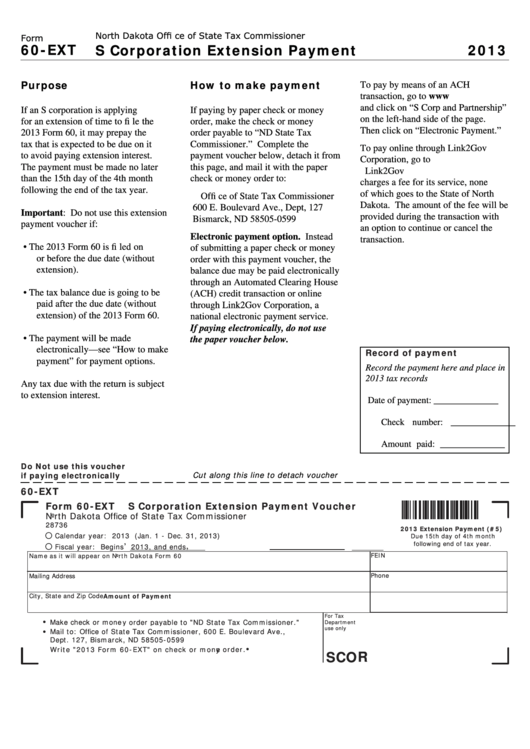

North Dakota Offi ce of State Tax Commissioner

Form

60-EXT

S Corporation Extension Payment

2013

Purpose

How to make payment

To pay by means of an ACH

transaction, go to

and click on “S Corp and Partnership”

If an S corporation is applying

If paying by paper check or money

on the left-hand side of the page.

for an extension of time to fi le the

order, make the check or money

Then click on “Electronic Payment.”

2013 Form 60, it may prepay the

order payable to “ND State Tax

tax that is expected to be due on it

Commissioner.” Complete the

To pay online through Link2Gov

to avoid paying extension interest.

payment voucher below, detach it from

Corporation, go to

The payment must be made no later

this page, and mail it with the paper

Link2Gov

than the 15th day of the 4th month

check or money order to:

charges a fee for its service, none

following the end of the tax year.

of which goes to the State of North

Offi ce of State Tax Commissioner

Dakota. The amount of the fee will be

600 E. Boulevard Ave., Dept, 127

Important: Do not use this extension

provided during the transaction with

Bismarck, ND 58505-0599

payment voucher if:

an option to continue or cancel the

Electronic payment option. Instead

transaction.

• The 2013 Form 60 is fi led on

of submitting a paper check or money

or before the due date (without

order with this payment voucher, the

extension).

balance due may be paid electronically

through an Automated Clearing House

• The tax balance due is going to be

(ACH) credit transaction or online

paid after the due date (without

through Link2Gov Corporation, a

extension) of the 2013 Form 60.

national electronic payment service.

If paying electronically, do not use

• The payment will be made

the paper voucher below.

electronically—see “How to make

Record of payment

payment” for payment options.

Record the payment here and place in

2013 tax records

Any tax due with the return is subject

to extension interest.

Date of payment: ______________

Check number: ______________

Amount paid: ______________

Do Not use this voucher

Cut along this line to detach voucher

if paying electronically

60-EXT

Form 60-EXT

S Corporation Extension Payment Voucher

North Dakota Office of State Tax Commissioner

28736

2013 Extension Payment (#5)

Calendar year: 2013 (Jan. 1 - Dec. 31, 2013)

Due 15th day of 4th month

,

following end of tax year.

Fiscal year: Begins

2013, and ends

,

FEIN

Name as it will appear on North Dakota Form 60

Phone

Mailing Address

City, State and Zip Code

Amount of Payment

For Tax

Make check or money order payable to "ND State Tax Commissioner."

•

Department

use only

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave.,

•

Dept. 127, Bismarck, ND 58505-0599

Write "2013 Form 60-EXT" on check or money order.

•

SCOR

1

1