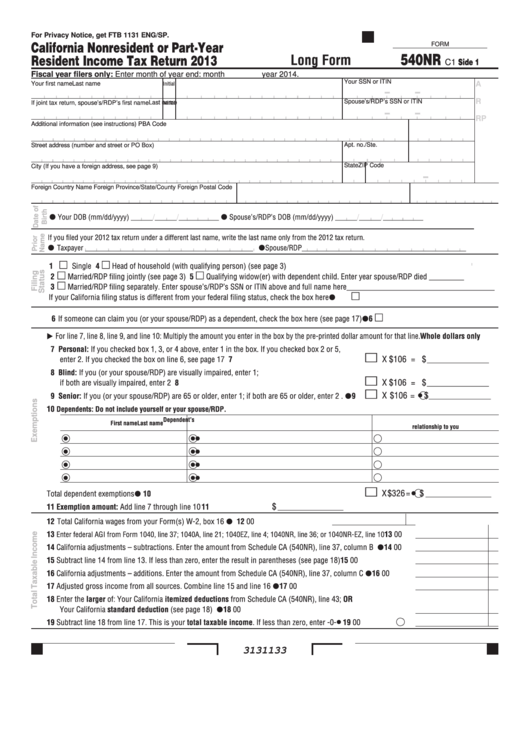

For Privacy Notice, get FTB 1131 ENG/SP.

California Nonresident or Part-Year

FORM

540NR

Resident Income Tax Return 2013

Long Form

C1 Side 1

Fiscal year filers only: Enter month of year end: month________ year 2014.

Your SSN or ITIN

Initial

A

Your first name

Last name

R

Spouse’s/RDP’s SSN or ITIN

Initial

Last name

If joint tax return, spouse’s/RDP’s first name

RP

Additional information (see instructions)

PBA Code

Street address (number and street or PO Box)

Apt. no./Ste. no.

PMB/Private Mailbox

State

ZIP Code

City (If you have a foreign address, see page 9)

Foreign Country Name

Foreign Province/State/County

Foreign Postal Code

Your DOB (mm/dd/yyyy) ______/______/___________

Spouse’s/RDP’s DOB (mm/dd/yyyy) ______/______/___________

If you filed your 2012 tax return under a different last name, write the last name only from the 2012 tax return .

Taxpayer ______________________________________________

Spouse/RDP_____________________________________________

1

Single

4

Head of household (with qualifying person) (see page 3)

2

Married/RDP filing jointly (see page 3)

5

Qualifying widow(er) with dependent child . Enter year spouse/RDP died _________

3

Married/RDP filing separately . Enter spouse’s/RDP’s SSN or ITIN above and full name here______________________________________

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . . .

6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here (see page 17) . . . .

6

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the pre-printed dollar amount for that line .

Whole dollars only

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box . If you checked box 2 or 5,

X $106 =

$

enter 2 . If you checked the box on line 6, see page 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

_________________

8 Blind: If you (or your spouse/RDP) are visually impaired, enter 1;

X $106 =

$

if both are visually impaired, enter 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

_________________

X $106 = $

9 Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 .

9

_________________

10

Dependents: Do not include yourself or your spouse/RDP.

Dependent’s

First name

Last name

relationship to you

X $326 = $

Total dependent exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

__________________

$

11 Exemption amount: Add line 7 through line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

__________________

12 Total California wages from your Form(s) W-2, box 16 . . . . . . . . . . . . . . . . . . . . . .

12

00

13

. . . . 13

00

Enter federal AGI from Form 1040, line 37; 1040A, line 21; 1040EZ, line 4; 1040NR, line 36; or 1040NR-EZ, line 10

14 California adjustments – subtractions . Enter the amount from Schedule CA (540NR), line 37, column B . . . . .

14

00

15 Subtract line 14 from line 13 . If less than zero, enter the result in parentheses (see page 18) . . . . . . . . . . . . . . . . . 15

00

16 California adjustments – additions . Enter the amount from Schedule CA (540NR), line 37, column C . . . . . . . .

16

00

17 Adjusted gross income from all sources . Combine line 15 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

00

18 Enter the larger of: Your California itemized deductions from Schedule CA (540NR), line 43; OR

Your California standard deduction (see page 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

00

19 Subtract line 18 from line 17 . This is your total taxable income . If less than zero, enter -0- . . . . . . . . . . . . . .

19

00

3131133

1

1 2

2 3

3