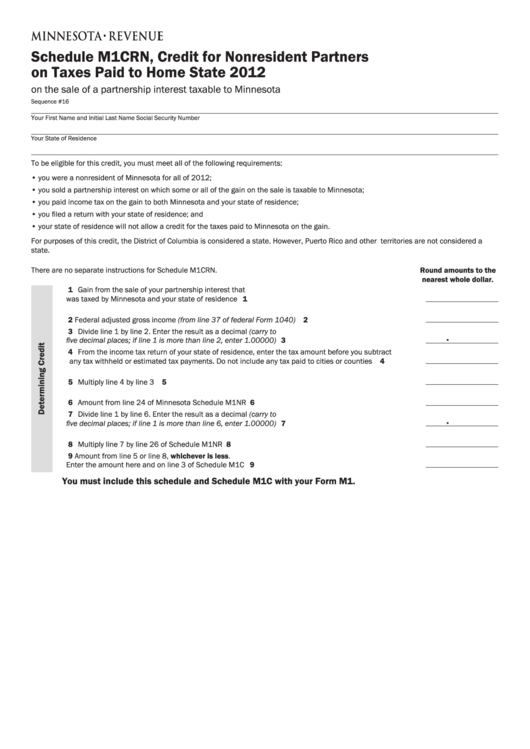

Schedule M1CRN, Credit for Nonresident Partners

on Taxes Paid to Home State 2012

on the sale of a partnership interest taxable to Minnesota

Sequence #16

Y

our First Name and Initial

Last Name

Social Security Number

Your State of Residence

To be eligible for this credit, you must meet all of the following requirements:

• you were a nonresident of Minnesota for all of 2012;

• you sold a partnership interest on which some or all of the gain on the sale is taxable to Minnesota;

• you paid income tax on the gain to both Minnesota and your state of residence;

• you filed a return with your state of residence; and

• your state of residence will not allow a credit for the taxes paid to Minnesota on the gain.

For purposes of this credit, the District of Columbia is considered a state. However, Puerto Rico and other U.S. territories are not considered a

state.

There are no separate instructions for Schedule M1CRN.

Round amounts to the

nearest whole dollar.

1 Gain from the sale of your partnership interest that

was taxed by Minnesota and your state of residence . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Federal adjusted gross income (from line 37 of federal Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Divide line 1 by line 2. Enter the result as a decimal (carry to

.

five decimal places; if line 1 is more than line 2, enter 1.00000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 From the income tax return of your state of residence, enter the tax amount before you subtract

any tax withheld or estimated tax payments. Do not include any tax paid to cities or counties . . . . . . . . 4

5 Multiply line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Amount from line 24 of Minnesota Schedule M1NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Divide line 1 by line 6. Enter the result as a decimal (carry to

.

five decimal places; if line 1 is more than line 6, enter 1.00000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Multiply line 7 by line 26 of Schedule M1NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Amount from line 5 or line 8, whichever is less.

Enter the amount here and on line 3 of Schedule M1C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

You must include this schedule and Schedule M1C with your Form M1.

1

1