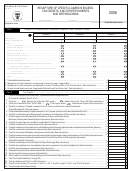

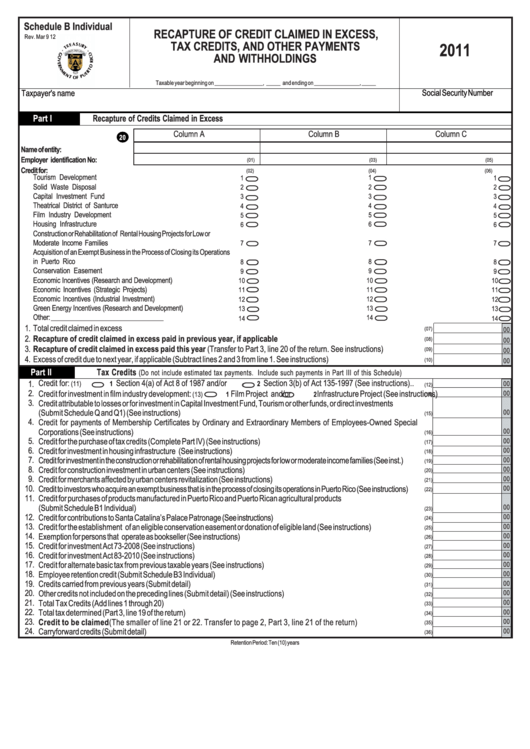

Schedule B Individual - Recapture Of Credit Claimed In Excess, Tax Credits, And Other Payments And Withholdings - 2011

ADVERTISEMENT

Schedule B Individual

RECAPTURE OF CREDIT CLAIMED IN EXCESS,

Rev. Mar 9 12

TAX CREDITS, AND OTHER PAYMENTS

2011

AND WITHHOLDINGS

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Recapture of Credits Claimed in Excess

Column A

Column B

Column C

20

Name of entity:

Employer identification No:

(01)

(03)

(05)

Credit for:

(02)

(04)

(06)

Tourism Development ............................................................................

.....................................................

.....................................................

1

1

1

Solid Waste Disposal .............................................................................

.....................................................

.....................................................

2

2

2

Capital Investment Fund ........................................................................

.....................................................

.....................................................

3

3

3

Theatrical District of Santurce ..................................................................

.....................................................

.....................................................

4

4

4

Film Industry Development .....................................................................

.....................................................

.....................................................

5

5

5

Housing Infrastructure ............................................................................

.....................................................

.....................................................

6

6

6

Construction or Rehabilitation of Rental Housing Projects for Low or

Moderate Income Families ...............................................................

.....................................................

.....................................................

7

7

7

Acquisition of an Exempt Business in the Process of Closing its Operations

in Puerto Rico ..................................................................................

.....................................................

.....................................................

8

8

8

Conservation Easement .........................................................................

.....................................................

.....................................................

9

9

9

Economic Incentives (Research and Development) ...................................

.....................................................

.....................................................

10

10

10

Economic Incentives (Strategic Projects) ..................................................

.....................................................

.....................................................

11

11

11

Economic Incentives (Industrial Investment) ..............................................

.....................................................

.....................................................

12

12

12

Green Energy Incentives (Research and Development) .............................

.....................................................

.....................................................

13

13

13

Other: _________________________________ ..........................................

.....................................................

.....................................................

14

14

14

1.

Total credit claimed in excess ....................................................................................................................................................

(07)

00

2.

Recapture of credit claimed in excess paid in previous year, if applicable ....................................................................

(08)

00

3.

Recapture of credit claimed in excess paid this year (Transfer to Part 3, line 20 of the return. See instructions) ...............

(09)

00

4.

Excess of credit due to next year, if applicable (Subtract lines 2 and 3 from line 1. See instructions) ..........................................

(10)

00

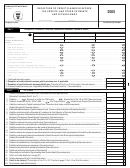

Part II

Tax Credits

(Do not include estimated tax payments. Include such payments in Part III of this Schedule)

1.

Credit for:

Section 4(a) of Act 8 of 1987 and/or

Section 3(b) of Act 135-1997 (See instructions)..

00

(11)

1

2

(12)

2.

Credit for investment in film industry development:

Film Project and/or

Infrastructure Project (See instructions)

00

(13)

1

2

(14)

3.

Credit attributable to losses or for investment in Capital Investment Fund, Tourism or other funds, or direct investments

(Submit Schedule Q and Q1) (See instructions) .......................................................................................................................

00

(15)

4.

Credit for payments of Membership Certificates by Ordinary and Extraordinary Members of Employees-Owned Special

Corporations (See instructions) ................................................................................................................................................

00

(16)

5.

Credit for the purchase of tax credits (Complete Part IV) (See instructions) ..............................................................................

00

(17)

6.

Credit for investment in housing infrastructure (See instructions) ..............................................................................................

00

(18)

7.

Credit for investment in the construction or rehabilitation of rental housing projects for low or moderate income families (See inst.) .......

00

(19)

8.

Credit for construction investment in urban centers (See instructions) .......................................................................................

00

(20)

9.

Credit for merchants affected by urban centers revitalization (See instructions) .........................................................................

00

(21)

10.

Credit to investors who acquire an exempt business that is in the process of closing its operations in Puerto Rico (See instructions) ....

00

(22)

11.

Credit for purchases of products manufactured in Puerto Rico and Puerto Rican agricultural products

(Submit Schedule B1 Individual) ..............................................................................................................................................

00

(23)

12.

Credit for contributions to Santa Catalina’s Palace Patronage (See instructions) ...............................................................................

00

(24)

13.

Credit for the establishment of an eligible conservation easement or donation of eligible land (See instructions) .......................

00

(25)

14.

Exemption for persons that operate as bookseller (See instructions) ............................................................................................

00

(26)

15.

Credit for investment Act 73-2008 (See instructions) ................................................................................................................

00

(27)

16.

Credit for investment Act 83-2010 (See instructions) ................................................................................................................

00

(28)

17.

Credit for alternate basic tax from previous taxable years (See instructions) ............................................................................

00

(29)

18.

Employee retention credit (Submit Schedule B3 Individual) ......................................................................................................

00

(30)

19.

Credits carried from previous years (Submit detail) .................................................................................................................

00

(31)

20.

Other credits not included on the preceding lines (Submit detail) (See instructions) ..................................................................

00

(32)

21.

Total Tax Credits (Add lines 1 through 20) ..............................................................................................................................

00

(33)

22.

Total tax determined (Part 3, line 19 of the return) ...................................................................................................................

00

(34)

23.

Credit to be claimed (The smaller of line 21 or 22. Transfer to page 2, Part 3, line 21 of the return) ..........................

00

(35)

24.

Carryforward credits (Submit detail) .........................................................................................................................................

00

(36)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2