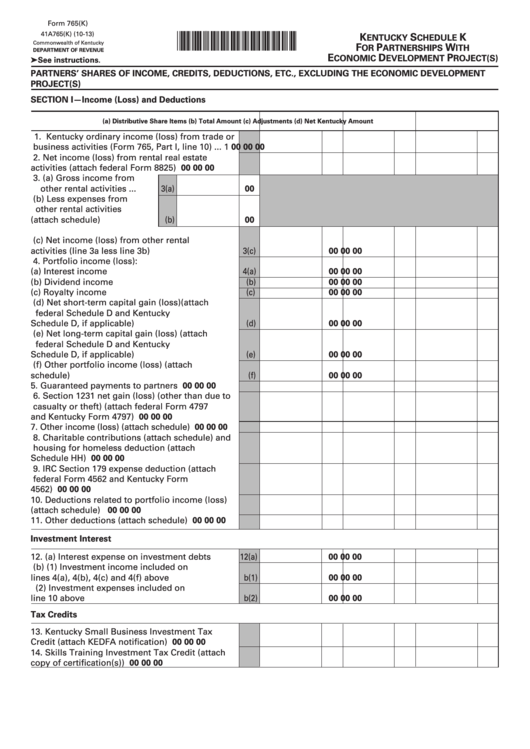

Kentucky Schedule K (Form 765(K)) For Partnerships With Economic Development Project(S)

ADVERTISEMENT

Form 765(K)

41A765(K) (10-13)

K

S

K

*1300010286*

ENTUCKY

CHEDULE

Commonwealth of Kentucky

F

P

W

OR

ARTNERSHIPS

ITH

DEPARTMENT OF REVENUE

E

D

P

CONOMIC

EVELOPMENT

ROJECT(S)

➤ See instructions.

PARTNERS’ SHARES OF INCOME, CREDITS, DEDUCTIONS, ETC., EXCLUDING THE ECONOMIC DEVELOPMENT

PROJECT(S)

SECTION I—Income (Loss) and Deductions

(a) Distributive Share Items

(b) Total Amount

(c) Adjustments

(d) Net Kentucky Amount

1. Kentucky ordinary income (loss) from trade or

business activities (Form 765, Part I, line 10) ...

1

00

00

00

2. Net income (loss) from rental real estate

activities (attach federal Form 8825) ................

2

00

00

00

3. (a) Gross income from

other rental activities ... 3(a)

00

(b) Less expenses from

other rental activities

(attach schedule) ..........

(b)

00

(c) Net income (loss) from other rental

activities (line 3a less line 3b) ......................

3(c)

00

00

00

4. Portfolio income (loss):

(a) Interest income .............................................

4(a)

00

00

00

(b) Dividend income ...........................................

(b)

00

00

00

(c) Royalty income .............................................

(c)

00

00

00

(d) Net short-term capital gain (loss)(attach

federal Schedule D and Kentucky

Schedule D, if applicable) ............................

(d)

00

00

00

(e) Net long-term capital gain (loss) (attach

federal Schedule D and Kentucky

Schedule D, if applicable) ............................

(e)

00

00

00

(f) Other portfolio income (loss) (attach

schedule) .......................................................

(f)

00

00

00

5. Guaranteed payments to partners ....................

5

00

00

00

6. Section 1231 net gain (loss) (other than due to

casualty or theft) (attach federal Form 4797

and Kentucky Form 4797) ..................................

6

00

00

00

7. Other income (loss) (attach schedule) ................

7

00

00

00

8. Charitable contributions (attach schedule) and

housing for homeless deduction (attach

Schedule HH) ......................................................

8

00

00

00

9. IRC Section 179 expense deduction (attach

federal Form 4562 and Kentucky Form

4562) ....................................................................

9

00

00

00

10. Deductions related to portfolio income (loss)

(attach schedule) ...............................................

10

00

00

00

11. Other deductions (attach schedule) ..................

11

00

00

00

Investment Interest

12. (a) Interest expense on investment debts ........ 12(a)

00

00

00

(b) (1) Investment income included on

lines 4(a), 4(b), 4(c) and 4(f) above .........

b(1)

00

00

00

(2) Investment expenses included on

line 10 above ............................................

b(2)

00

00

00

Tax Credits

13. Kentucky Small Business Investment Tax

Credit (attach KEDFA notification) ....................

13

00

00

00

14. Skills Training Investment Tax Credit (attach

copy of certification(s)) ......................................

14

00

00

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4