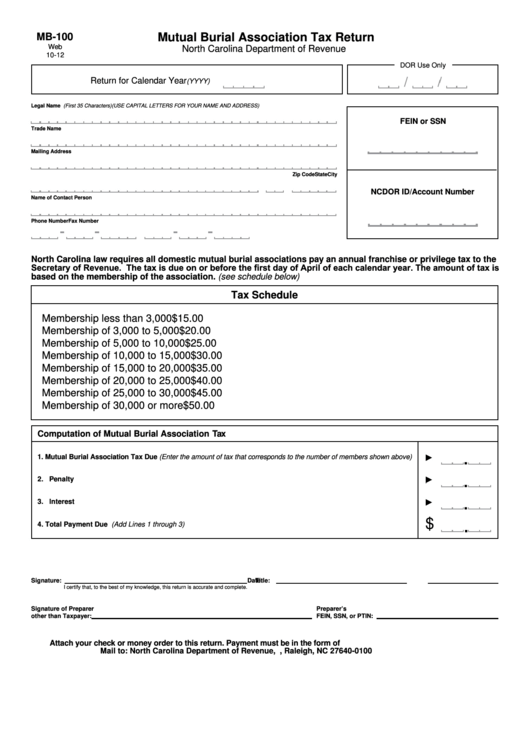

MB-100

Mutual Burial Association Tax Return

Web

North Carolina Department of Revenue

10-12

DOR Use Only

Return for Calendar Year

(YYYY)

Legal Name (First 35 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

FEIN or SSN

Trade Name

Mailing Address

City

State

Zip Code

NCDOR ID/Account Number

Name of Contact Person

Phone Number

Fax Number

North Carolina law requires all domestic mutual burial associations pay an annual franchise or privilege tax to the

Secretary of Revenue. The tax is due on or before the first day of April of each calendar year. The amount of tax is

based on the membership of the association. (see schedule below)

Tax Schedule

Membership less than 3,000 ................................................................................................. $15.00

Membership of 3,000 to 5,000 ............................................................................................... $20.00

Membership of 5,000 to 10,000 ............................................................................................. $25.00

Membership of 10,000 to 15,000 ........................................................................................... $30.00

Membership of 15,000 to 20,000 ........................................................................................... $35.00

Membership of 20,000 to 25,000 ........................................................................................... $40.00

Membership of 25,000 to 30,000 ........................................................................................... $45.00

Membership of 30,000 or more ............................................................................................. $50.00

Computation of Mutual Burial Association Tax

.

1. Mutual Burial Association Tax Due (Enter the amount of tax that corresponds to the number of members shown above)

.

2. Penalty

.

3. Interest

.

$

4. Total Payment Due (Add Lines 1 through 3)

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Signature of Preparer

Preparer’s

other than Taxpayer:

FEIN, SSN, or PTIN:

Attach your check or money order to this return. Payment must be in the form of U.S. currency from a domestic bank.

Mail to: North Carolina Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0100

1

1