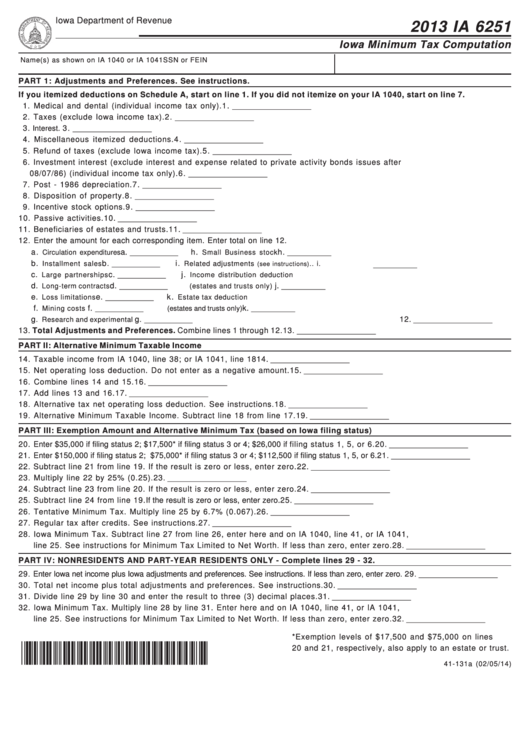

Iowa Department of Revenue

2013 IA 6251

Iowa Minimum Tax Computation

Name(s) as shown on IA 1040 or IA 1041

SSN or FEIN

PART 1: Adjustments and Preferences. See instructions.

If you itemized deductions on Schedule A, start on line 1. If you did not itemize on your IA 1040, start on line 7.

1. Medical and dental (individual income tax only). ......................................................................................... 1. __________________

2. Taxes (exclude Iowa income tax). ................................................................................................................... 2. __________________

3. Interest. ........................................................................................................................................................................... 3. __________________

4. Miscellaneous itemized deductions. ............................................................................................................... 4. __________________

5. Refund of taxes (exclude Iowa income tax). .................................................................................................. 5. __________________

6. Investment interest (exclude interest and expense related to private activity bonds issues after

08/07/86) (individual income tax only). ........................................................................................................... 6. __________________

7. Post - 1986 depreciation. .................................................................................................................................. 7. __________________

8. Disposition of property. ..................................................................................................................................... 8. __________________

9. Incentive stock options. ..................................................................................................................................... 9. __________________

10. Passive activities. ............................................................................................................................................... 10. __________________

11. Beneficiaries of estates and trusts. ................................................................................................................. 11. __________________

12. Enter the amount for each corresponding item. Enter total on line 12.

a.

a. ___________

h.

h. __________

Circulation expenditures ...............

Small Business stock ...........................

b.

b. ___________

i.

Installment sales .........................

Related adjustments

.. i.

(see instructions)

c.

c. ___________

j.

Large partnerships .....................

Income distribution deduction

d.

d. ___________

j. __________

Long-term contracts .....................

(estates and trusts only) .........................

e.

e. ___________

k.

Loss limitations ............................

Estate tax deduction

f.

f. ___________

k. __________

Mining costs ..................................

(estates and trusts only) ............................

g.

g. ___________

12. __________________

Research and experimental ........

13. Total Adjustments and Preferences. Combine lines 1 through 12. ............................................................ 13. __________________

PART II: Alternative Minimum Taxable Income

14. Taxable income from IA 1040, line 38; or IA 1041, line 18 ......................................................................... 14. __________________

15. Net operating loss deduction. Do not enter as a negative amount. .......................................................... 15. __________________

16. Combine lines 14 and 15. ................................................................................................................................. 16. __________________

17. Add lines 13 and 16. .......................................................................................................................................... 17. __________________

18. Alternative tax net operating loss deduction. See instructions. ................................................................ 18. __________________

19. Alternative Minimum Taxable Income. Subtract line 18 from line 17. ...................................................... 19. __________________

PART III: Exemption Amount and Alternative Minimum Tax (based on Iowa filing status)

20. Enter $35,000 if filing status 2; $17,500* if filing status 3 or 4; $26,000 if filing status 1, 5, or 6. .................. 20. __________________

21. Enter $150,000 if filing status 2; $75,000* if filing status 3 or 4; $112,500 if filing status 1, 5, or 6. ................. 21. __________________

22. Subtract line 21 from line 19. If the result is zero or less, enter zero. ...................................................... 22. __________________

23. Multiply line 22 by 25% (0.25). ........................................................................................................................ 23. __________________

24. Subtract line 23 from line 20. If the result is zero or less, enter zero. ...................................................... 24. __________________

25. Subtract line 24 from line 19.If the result is zero or less, enter zero. ............................................................. 25. __________________

26. Tentative Minimum Tax. Multiply line 25 by 6.7% (0.067). ......................................................................... 26. __________________

27. Regular tax after credits. See instructions. .................................................................................................... 27. __________________

28. Iowa Minimum Tax. Subtract line 27 from line 26, enter here and on IA 1040, line 41, or IA 1041,

line 25. See instructions for Minimum Tax Limited to Net Worth. If less than zero, enter zero. .......... 28. __________________

PART IV: NONRESIDENTS AND PART-YEAR RESIDENTS ONLY - Complete lines 29 - 32.

29. Enter Iowa net income plus Iowa adjustments and preferences. See instructions. If less than zero, enter zero. ..... 29. __________________

30. Total net income plus total adjustments and preferences. See instructions. .......................................... 30. __________________

31. Divide line 29 by line 30 and enter the result to three (3) decimal places. ............................................ 31. __________________

32. Iowa Minimum Tax. Multiply line 28 by line 31. Enter here and on IA 1040, line 41, or IA 1041,

line 25. See instructions for Minimum Tax Limited to Net Worth. If less than zero, enter zero. .......... 32. __________________

*Exemption levels of $17,500 and $75,000 on lines

*1341131019999*

20 and 21, respectively, also apply to an estate or trust.

41-131a (02/05/14)

1

1 2

2