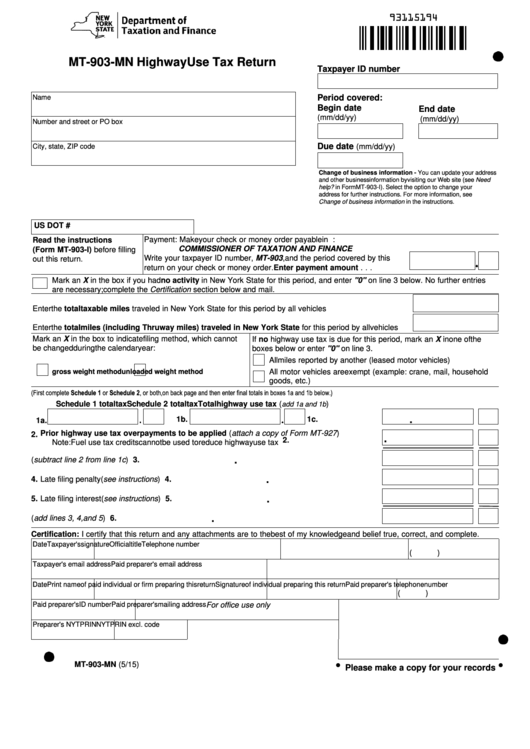

93115194

MT-903-MN Highway Use Tax Return

Taxpayer ID number

Name

Period covered:

Begin date

End date

(mm/dd/yy)

(mm/dd/yy)

Number and street or PO box

Due date

City, state, ZIP code

(mm/dd/yy)

Change of business information - You can update your address

and other business information by visiting our Web site (see Need

help? in Form MT-903-I). Select the option to change your

address for further instructions. For more information, see

Change of business information in the instructions.

US DOT #

Payment: Make your check or money order payable in U.S. funds to:

Read the instructions

COMMISSIONER OF TAXATION AND FINANCE

(Form MT-903-I) before filling

Write your taxpayer ID number, MT-903, and the period covered by this

out this return.

return on your check or money order.

Enter payment amount . . .

Mark an X in the box if you had no activity in New York State for this period, and enter "0" on line 3 below. No further entries

are necessary; complete the Certification section below and mail.

Enter the total taxable miles traveled in New York State for this period by all vehicles .................................

Enter the total miles (including Thruway miles) traveled in New York State for this period by all vehicles

Mark an X in the box to indicate filing method, which cannot

If no highway use tax is due for this period, mark an X in one of the

be changed during the calendar year:

boxes below or enter "0" on line 3.

All miles reported by another (leased motor vehicles)

All motor vehicles are exempt (example: crane, mail, household

gross weight method

unloaded weight method

goods, etc.)

(First complete Schedule 1 or Schedule 2, or both, on back page and then enter final totals in boxes 1a and 1b below.)

1. Highway use tax schedule totals

Schedule 1 total tax

Schedule 2 total tax

Total highway use tax (

)

add 1a and 1b

.

1b.

1c.

..........................

1a.

2. Prior highway use tax overpayments to be applied (attach a copy of Form MT-927)

.

Note: Fuel use tax credits cannot be used to reduce highway use tax ................................... 2.

.

3. Highway use tax due (subtract line 2 from line 1c) .................................................................. 3.

.

4. Late filing penalty (see instructions) ......................................................................................... 4.

.

5. Late filing interest (see instructions) ......................................................................................... 5.

.

6. Highway use tax due (add lines 3, 4, and 5) ........................................................................... 6.

Certification: I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Date

Taxpayer's signature

Official title

Telephone number

(

)

Taxpayer's email address

Paid preparer's email address

Date

Print name of paid individual or firm preparing this return Signature of individual preparing this return Paid preparer's telephone number

(

)

Paid preparer's ID number

Paid preparer's mailing address

For office use only

Preparer's NYTPRIN

NYTPRIN excl. code

•

•

MT-903-MN (5/15)

Please make a copy for your records

1

1 2

2