Form U00588 - Memorandum On Employer Liability

ADVERTISEMENT

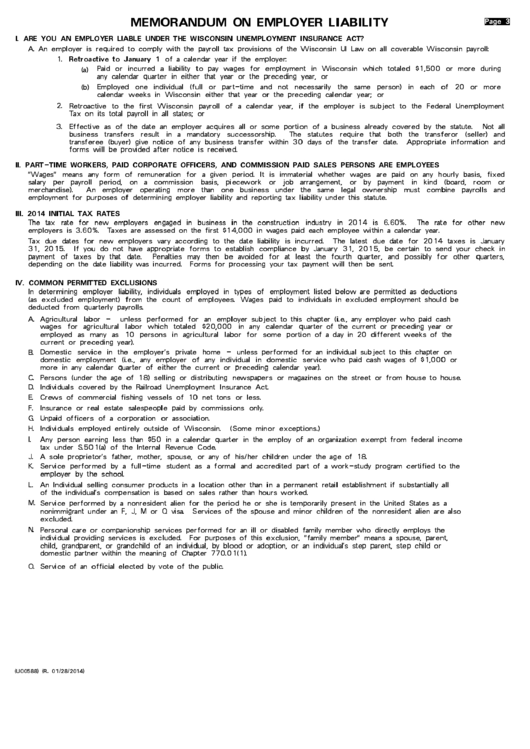

MEMORANDUM ON EMPLOYER LIABILITY

Page 3

I. ARE YOU AN EMPLOYER LIABLE UNDER THE WISCONSIN UNEMPLOYMENT INSURANCE ACT?

A. An employer is required to comply with the payroll tax provisions of the Wisconsin UI Law on all coverable Wisconsin payroll:

Retroactive to January 1

1.

of a calendar year if the employer:

Paid

or

incurred

a

liability

to

pay

wages

for

employment

in

Wisconsin

which

totaled

$1,500

or

more

during

(a)

any

calendar

quarter

in

either

that

year

or

the

preceding

year,

or

Employed

one

individual

(full

or

part-time

and

not

necessarily

the

same

person)

in

each

of

20

or

more

(b)

calendar

weeks

in

Wisconsin

either

that

year

or

the

preceding

calendar

year;

or

2.

Retroactive

to

the

first

Wisconsin

payroll

of

a

calendar

year,

if

the

employer

is

subject

to

the

Federal

Unemployment

Tax on its total payroll in all states; or

3.

Effective

as

of

the

date

an

employer

acquires

all

or

some

portion

of

a

business

already

covered

by

the

statute.

Not

all

business

transfers

result

in

a

mandatory

successorship.

The

statutes

require

that

both

the

transferor

(seller)

and

transferee

(buyer)

give

notice

of

any

business

transfer

within

30

days

of

the

transfer

date.

Appropriate

information

and

forms will be provided after notice is received.

II. PART-TIME WORKERS, PAID CORPORATE OFFICERS, AND COMMISSION PAID SALES PERSONS ARE EMPLOYEES

"Wages"

means

any

form

of

remuneration

for

a

given

period.

It

is

immaterial

whether

wages

are

paid

on

any

hourly

basis,

fixed

salary

per

payroll

period,

on

a

commission

basis,

piecework

or

job

arrangement,

or

by

payment

in

kind

(board,

room

or

merchandise).

An

employer

operating

more

than

one

business

under

the

same

legal

ownership

must

combine

payrolls

and

employment for purposes of determining employer liability and reporting tax liability under this statute.

III. 2014 INITIAL TAX RATES

The

tax

rate

for

new

employers

engaged

in

business

in

the

construction

industry

in

2014

is

6.60%.

The

rate

for

other

new

employers is 3.60%. Taxes are assessed on the first $14,000 in wages paid each employee within a calendar year.

Tax

due

dates

for

new

employers

vary

according

to

the

date

liability

is

incurred.

The

latest

due

date

for

2014

taxes

is

January

31,

2015.

If

you

do

not

have

appropriate

forms

to

establish

compliance

by

January

31,

2015,

be

certain

to

send

your

check

in

payment

of

taxes

by

that

date.

Penalties

may

then

be

avoided

for

at

least

the

fourth

quarter,

and

possibly

for

other

quarters,

depending on the date liability was incurred. Forms for processing your tax payment will then be sent.

IV. COMMON PERMITTED EXCLUSIONS

In

determining

employer

liability,

individuals

employed

in

types

of

employment listed below are permitted as deductions

(as

excluded

employment)

from

the

count

of

employees.

Wages

paid

to

individuals in excluded employment should be

deducted

from

quarterly

payrolls.

Agricultural

labor

-

unless

performed

for

an

employer subject to this chapter (i.e., any employer who paid cash

A.

wages

for

agricultural

labor

which

totaled

$20,000

in

any

calendar

quarter of the current or preceding year or

employed

as

many

as

10

persons

in

agricultural

labor

for

some

portion of a day in 20 different weeks of the

current

or

preceding

year).

Domestic

service

in

the

employer's

private

home

-

unless performed for an individual subject to this chapter on

B.

domestic

employment

(i.e.,

any

employer

of

any

individual

in

domestic

service who paid cash wages of $1,000 or

more

in

any

calendar

quarter

of

either

the

current

or

preceding

calendar

year).

C.

Persons

(under

the

age

of

18)

selling

or

distributing

newspapers

or

magazines on the street or from house to house.

D.

Individuals

covered

by

the

Railroad

Unemployment

Insurance

Act.

E.

Crews

of

commercial

fishing

vessels

of

10

net

tons

or

less.

F.

Insurance

or

real

estate

salespeople

paid

by

commissions

only.

G.

Unpaid

officers

of

a

corporation

or

association.

H.

Individuals

employed

entirely

outside

of

Wisconsin.

(Some

minor

exceptions.)

I.

Any

person

earning

less

than

$50

in

a

calendar

quarter

in

the

employ

of an organization exempt from federal income

tax

under

S.501(a)

of

the

Internal

Revenue

Code.

J.

A

sole

proprietor's

father,

mother,

spouse,

or

any

of

his/her

children

under the age of 18.

K.

Service

performed

by

a

full-time

student

as

a

formal

and

accredited

part of a work-study program certified to the

employer

by

the

school.

L.

An Individual selling consumer products in a location other than in a permanent retail establishment if substantially all

of the individual's compensation is based on sales rather than hours worked.

M.

Service performed by a nonresident alien for the period he or she is temporarily present in the United States as a

nonimmigrant under an F, J, M or Q visa. Services of the spouse and minor children of the nonresident alien are also

excluded.

N.

Personal care or companionship services performed for an ill or disabled family member who directly employs the

individual providing services is excluded. For purposes of this exclusion, "family member" means a spouse, parent,

child, grandparent, or grandchild of an individual, by blood or adoption, or an individual's step parent, step child or

domestic partner within the meaning of Chapter 770.01(1).

O.

Service of an official elected by vote of the public.

(U00588) (R. 01/28/2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1