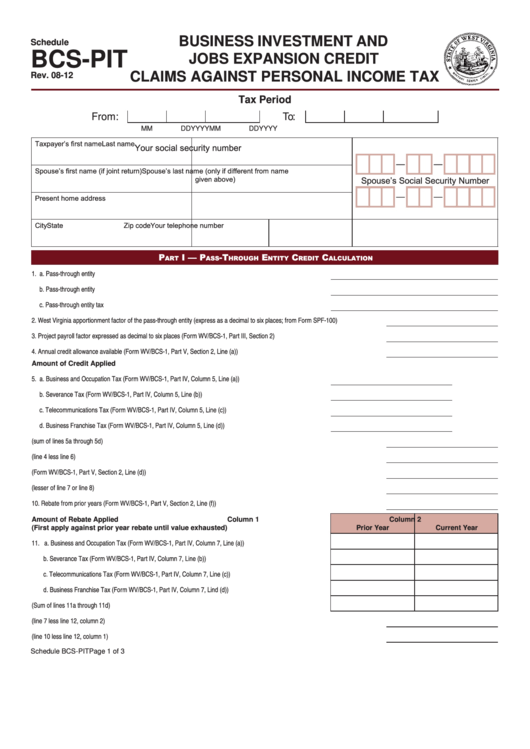

BUSINESS INVESTMENT AND

Schedule

BCS-PIT

JOBS EXPANSION CREDIT

CLAIMS AGAINST PERSONAL INCOME TAX

Rev. 08-12

Tax Period

From:

To:

MM

DD

YYYY

MM

DD

YYYY

Taxpayer’s first name

Last name

Your social security number

—

—

Spouse’s first name (if joint return)

Spouse’s last name (only if different from name

given above)

Spouse’s Social Security Number

Present home address

—

—

City

State

Your telephone number

Zip code

P

I — P

-t

E

C

C

art

ass

hrough

ntIty

rEdIt

alCulatIon

1. a. Pass-through entity name...........................................................................................................................................

b. Pass-through entity FEIN............................................................................................................................................

c. Pass-through entity tax year........................................................................................................................................

2. West Virginia apportionment factor of the pass-through entity (express as a decimal to six places; from Form SPF-100)................................

3. Project payroll factor expressed as decimal to six places (Form WV/BCS-1, Part III, Section 2).......................................................................

4. Annual credit allowance available (Form WV/BCS-1, Part V, Section 2, Line (a))..............................................................................................

Amount of Credit Applied

5. a. Business and Occupation Tax (Form WV/BCS-1, Part IV, Column 5, Line (a))..........................................................

b. Severance Tax (Form WV/BCS-1, Part IV, Column 5, Line (b))..................................................................................

c. Telecommunications Tax (Form WV/BCS-1, Part IV, Column 5, Line (c))...................................................................

d. Business Franchise Tax (Form WV/BCS-1, Part IV, Column 5, Line (d))...................................................................

6. Amount of credit applied total (sum of lines 5a through 5d)...............................................................................................................................

7. Amount of credit remaining (line 4 less line 6)...................................................................................................................................................

8. Maximum rebate allowable current year (Form WV/BCS-1, Part V, Section 2, Line (d))...................................................................................

9. Rebate available current year (lesser of line 7 or line 8)...................................................................................................................................

10. Rebate from prior years (Form WV/BCS-1, Part V, Section 2, Line (f))............................................................................................................

Amount of Rebate Applied

Column 1

Column 2

(First apply against prior year rebate until value exhausted)

Prior Year

Current Year

11. a. Business and Occupation Tax (Form WV/BCS-1, Part IV, Column 7, Line (a)).......................................................

b. Severance Tax (Form WV/BCS-1, Part IV, Column 7, Line (b))...............................................................................

c. Telecommunications Tax (Form WV/BCS-1, Part IV, Column 7, Line (c))................................................................

d. Business Franchise Tax (Form WV/BCS-1, Part IV, Column 7, Lind (d)).................................................................

12. Amount of rebate applied total (Sum of lines 11a through 11d)...................................................................................

13. Amount of credit remaining for shareholders (line 7 less line 12, column 2)..................................................................................................

14. Amount of prior year rebate available for shareholders (line 10 less line 12, column 1)................................................................................

Schedule BCS-PIT

Page 1 of 3

1

1 2

2 3

3 4

4 5

5