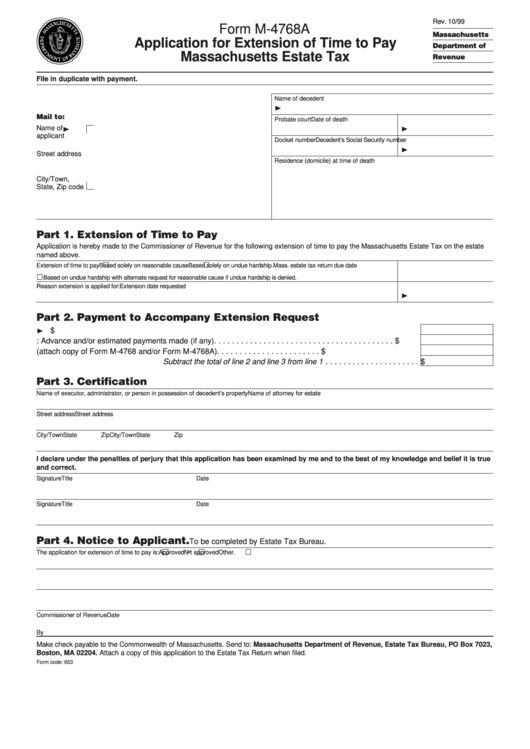

Rev. 10/99

Form M-4768A

Massachusetts

Application for Extension of Time to Pay

Department of

Massachusetts Estate Tax

Revenue

File in duplicate with payment.

Name of decedent

¨

Mail to:

Probate court

Date of death

¨

Name of

¨

applicant

Docket number

Decedent’s Social Security number

¨

Street address

Residence (domicile) at time of death

City/Town,

State, Zip code

Part 1. Extension of Time to Pay

Application is hereby made to the Commissioner of Revenue for the following extension of time to pay the Massachusetts Estate T ax on the estate

named above.

Extension of time to pay

Based solely on reasonable cause

Based solely on undue hardship.

Mass. estate tax return due date

Based on undue hardship with alternate request for reasonable cause if undue hardship is denied.

Reason extension is applied for:

Extension date requested

¨

Part 2. Payment to Accompany Extension Request

¨

1. Estimated amount of Massachusetts estate tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

2. Less: Advance and/or estimated payments made (if any) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

3. Prior extension payments (attach copy of Form M-4768 and/or Form M-4768A) . . . . . . . . . . . . . . . . . . . . . . .

$

4. Balance due with this application. Subtract the total of line 2 and line 3 from line 1 . . . . . . . . . . . . . . . . . . . . .

$

Part 3. Certification

Name of executor, administrator, or person in possession of decedent’s property

Name of attorney for estate

Street address

Street address

City/Town

State

Zip

City/Town

State

Zip

I declare under the penalties of perjury that this application has been examined by me and to the best of my knowledge and belief it is true

and correct.

Signature

Title

Date

Signature

Title

Date

Part 4. Notice to Applicant.

To be completed by Estate Tax Bureau.

The application for extension of time to pay is:

Approved

Not approved

Other.

Commissioner of Revenue

Date

By

Make check payable to the Commonwealth of Massachusetts. Send to: Massachusetts Department of Revenue, Estate Tax Bureau, PO Box 7023,

Boston, MA 02204. Attach a copy of this application to the Estate Tax Return when filed.

Form code: 653

1

1 2

2