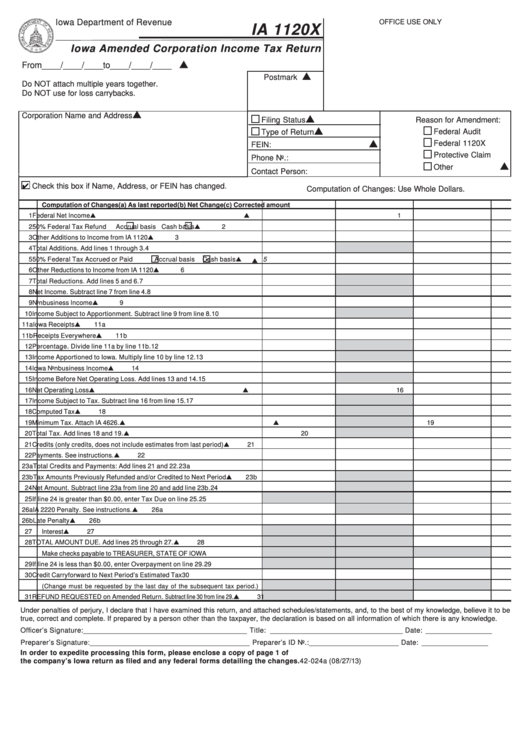

Iowa Department of Revenue

OFFICE USE ONLY

IA 1120X

Iowa Amended Corporation Income Tax Return

From____/____/____to____/____/____

Postmark

Do NOT attach multiple years together.

Do NOT use for loss carrybacks.

Corporation Name and Address

Filing Status

Reason for Amendment:

Federal Audit

Type of Return

Federal 1120X

FEIN:

Protective Claim

Phone No.:

Other

Contact Person:

Check this box if Name, Address, or FEIN has changed.

Computation of Changes: Use Whole Dollars.

Computation of Changes

(a) As last reported

(b) Net Change

(c) Corrected amount

1

Federal Net Income

1

2

50% Federal Tax Refund

Accrual basis

Cash basis

2

3

Other Additions to Income from IA 1120

3

4

Total Additions. Add lines 1 through 3.

4

5

50% Federal Tax Accrued or Paid

Accrual basis

Cash basis

5

6

Other Reductions to Income from IA 1120

6

7

Total Reductions. Add lines 5 and 6.

7

8

Net Income. Subtract line 7 from line 4.

8

9

Nonbusiness Income

9

10

Income Subject to Apportionment. Subtract line 9 from line 8.

10

11a

Iowa Receipts

11a

11b

Receipts Everywhere

11b

12

Percentage. Divide line 11a by line 11b.

12

13

Income Apportioned to Iowa. Multiply line 10 by line 12.

13

14

Iowa Nonbusiness Income

14

15

Income Before Net Operating Loss. Add lines 13 and 14.

15

16

Net Operating Loss

16

17

Income Subject to Tax. Subtract line 16 from line 15.

17

18

Computed Tax

18

19

Minimum Tax. Attach IA 4626.

19

20

Total Tax. Add lines 18 and 19.

20

21

Credits (only credits, does not include estimates from last period)

21

22

Payments. See instructions.

22

23a

Total Credits and Payments: Add lines 21 and 22.

23a

23b

Tax Amounts Previously Refunded and/or Credited to Next Period

23b

24

Net Amount. Subtract line 23a from line 20 and add line 23b.

24

25

If line 24 is greater than $0.00, enter Tax Due on line 25.

25

26a

IA 2220 Penalty. See instructions.

26a

26b

Late Penalty

26b

27

Interest

27

28

TOTAL AMOUNT DUE. Add lines 25 through 27.

28

Make checks payable to TREASURER, STATE OF IOWA

29

If line 24 is less than $0.00, enter Overpayment on line 29.

29

30

Credit Carryforward to Next Period’s Estimated Tax

30

(Change must be requested by the last day of the subsequent tax period.)

REFUND REQUESTED on Amended Return. Subtract line 30 from line 29.

31

31

Under penalties of perjury, I declare that I have examined this return, and attached schedules/statements, and, to the best of my knowledge, believe it to be

true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of which there is any knowledge.

Officer’s Signature: __________________________________________ Title: __________________________________ Date: _________________

Preparer’s Signature: _________________________________________ Preparer’s ID No.: _______________________ Date: _________________

In order to expedite processing this form, please enclose a copy of page 1 of

the company’s Iowa return as filed and any federal forms detailing the changes.

42-024a (08/27/13)

1

1 2

2