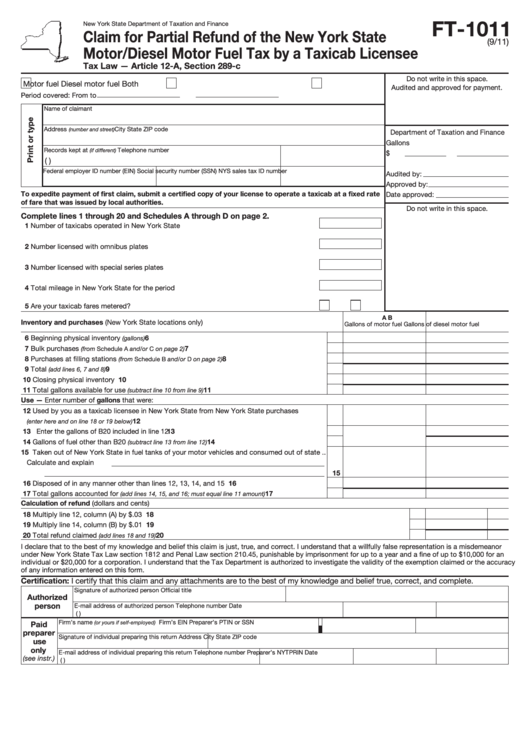

Form Ft-1011 - Claim For Partial Refund Of The New York State Motor/diesel Motor Fuel Tax By A Taxicab Licensee

ADVERTISEMENT

FT-1011

New York State Department of Taxation and Finance

Claim for Partial Refund of the New York State

(9/11)

Motor/Diesel Motor Fuel Tax by a Taxicab Licensee

Tax Law — Article 12-A, Section 289-c

Do not write in this space.

Motor fuel

Diesel motor fuel

Both

Audited and approved for payment.

Period covered: From

to

Name of claimant

Address

City

State

ZIP code

(number and street)

Department of Taxation and Finance

Gallons

Records kept at

Telephone number

(if different)

$

(

)

Federal employer ID number (EIN)

Social security number (SSN)

NYS sales tax ID number

Audited by:

Approved by:

To expedite payment of first claim, submit a certified copy of your license to operate a taxicab at a fixed rate

Date approved:

of fare that was issued by local authorities.

Do not write in this space.

Complete lines 1 through 20 and Schedules A through D on page 2.

1

Number of taxicabs operated in New York State ..................................................................

2

Number licensed with omnibus plates ..................................................................................

3

Number licensed with special series plates ..........................................................................

4

Total mileage in New York State for the period claimed........................................................

5

Are your taxicab fares metered? ...........................................................................................

Yes

No

A

B

Inventory and purchases (New York State locations only)

Gallons of motor fuel

Gallons of diesel motor fuel

6

6

Beginning physical inventory

.........................................................................................

(gallons)

7

Bulk purchases

.....................................................................

7

(from Schedule A and/or C on page 2)

8

Purchases at filling stations

..................................................

8

(from Schedule B and/or D on page 2)

9

Total

..............................................................................................................

9

(add lines 6, 7 and 8)

10

Closing physical inventory ..........................................................................................................

10

11

11

Total gallons available for use

.............................................................

(subtract line 10 from line 9)

Use — Enter number of gallons that were:

12

Used by you as a taxicab licensee in New York State from New York State purchases

..........................................................................................

12

(enter here and on line 18 or 19 below)

13

Enter the gallons of B20 included in line 12.................................................................................

13

14

14

Gallons of fuel other than B20

...........................................................

(subtract line 13 from line 12)

15

Taken out of New York State in fuel tanks of your motor vehicles and consumed out of state ..

Calculate and explain

15

16

Disposed of in any manner other than lines 12, 13, 14, and 15 ..................................................

16

17

Total gallons accounted for

..............................

17

(add lines 14, 15, and 16; must equal line 11 amount)

Calculation of refund (dollars and cents)

18

Multiply line 12, column (A) by $.03 ........................................................................................................................................

18

19

Multiply line 14, column (B) by $.01 ........................................................................................................................................

19

20

Total refund claimed

.................................................................................................................................

20

(add lines 18 and 19)

I declare that to the best of my knowledge and belief this claim is just, true, and correct. I understand that a willfully false representation is a misdemeanor

under New York State Tax Law section 1812 and Penal Law section 210.45, punishable by imprisonment for up to a year and a fine of up to $10,000 for an

individual or $20,000 for a corporation. I understand that the Tax Department is authorized to investigate the validity of the exemption claimed or the accuracy

of any information entered on this form.

Certification: I certify that this claim and any attachments are to the best of my knowledge and belief true, correct, and complete.

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Telephone number

Preparer’s NYTPRIN

Date

(see instr.)

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2