Reset Form

Print Form

Iowa Department of Revenue

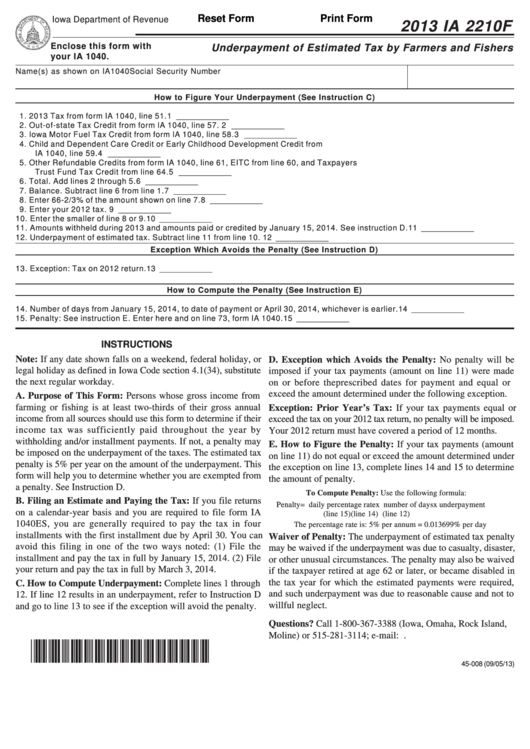

2013 IA 2210F

Enclose this form with

Underpayment of Estimated Tax by Farmers and Fishers

your IA 1040.

Name(s) as shown on IA1040

Social Security Number

How to Figure Your Underpayment (See Instruction C)

1. 2013 Tax from form IA 1040, line 51. .............................................................................................................................. 1 ____________

2. Out-of-state Tax Credit from form IA 1040, line 57. .......................................................................... 2 ____________

3. Iowa Motor Fuel Tax Credit from form IA 1040, line 58. .................................................................... 3 ____________

4. Child and Dependent Care Credit or Early Childhood Development Credit from

IA 1040, line 59. .................................................................................................................................. 4 ____________

5. Other Refundable Credits from form IA 1040, line 61, EITC from line 60, and Taxpayers

Trust Fund Tax Credit from line 64. ................................................................................................. 5 ____________

6. Total. Add lines 2 through 5. ............................................................................................................................................. 6 ____________

7. Balance. Subtract line 6 from line 1. ................................................................................................................................ 7 ____________

8. Enter 66-2/3% of the amount shown on line 7. ............................................................................................................... 8 ____________

9. Enter your 2012 tax. .......................................................................................................................................................... 9 ____________

10. Enter the smaller of line 8 or 9. ........................................................................................................................................ 10 ____________

11. Amounts withheld during 2013 and amounts paid or credited by January 15, 2014. See instruction D. ................ 11 ____________

12. Underpayment of estimated tax. Subtract line 11 from line 10. ................................................................................... 12 ____________

Exception Which Avoids the Penalty (See Instruction D)

13. Exception: Tax on 2012 return. ........................................................................................................................................ 13 ____________

How to Compute the Penalty (See Instruction E)

14. Number of days from January 15, 2014, to date of payment or April 30, 2014, whichever is earlier. .................... 14 ____________

15. Penalty: See instruction E. Enter here and on line 73, form IA 1040. ......................................................................... 15 ____________

INSTRUCTIONS

Note: If any date shown falls on a weekend, federal holiday, or

D. Exception which Avoids the Penalty: No penalty will be

legal holiday as defined in Iowa Code section 4.1(34), substitute

imposed if your tax payments (amount on line 11) were made

the next regular workday.

on or before the prescribed dates for payment and equal or

exceed the amount determined under the following exception.

A. Purpose of This Form: Persons whose gross income from

farming or fishing is at least two-thirds of their gross annual

Exception: Prior Year’s Tax: If your tax payments equal or

income from all sources should use this form to determine if their

exceed the tax on your 2012 tax return, no penalty will be imposed.

income tax was sufficiently paid throughout the year by

Your 2012 return must have covered a period of 12 months.

withholding and/or installment payments. If not, a penalty may

E. How to Figure the Penalty: If your tax payments (amount

be imposed on the underpayment of the taxes. The estimated tax

on line 11) do not equal or exceed the amount determined under

penalty is 5% per year on the amount of the underpayment. This

the exception on line 13, complete lines 14 and 15 to determine

form will help you to determine whether you are exempted from

the amount of penalty.

a penalty. See Instruction D.

To Compute Penalty: Use the following formula:

B. Filing an Estimate and Paying the Tax: If you file returns

Penalty = daily percentage rate x number of days x underpayment

on a calendar-year basis and you are required to file form IA

(line 15)

(line 14)

(line 12)

1040ES, you are generally required to pay the tax in four

The percentage rate is: 5% per annum = 0.013699% per day

installments with the first installment due by April 30. You can

Waiver of Penalty: The underpayment of estimated tax penalty

avoid this filing in one of the two ways noted: (1) File the

may be waived if the underpayment was due to casualty, disaster,

installment and pay the tax in full by January 15, 2014. (2) File

or other unusual circumstances. The penalty may also be waived

your return and pay the tax in full by March 3, 2014.

if the taxpayer retired at age 62 or later, or became disabled in

the tax year for which the estimated payments were required,

C. How to Compute Underpayment: Complete lines 1 through

and such underpayment was due to reasonable cause and not to

12. If line 12 results in an underpayment, refer to Instruction D

willful neglect.

and go to line 13 to see if the exception will avoid the penalty.

Questions? Call 1-800-367-3388 (Iowa, Omaha, Rock Island,

Moline) or 515-281-3114; e-mail: idr@iowa.gov.

*1345008019999*

45-008 (09/05/13)

1

1