Form M-656 - Offer In Settlement

Download a blank fillable Form M-656 - Offer In Settlement in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form M-656 - Offer In Settlement with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

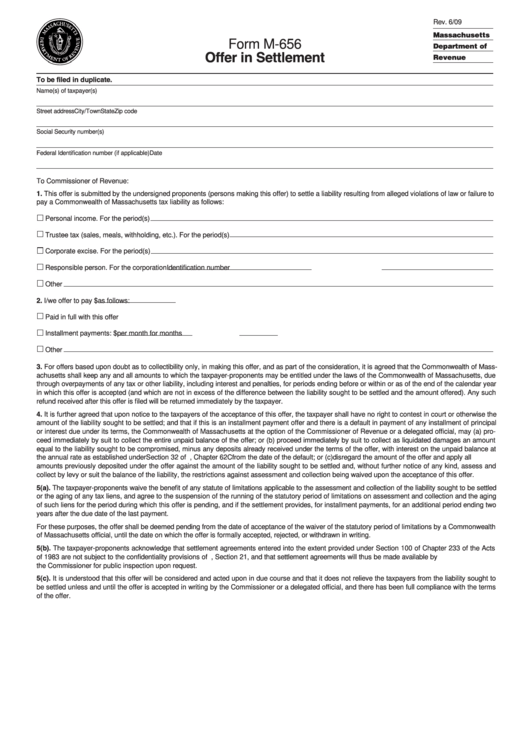

Rev. 6/09

Massachusetts

Form M-656

Department of

Offer in Settlement

Revenue

To be filed in duplicate.

Name(s) of taxpayer(s)

Street address

City/Town

State

Zip code

Social Security number(s)

Federal Identification number (if applicable)

Date

To Commissioner of Revenue:

1. This offer is submitted by the undersigned proponents (persons making this offer) to settle a liability resulting from alleged violations of law or failure to

pay a Commonwealth of Massachusetts tax liability as follows:

Personal income. For the period(s)

Trustee tax (sales, meals, withholding, etc.). For the period(s)

Corporate excise. For the period(s)

Responsible person. For the corporation

Identification number

Other

2. I/we offer to pay $

as follows:

Paid in full with this offer

Installment payments: $

per month for

months

Other

3. For offers based upon doubt as to collectibility only, in making this offer, and as part of the consideration, it is agreed that the Commonwealth of Mass-

achusetts shall keep any and all amounts to which the taxpayer-proponents may be entitled under the laws of the Commonwealth of Massachusetts, due

through overpayments of any tax or other liability, including interest and penalties, for periods ending before or within or as of the end of the calendar year

in which this offer is accepted (and which are not in excess of the difference between the liability sought to be settled and the amount offered). Any such

refund received after this offer is filed will be returned immediately by the taxpayer.

4. It is further agreed that upon notice to the taxpayers of the acceptance of this offer, the taxpayer shall have no right to contest in court or otherwise the

amount of the liability sought to be settled; and that if this is an installment payment offer and there is a default in payment of any installment of principal

or interest due under its terms, the Commonwealth of Massachusetts at the option of the Commissioner of Revenue or a delegated official, may (a) pro-

ceed immediately by suit to collect the entire unpaid balance of the offer; or (b) proceed immediately by suit to collect as liquidated damages an amount

equal to the liability sought to be compromised, minus any deposits already received under the terms of the offer, with interest on the unpaid balance at

the annual rate as established under Section 32 of M.G.L., Chapter 62C from the date of the default; or (c) disregard the amount of the offer and apply all

amounts previously deposited under the offer against the amount of the liability sought to be settled and, without further notice of any kind, assess and

collect by levy or suit the balance of the liability, the restrictions against assessment and collection being waived upon the acceptance of this offer.

5(a). The taxpayer-proponents waive the benefit of any statute of limitations applicable to the assessment and collection of the liability sought to be settled

or the aging of any tax liens, and agree to the suspension of the running of the statutory period of limitations on assessment and collection and the aging

of such liens for the period during which this offer is pending, and if the settlement provides, for installment payments, for an additional period ending two

years after the due date of the last payment.

For these purposes, the offer shall be deemed pending from the date of acceptance of the waiver of the statutory period of limitations by a Commonwealth

of Massachusetts official, until the date on which the offer is formally accepted, rejected, or withdrawn in writing.

5(b). The taxpayer-proponents acknowledge that settlement agreements entered into the extent provided under Section 100 of Chapter 233 of the Acts

of 1983 are not subject to the confidentiality provisions of M.G.L. Chapter 62C, Section 21, and that settlement agreements will thus be made available by

the Commissioner for public inspection upon request.

5(c). It is understood that this offer will be considered and acted upon in due course and that it does not relieve the taxpayers from the liability sought to

be settled unless and until the offer is accepted in writing by the Commissioner or a delegated official, and there has been full compliance with the terms

of the offer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2