (Annually)

(Nonprofit Entity Only)

organization.

1.

Name of Taxing County

(If more than one county, see instructions on reverse and attach Form E-536R.)

State

County & Transit

2.

Total Purchases of Tangible Personal Property for Use on

Which North Carolina State or County & Transit Sales or

Use Tax Has Been Paid Directly to Retailers (Do not include

tax paid, purchases for resale, or items described in Line 3.)

3.

Amount of Sales and Use Tax Paid Directly

to Retailers on Purchases for Use

(Do not include tax paid on any of the following:

- electricity, piped natural gas, or telecommunications

and ancillary services

- the purchase, lease, or rental of motor vehicles

- local occupancy or local prepared food and beverage taxes

- scrap tire disposal or white goods disposal taxes

- reimbursements for travel expenses

- alcoholic beverages)

4.

Amount of Sales and Use Tax Paid Indirectly

on Building Materials and Supplies as Shown

on Contractors’ Statements

5.

Amount of Use Tax Paid Directly to the Department of

Revenue by the entity (Do not include tax collected and

remitted on sales made by the entity.)

6.

Total Tax (Add Lines 3, 4, and 5. County & Transit tax

must be identified by rate on Line 8.)

$

7.

Total Refund Requested

(Add State and County & Transit tax on Line 6.)

8. Allocation of County & Transit Tax on Line 6 (Enter the county & transit tax paid at each applicable

rate. If you paid more than one county’s tax, see the instructions on Page 2 and attach Form E-536R.)

Food 2.00% Tax

County 2.00% Tax

County 2.25% Tax

Transit 0.50% Tax

Signature:

Date:

I certify that, to the best of my knowledge, this claim is accurate and complete.

Title:

Telephone:

For Departmental Use Only

State Tax

County Tax

Transit Tax

Total Tax

,

,

,

,

,

,

,

,

.

.

.

.

By:

Date:

As Filed

As Corrected

Refund Approved:

MAIL TO: NC Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0001

1

1 2

2