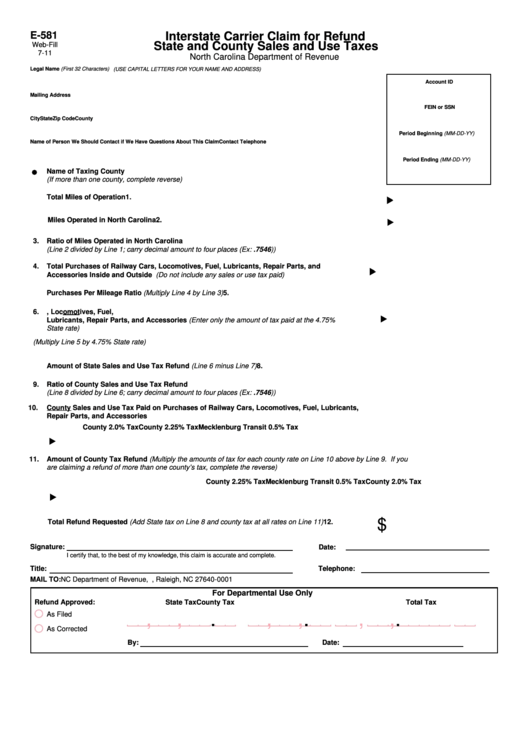

E-581

Interstate Carrier Claim for Refund

State and County Sales and Use Taxes

Web-Fill

7-11

North Carolina Department of Revenue

Legal Name (First 32 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Account ID

Mailing Address

FEIN or SSN

City

State

Zip Code

County

Period Beginning (MM-DD-YY)

Name of Person We Should Contact if We Have Questions About This Claim

Contact Telephone

Period Ending (MM-DD-YY)

Name of Taxing County

(If more than one county, complete reverse)

1.

Total Miles of Operation

2.

Miles Operated in North Carolina

3.

Ratio of Miles Operated in North Carolina

(Line 2 divided by Line 1; carry decimal amount to four places (Ex: .7546))

4.

Total Purchases of Railway Cars, Locomotives, Fuel, Lubricants, Repair Parts, and

Accessories Inside and Outside N.C. (Do not include any sales or use tax paid)

5.

Purchases Per Mileage Ratio (Multiply Line 4 by Line 3)

6.

N.C. State Sales and Use Tax Paid on Purchases of Railway Cars, Locomotives, Fuel,

Lubricants, Repair Parts, and Accessories (Enter only the amount of tax paid at the 4.75%

State rate)

7.

State Tax on Purchases Per Mileage Ratio (Multiply Line 5 by 4.75% State rate)

8.

Amount of State Sales and Use Tax Refund (Line 6 minus Line 7)

9.

Ratio of County Sales and Use Tax Refund

(Line 8 divided by Line 6; carry decimal amount to four places (Ex: .7546))

10.

County Sales and Use Tax Paid on Purchases of Railway Cars, Locomotives, Fuel, Lubricants,

Repair Parts, and Accessories

County 2.0% Tax

County 2.25% Tax

Mecklenburg Transit 0.5% Tax

11.

Amount of County Tax Refund (Multiply the amounts of tax for each county rate on Line 10 above by Line 9. If you

are claiming a refund of more than one county’s tax, complete the reverse)

County 2.0% Tax

County 2.25% Tax

Mecklenburg Transit 0.5% Tax

$

12.

Total Refund Requested (Add State tax on Line 8 and county tax at all rates on Line 11)

Signature:

Date:

I certify that, to the best of my knowledge, this claim is accurate and complete.

Title:

Telephone:

MAIL TO: NC Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0001

For Departmental Use Only

Refund Approved:

State Tax

County Tax

Total Tax

,

,

.

,

,

.

,

,

.

As Filed

As Corrected

By:

Date:

1

1 2

2