Form Ft-943 - Quarterly Inventory Report By Retail Service Stations And Fixed Base Operators

ADVERTISEMENT

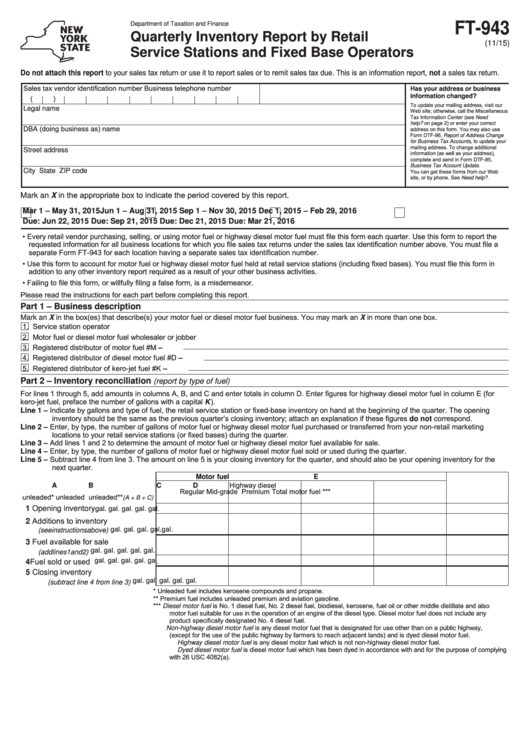

FT-943

Department of Taxation and Finance

Quarterly Inventory Report by Retail

(11/15)

Service Stations and Fixed Base Operators

Do not attach this report to your sales tax return or use it to report sales or to remit sales tax due. This is an information report, not a sales tax return.

Sales tax vendor identification number

Business telephone number

Has your address or business

information changed?

(

)

To update your mailing address, visit our

Legal name

Web site; otherwise, call the Miscellaneous

Tax Information Center (see Need

help? on page 2) or enter your correct

DBA (doing business as) name

address on this form. You may also use

Form DTF-96, Report of Address Change

for Business Tax Accounts, to update your

mailing address. To change additional

Street address

information (as well as your address),

complete and send in Form DTF-95,

Business Tax Account Update.

City

State

ZIP code

You can get these forms from our Web

site, or by phone. See Need help?.

Mark an X in the appropriate box to indicate the period covered by this report.

Mar 1 – May 31, 2015

Jun 1 – Aug 31, 2015

Sep 1 – Nov 30, 2015

Dec 1, 2015 – Feb 29, 2016

Due: Jun 22, 2015

Due: Sep 21, 2015

Due: Dec 21, 2015

Due: Mar 21, 2016

• Every retail vendor purchasing, selling, or using motor fuel or highway diesel motor fuel must file this form each quarter. Use this form to report the

requested information for all business locations for which you file sales tax returns under the sales tax identification number above. You must file a

separate Form FT-943 for each location having a separate sales tax identification number.

• Use this form to account for motor fuel or highway diesel motor fuel held at retail service stations (including fixed bases). You must file this form in

addition to any other inventory report required as a result of your other business activities.

• Failing to file this form, or willfully filing a false form, is a misdemeanor.

Please read the instructions for each part before completing this report.

Part 1 – Business description

Mark an X in the box(es) that describe(s) your motor fuel or diesel motor fuel business. You may mark an X in more than one box.

1. Service station operator

2. Motor fuel or diesel motor fuel wholesaler or jobber

3. Registered distributor of motor fuel #M –

4. Registered distributor of diesel motor fuel #D –

5. Registered distributor of kero-jet fuel #K –

Part 2 – Inventory reconciliation

(report by type of fuel)

For lines 1 through 5, add amounts in columns A, B, and C and enter totals in column D. Enter figures for highway diesel motor fuel in column E (for

kero-jet fuel, preface the number of gallons with a capital K ).

Line 1 – Indicate by gallons and type of fuel, the retail service station or fixed-base inventory on hand at the beginning of the quarter. The opening

inventory should be the same as the previous quarter’s closing inventory; attach an explanation if these figures do not correspond.

Line 2 – Enter, by type, the number of gallons of motor fuel or highway diesel motor fuel purchased or transferred from your non-retail marketing

locations to your retail service stations (or fixed bases) during the quarter.

Line 3 – Add lines 1 and 2 to determine the amount of motor fuel or highway diesel motor fuel available for sale.

Line 4 – Enter, by type, the number of gallons of motor fuel or highway diesel motor fuel sold or used during the quarter.

Line 5 – Subtract line 4 from line 3. The amount on line 5 is your closing inventory for the quarter, and should also be your opening inventory for the

next quarter.

Motor fuel

E

Highway diesel

A

B

C

D

Regular

Mid-grade

Premium

Total

motor fuel ***

unleaded*

unleaded

unleaded**

(A + B + C)

1 Opening inventory ........................

gal.

gal.

gal.

gal.

gal.

2 Additions to inventory

.................

gal.

gal.

gal.

gal.

gal.

(see instructions above)

3 Fuel available for sale

gal.

gal.

gal.

gal.

gal.

.........................

(add lines 1 and 2)

gal.

gal.

gal.

gal.

gal .

4 Fuel sold or used ..........................

5 Closing inventory

gal.

gal.

gal.

gal.

gal.

.............

(subtract line 4 from line 3)

* Unleaded fuel includes kerosene compounds and propane.

** Premium fuel includes unleaded premium and aviation gasoline.

*** Diesel motor fuel is No. 1 diesel fuel, No. 2 diesel fuel, biodiesel, kerosene, fuel oil or other middle distillate and also

motor fuel suitable for use in the operation of an engine of the diesel type. Diesel motor fuel does not include any

product specifically designated No. 4 diesel fuel.

Non-highway diesel motor fuel is any diesel motor fuel that is designated for use other than on a public highway,

(except for the use of the public highway by farmers to reach adjacent lands) and is dyed diesel motor fuel.

Highway diesel motor fuel is any diesel motor fuel which is not non-highway diesel motor fuel.

Dyed diesel motor fuel is diesel motor fuel which has been dyed in accordance with and for the purpose of complying

with 26 USC 4082(a).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2