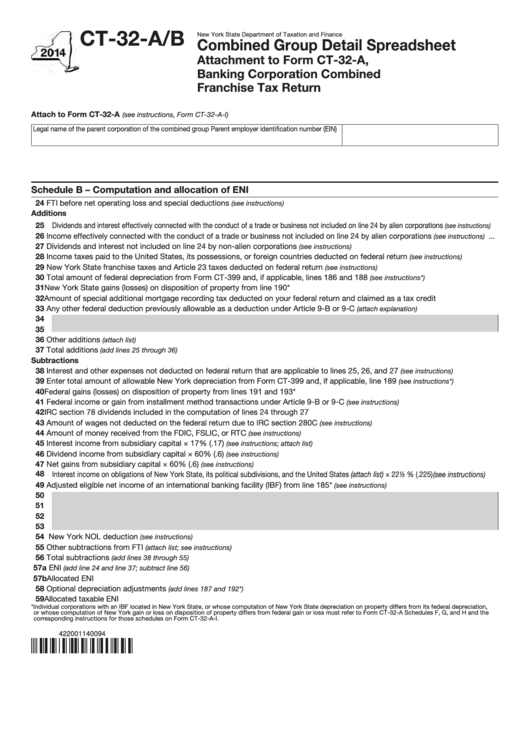

Form Ct-32-A/b - Combined Group Detail Spreadsheet Attachment To Form Ct-32-A, Banking Corporation Combined Franchise Tax Return - 2014

ADVERTISEMENT

CT-32-A/B

New York State Department of Taxation and Finance

Combined Group Detail Spreadsheet

Attachment to Form CT-32-A,

Banking Corporation Combined

Franchise Tax Return

Attach to Form CT-32-A

(see instructions, Form CT-32-A-I)

Legal name of the parent corporation of the combined group

Parent employer identification number (EIN)

Schedule B – Computation and allocation of ENI

24 FTI before net operating loss and special deductions

...............................................................................................

(see instructions)

Additions

25 Dividends and interest effectively connected with the conduct of a trade or business not included on line 24 by alien corporations

....

(see instructions)

26 Income effectively connected with the conduct of a trade or business not included on line 24 by alien corporations

...

(see instructions)

27 Dividends and interest not included on line 24 by non-alien corporations

................................................................

(see instructions)

28 Income taxes paid to the United States, its possessions, or foreign countries deducted on federal return

.............

(see instructions)

29 New York State franchise taxes and Article 23 taxes deducted on federal return

.....................................................

(see instructions)

30 Total amount of federal depreciation from Form CT-399 and, if applicable, lines 186 and 188

...............................

(see instructions*)

31 New York State gains (losses) on disposition of property from line 190* ............................................................................................

32 Amount of special additional mortgage recording tax deducted on your federal return and claimed as a tax credit ........................

33 Any other federal deduction previously allowable as a deduction under Article 9-B or 9-C

..................................

(attach explanation)

34

35

36 Other additions

...................................................................................................................................................................

(attach list)

37 Total additions

.................................................................................................................................................

(add lines 25 through 36)

Subtractions

38 Interest and other expenses not deducted on federal return that are applicable to lines 25, 26, and 27

..................

(see instructions)

39 Enter total amount of allowable New York depreciation from Form CT-399 and, if applicable, line 189

..................

(see instructions*)

40 Federal gains (losses) on disposition of property from lines 191 and 193* .........................................................................................

41 Federal income or gain from installment method transactions under Article 9-B or 9-C

...........................................

(see instructions)

42 IRC section 78 dividends included in the computation of lines 24 through 27 ...................................................................................

43 Amount of wages not deducted on the federal return due to IRC section 280C

.......................................................

(see instructions)

44 Amount of money received from the FDIC, FSLIC, or RTC

........................................................................................

(see instructions)

45 Interest income from subsidiary capital × 17% (.17)

..................................................................................

(see instructions; attach list)

46 Dividend income from subsidiary capital × 60% (.6)

..................................................................................................

(see instructions)

47 Net gains from subsidiary capital × 60% (.6)

.............................................................................................................

(see instructions)

48 Interest income on obligations of New York State, its political subdivisions, and the United States (attach list) × 22½ % (.225) (see instructions) ....

49 Adjusted eligible net income of an international banking facility (IBF) from line 185*

................................................

(see instructions)

50

51

52

53

54

New York NOL deduction

...........................................................................................................................................

(see instructions)

55 Other subtractions from FTI

........................................................................................................................

(attach list; see instructions)

56 Total subtractions

............................................................................................................................................

(add lines 38 through 55)

57a ENI

............................................................................................................................................

(add line 24 and line 37; subtract line 56)

57b Allocated ENI .......................................................................................................................................................................................

58 Optional depreciation adjustments

..................................................................................................................

(add lines 187 and 192*)

59 Allocated taxable ENI ..........................................................................................................................................................................

*Individual corporations with an IBF located in New York State, or whose computation of New York State depreciation on property differs from its federal depreciation,

or whose computation of New York gain or loss on disposition of property differs from federal gain or loss must refer to Form CT-32-A Schedules F, G, and H and the

corresponding instructions for those schedules on Form CT-32-A-I.

422001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8