Form Ft-949 - Application For Refund Of Prepaid Sales Tax On Motor Fuel Sold Other Than At Retail Service Stations

ADVERTISEMENT

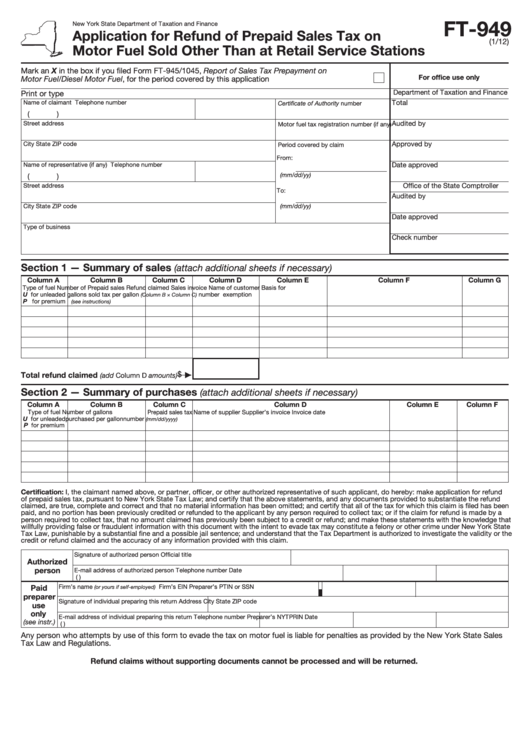

FT-949

New York State Department of Taxation and Finance

Application for Refund of Prepaid Sales Tax on

(1/12)

Motor Fuel Sold Other Than at Retail Service Stations

Mark an X in the box if you filed Form FT-945/1045, Report of Sales Tax Prepayment on

For office use only

Motor Fuel/Diesel Motor Fuel, for the period covered by this application ..............................................

Department of Taxation and Finance

Print or type

Name of claimant

Telephone number

Total

Certificate of Authority number

(

)

Audited by

Street address

Motor fuel tax registration number (if any)

Approved by

City

State

ZIP code

Period covered by claim

From:

Date approved

Name of representative (if any)

Telephone number

(mm/dd/yy)

(

)

Office of the State Comptroller

Street address

To:

Audited by

City

State

ZIP code

(mm/dd/yy)

Date approved

Type of business

Check number

Section 1 — Summary of sales

(attach additional sheets if necessary)

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Type of fuel

Number of

Prepaid sales

Refund claimed

Sales invoice

Name of customer

Basis for

U for unleaded

gallons sold

tax per gallon

number

exemption

(Column B × Column C)

P for premium

(see instructions)

$

Total refund claimed

(add Column D amounts)

Section 2 — Summary of purchases

(attach additional sheets if necessary)

Column A

Column B

Column C

Column D

Column E

Column F

Type of fuel

Number of gallons

Prepaid sales tax

Name of supplier

Supplier’s invoice

Invoice date

U for unleaded

purchased

per gallon

number

(mm/dd/yyyy)

P for premium

Certification: I, the claimant named above, or partner, officer, or other authorized representative of such applicant, do hereby: make application for refund

of prepaid sales tax, pursuant to New York State Tax Law; and certify that the above statements, and any documents provided to substantiate the refund

claimed, are true, complete and correct and that no material information has been omitted; and certify that all of the tax for which this claim is filed has been

paid, and no portion has been previously credited or refunded to the applicant by any person required to collect tax; or if the claim for refund is made by a

person required to collect tax, that no amount claimed has previously been subject to a credit or refund; and make these statements with the knowledge that

willfully providing false or fraudulent information with this document with the intent to evade tax may constitute a felony or other crime under New York State

Tax Law, punishable by a substantial fine and a possible jail sentence; and understand that the Tax Department is authorized to investigate the validity or the

credit or refund claimed and the accuracy of any information provided with this claim.

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Telephone number

Preparer’s NYTPRIN

Date

(see instr.)

(

)

Any person who attempts by use of this form to evade the tax on motor fuel is liable for penalties as provided by the New York State Sales

Tax Law and Regulations.

Refund claims without supporting documents cannot be processed and will be returned.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2