Form Ft-500 - Application For Refund Of Sales Tax Paid On Petroleum Products

ADVERTISEMENT

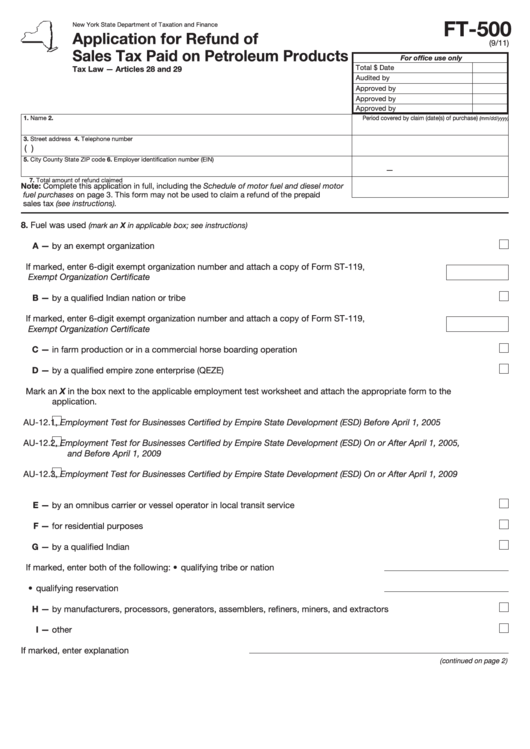

FT-500

New York State Department of Taxation and Finance

Application for Refund of

(9/11)

Sales Tax Paid on Petroleum Products

For office use only

Total

$

Date

Tax Law — Articles 28 and 29

Audited by

Approved by

Approved by

Approved by

1. Name

2. Period covered by claim (date(s) of purchase)

(mm/dd/yyyy)

3. Street address

4. Telephone number

(

)

5. City

County

State

ZIP code

6. Employer identification number (EIN)

—

7. Total amount of refund claimed

Note: Complete this application in full, including the Schedule of motor fuel and diesel motor

fuel purchases on page 3. This form may not be used to claim a refund of the prepaid

sales tax (see instructions).

8. Fuel was used

(mark an X in applicable box; see instructions)

A — by an exempt organization ............................................................................................................................................

If marked, enter 6-digit exempt organization number and attach a copy of Form ST-119,

Exempt Organization Certificate ..............................................................................................................

B — by a qualified Indian nation or tribe ................................................................................................................................

If marked, enter 6-digit exempt organization number and attach a copy of Form ST-119,

Exempt Organization Certificate ..............................................................................................................

C — in farm production or in a commercial horse boarding operation .................................................................................

D — by a qualified empire zone enterprise (QEZE) ...............................................................................................................

Mark an X in the box next to the applicable employment test worksheet and attach the appropriate form to the

application.

AU-12.1, Employment Test for Businesses Certified by Empire State Development (ESD) Before April 1, 2005

AU-12.2, Employment Test for Businesses Certified by Empire State Development (ESD) On or After April 1, 2005,

and Before April 1, 2009

AU-12.3, Employment Test for Businesses Certified by Empire State Development (ESD) On or After April 1, 2009

E — by an omnibus carrier or vessel operator in local transit service ..................................................................................

F — for residential purposes .................................................................................................................................................

G — by a qualified Indian ......................................................................................................................................................

If marked, enter both of the following: • qualifying tribe or nation ...............................

• qualifying reservation ....................................

H — by manufacturers, processors, generators, assemblers, refiners, miners, and extractors ...........................................

I — other ..............................................................................................................................................................................

If marked, enter explanation ..................................

(continued on page 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3