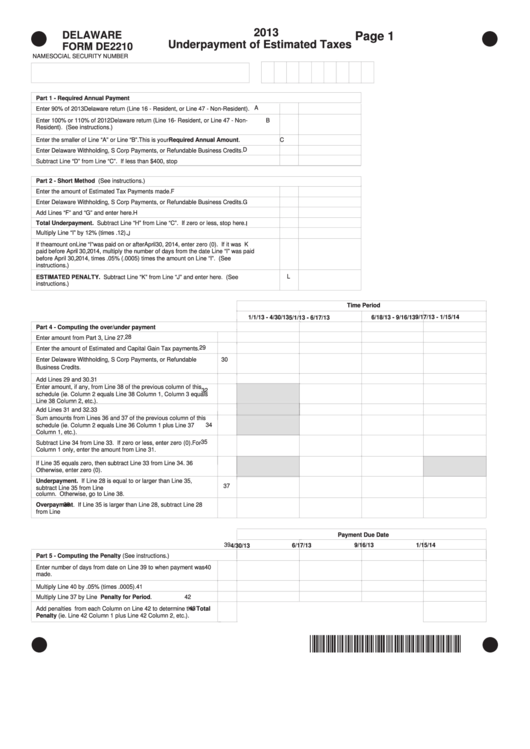

2013

DELAWARE

Page 1

Underpayment of Estimated Taxes

FORM DE2210

NAME

SOCIAL SECURITY NUMBER

Part 1 - Required Annual Payment

A

Enter 90% of 2013 Delaware return (Line 16 - Resident, or Line 47 - Non-Resident).

Reset

Enter 100% or 110% of 2012 Delaware return (Line 16 - Resident, or Line 47 - Non

-

B

Resident). (See instructions.)

Print Form

Enter the smaller of Line “A” or Line “B”. This is your Required Annual Amount.

C

D

Enter Delaware Withholding, S Corp Payments, or Refundable Business Credits.

Subtract Line “D” from Line “C”. If less than $400, stop here. You do not owe the penalty.

E

Part 2 - Short Method (See instructions.)

Enter the amount of Estimated Tax Payments made.

F

Enter Delaware Withholding, S Corp Payments, or Refundable Business Credits.

G

Add Lines “F” and “G” and enter here.

H

Total Underpayment. Subtract Line “H” from Line “C”. If zero or less, stop here.

I

Multiply Line “I” by 12% (times .12).

J

If the amount on Line “I” was paid on or after April 30, 2014, enter zero (0). If it was

K

paid before April 30, 2014, multiply the number of days from the date Line “I” was paid

before April 30, 2014 , times .05% (.0005) times the amount on Line “I”. (See

instructions.)

L

ESTIMATED PENALTY. Subtract Line “K” from Line “J” and enter here. (See

instructions.)

Time Period

1/1/13 - 4/30/13

6/18/13 - 9/16/13

9/17/13 - 1/15/14

5/1/13 - 6/17/13

Part 4 - Computing the over/under payment

28

Enter amount from Part 3, Line 27.

29

Enter the amount of Estimated and Capital Gain Tax payments.

Enter Delaware Withholding, S Corp Payments, or Refundable

30

Business Credits.

Add Lines 29 and 30.

31

Enter amount, if any, from Line 38 of the previous column of this

32

schedule (ie. Column 2 equals Line 38 Column 1, Column 3 equals

Line 38 Column 2, etc.).

Add Lines 31 and 32.

33

Sum amounts from Lines 36 and 37 of the previous column of this

schedule (ie. Column 2 equals Line 36 Column 1 plus Line 37

34

Column 1, etc.).

35

Subtract Line 34 from Line 33. If zero or less, enter zero (0). For

Column 1 only, enter the amount from Line 31.

If Line 35 equals zero, then subtract Line 33 from Line 34.

36

Otherwise, enter zero (0).

Underpayment. If Line 28 is equal to or larger than Line 35,

37

subtract Line 35 from Line 28. Then go to Line 32 of the next

column. Otherwise, go to Line 38.

Overpayment. If Line 35 is larger than Line 28, subtract Line 28

38

from Line 35. Then go to Line 32 of the next column.

Payment Due Date

39

9/16/13

1/15/14

4/30/13

6/17/13

Part 5 - Computing the Penalty (See instructions.)

Enter number of days from date on Line 39 to when payment was

40

made.

Multiply Line 40 by .05% (times .0005).

41

Multiply Line 37 by Line 41. This is the Penalty for Period.

42

Add penalties from each Column on Line 42 to determine the Total

43

Penalty (ie. Line 42 Column 1 plus Line 42 Column 2, etc.).

*DF20913019999*

1

1 2

2